In my last post, I discussed how inflation's return has changed the calculus for investors, looking at how inflation affects returns on different asset classes, and tracing out the consequences for equity values, in the aggregate. In general, higher and more volatile inflation has negative effects on all financial assets, from stocks to corporate bonds to treasury bonds, and neutral to positive effects on gold, collectibles and real assets. That said, the impact of inflation on individual company values can vary widely, with a few companies benefiting, some affected only lightly, and other companies being affected more adversely, by higher than expected inflation. In an environment where finding inflation hedges has become the first priority for most investors, the search is on for companies that are less exposed to high and rising inflation. The conventional wisdom, based largely on investor experiences from the 1970s, is that commodity companies and firms with pricing power are the best ones to hold, if you fear inflation, but is that true, and even if it is true, why is it so? To answer these questions, I will return to basics and try to trace the effects of inflation on the drivers of value, with the intent of finding the characteristics of stocks with better inflation-hedging properties.

Inflation and Value

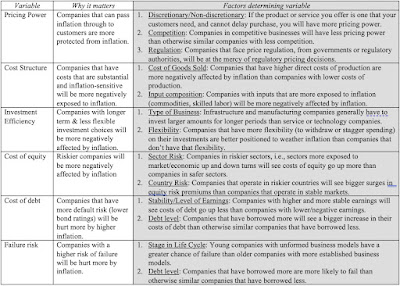

When in doubt about how any action or information plays out in value, I find it useful to go back to value basics, and trace out the effects of that action/information on value drivers. Following that rule book, I looked at the effects of inflation on the levers that determines value, in the graph below:

Put simply, the effects of inflation on firm value boil down to the impact inflation has on expected cash flows/growth and risk. At the risk of restating what is already in the graph above, the factors that will play out in determining the end impact on inflation on value are in the table below:

If you were seeking out a company that would operate as an inflation hedge, you would want it to have pricing power on the products and services that it sells, with low input costs, and operating in a business where investments are short term and reversible. On the risk front, you would like the company to have a large and stable earnings stream and a light debt load.

Looking Back

There are lessons that can be learned by looking at the past, about how inflation affects different groupings of companies, though there is the danger of over extrapolation. In this section, I look first at how classes of stocks have done over the decades, and relating that performance to inflation (expected and unexpected). I then examine how equities have performed in the less than five months of 2022, where inflation has returned to the front pages.

Historical Data: 1930-2019

To see how this framework works in practice, let's start by looking at the performance of US stocks, across the decades, and look at the returns on stocks, broadly categorized based on market capitalization and price to book ratios. The former is short hand for the small cap premium and the latter is the proxy for the value factor in returns.

The distinction that I made between expected and unexpected inflation comes into play in this table. It is unexpected inflation that seems to have a large impact on the behavior of small cap stocks, outperforming in decades where inflation was higher than expected (1940-49, 196069, 1970-79) and underperforming in decades with lower than expected inflation (1990-99, 2010-19). The value effect, measured as the difference between low price