Equity bulls are pressing the pause button after the S&P 500 closed at a fresh all-time high this week. A lack of stock bids stems from the latest round of Trump tariff threats, which are particularly stringent, including duties of around 25% on imports of automobiles, pharmaceuticals and semiconductors. The actions reflect a meaningful broadening in potential commerce disruptions and risks sending several export-oriented economies into downturns. Meanwhile, geopolitical tensions are also ticking north due to a Ukraine peace deal possibly being reached without Kyiv’s participation. The speculation arrives on the back of leaders from Washington and Moscow meeting in Riyadh yesterday to discuss ending the conflict. And while the volatile and unpredictable landscape has traders refraining from adding to long equity exposure, market participants are scooping up T-bills, volatility call options, equity index put derivatives, greenback futures, gold bars and barrels of crude oil. Moreover, the energy sector is performing strongly as OPEC+ considers delaying production increases for a fourth time, despite calls from US President Trump to go the other way.

Housing Starts Slip but West Begins Recovery

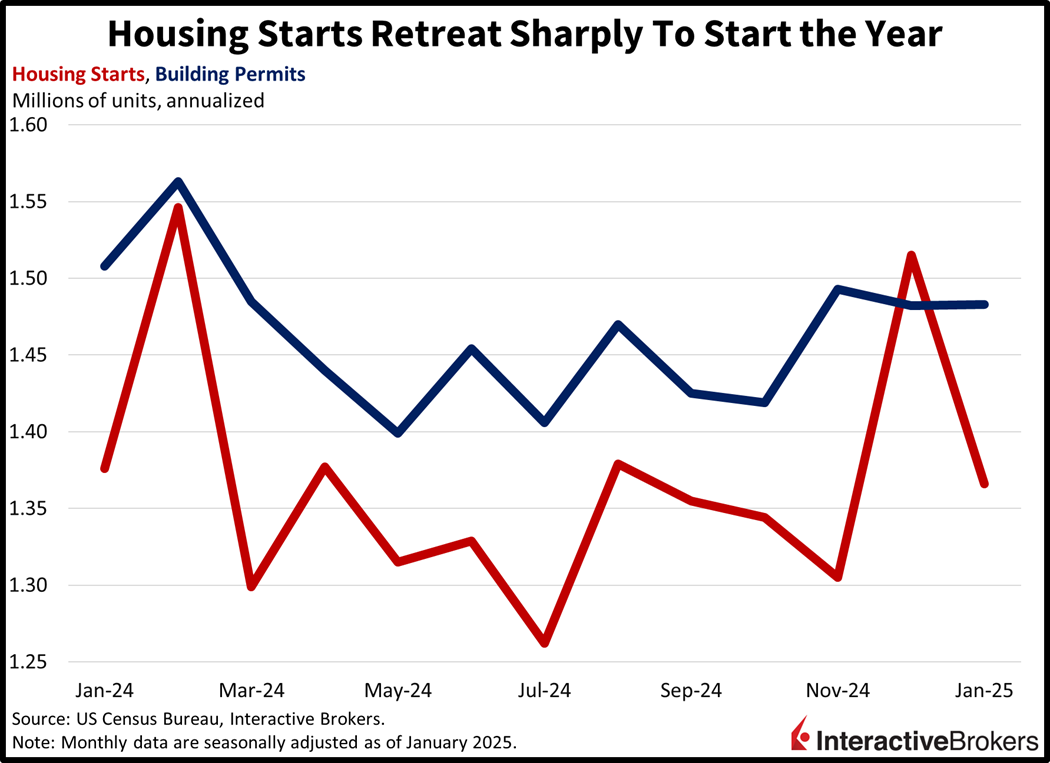

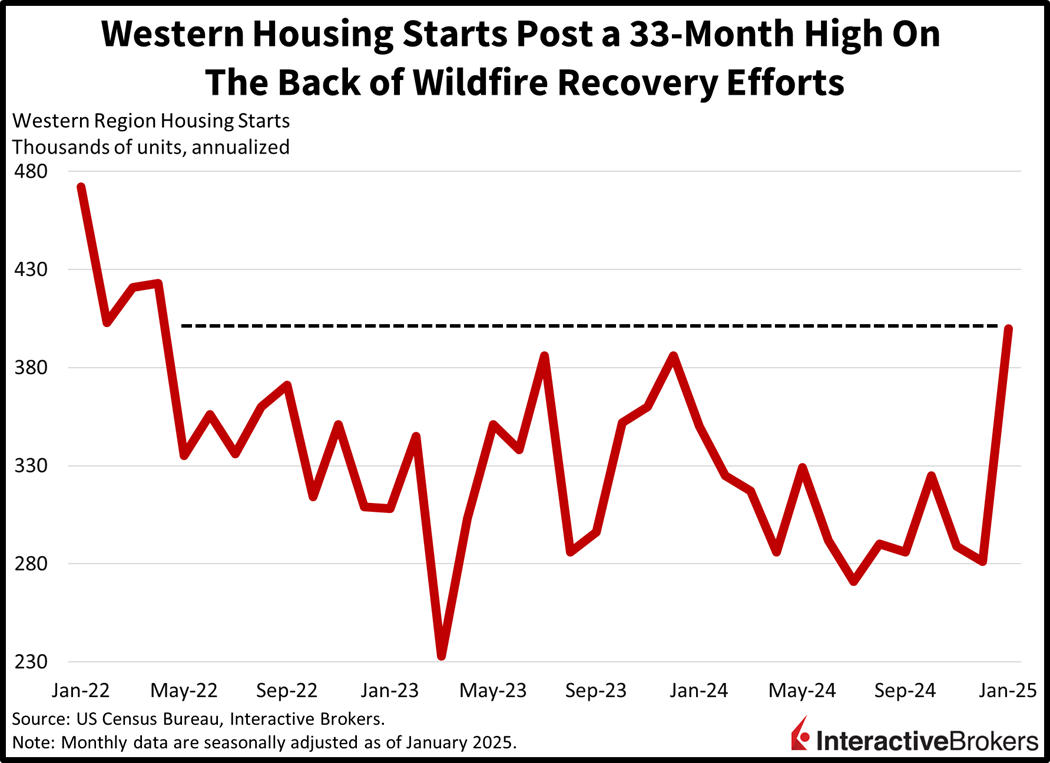

Wednesday’s news of plummeting homebuilder sentiment arrived on the heels of this morning’s sharp drop in housing starts, adding to evidence that sour confidence is beginning to weigh on actual activity. But permitting momentum was flat which served to counter some of the negativity. Still, the pace of groundbreaking projects fell a whopping 9.8% month over month (m/m) to 1.37 million seasonally adjusted annualized units (SAAU). Wall Street anticipated a number closer to 1.4 million, which would have still marked a stumble from December’s 1.52 million. The weakness was consistent across asset classes and existed in 3 out of 4 regions; single- and multi-family descended 8.4% and 11% m/m while the Northeast, South and West experienced decreases of 27.6%, 23.3% and 10.4% m/m. The West rebounded strongly and is in recovery mode following the tragic wildfires which destroyed many residences and businesses. The region saw starts increase a whopping 42.3% during the period to a pace of 400 thousand SAAU, the highest level in almost three years, as the region bounces back.

Permitting volumes were essentially unchanged to begin 2025, however, as modest weakness in multi-family was counted by a light pickup in single-family. The 1.482 million SAAU came in above the 1.46 million median estimate and progress in the West and Midwest offset the sluggishness in the Northeast and South. Indeed, the West and Midwest grew filings 2.3% and 1.8% m/m while the Northeast and South contracted 6.1% and 0.1%.

Equites Retreat Modestly

Investor sentiment is slightly dampened as folks increase the odds of the world falling into an all-out trade war sparked by President Trump’s intentions to level the playing field. All equity benchmarks are suffering losses with the Russell 2000, Nasdaq 100, Dow Jones Industrial and S&P 500 indices down 0.4%, 0.3%, 0.2% and 0.1%. Sectoral breadth is tilted negative with materials, technology and communication services lower by 0.9%, 0.6% and 0.5%. But 4 segments are higher and upside representation is led by energy, which is up 1.6% due to a sharp increase in prices for WTI crude oil. The critical liquid is up 1.3% and trading at $72.64 per barrel as OPEC+ appears poised to delay supply increases. Meanwhile, the other three equity sectors gaining are the defensive healthcare, consumer staples and utilities; they’re up 0.6%, 0.4% and 0.3%. The buying in these segments is motivated by inelastic demand curves since consumers will continue spending in these areas despite the potential for worsening economic conditions, such as inflationary pressures or weaker hiring trends.

In fixed-income, currency and commodities, investors are tilting toward the safety of the short-end of the curve while keeping inflation expectations in mind. The 2- and 10-year Treasury maturities are changing hands at 4.29% and 4.55%. The former is lighter by 2 basis points (bps) while the latter is unchanged. But trade tensions and projected US economic outperformance is strengthening bids for the greenback. The Dollar Index is up 8 bps as Washington tender appreciates against the euro, pound sterling, franc, yuan and loonie. It is depreciating relative to the yen and Aussie currency, however. In commodities, crude oil, copper and gold are gaining 1.3%, 0.1% and 0.1% while lumber and silver decline 1.1% and 0.6%. This week’s lethargic real estate data, a result primarily of elevated mortgage rates, is blunting the demand for lumber, a critical material for construction.

Trade Concerns Are Paramount

With almost a third of S&P 500 revenues stemming from foreign sources, investors are wise to worry about the adverse effects to earnings that a trade war can have. In fact, 2018 featured a rare annual decline in stocks, which was in large part due to the heightening tensions between Beijing and Washington. While I don’t think tariffs and commerce disruptions will be widespread despite President Trump’s threats, equities are poised to decline meaningfully if some of these developments manifest. Stock markets and global economies alike have depended on free trade and cheap goods to keep financing costs limited and central banks off their back. A rise in protectionism and pricier products as a result risk margin compression and higher borrowing costs, weighing on the risk premium for equities and serving to incrementally reduce future returns.

International Roundup

UK Price Pressures Remain Problematic

Stronger-than-expected inflation may have landed the Bank of England between a rock and a hard place by making it less likely that the organization will lower its key interest rate even as the country’s economy slows. The UK’s core Consumer Price Index jumped 3.7% year over year (y/y) last month, according to today’s release from the Office of National Statistics. The result matched expectations but accelerated considerably from December’s 3.2% increase. Conversely, it fell 0.4% m/m after gaining 0.3% in the final month of 2024. Analysts anticipated a 0.4% drop for the core gauge, which excludes volatile prices for energy and food. For the broader headline number, prices climbed 3% y/y but sank 0.1% m/m. Economists forecasted results of 2.8% and -0.3%. While the y/y result accelerated from 2.5% in December, the m/m number weakened from 0.3%.

The CPIH, which includes housing, however, depicted even stronger y/y inflation of 3.9% but was relatively flat m/m. Within the CPIH, shelter costs jumped 8% y/y and accounted for roughly 17% of the metric’s northward movement. Services and goods climbed 5.8% and 1% y/y, respectively. Another benchmark that focuses on items most frequently purchased by households, the Retail Price Index, climbed 3.6% y/y, falling below the analyst forecast of 3.7% while gaining steam relative to December’s 3.5% score.

Pay Gains Slow in Australia

Aussie paycheck growth slowed down in the final quarter of last year. The wage price index rose 0.7% quarter over quarter, missing the consensus forecast of 0.8%. In the third quarter of 2024, employers increased compensation by 0.9%. On a y/y basis, worker incomes grew 3.2%, down from 3.6% in the preceding three-month period. Growth in the private sector was a tad better, at 3.3% in the quarter, but public earnings climbed only 2.8%.

Japan Swings to Trade Deficit

A one-two combo of increased demand for electronics imports and a weakening yen pushed Japan’s January trade balance into a 2.76 trillion yen deficit, just one month after the country’s foreign sales outpaced purchases from other jurisdictions by 133 billion yen. On a favorable note, Japan exports grew 7.2% y/y but the number missed expectations of 7.9% while exceeding December’s 2.8% expansion. The weaker yen helped make the country’s products more affordable in foreign markets. Imports, however, jumped 16.7%, significantly outpacing the consensus call for 9.7% and the 1.7% increase during the final month of 2024.

Related: Retail Sales Hit a 22-Month Low—What It Means for the Economy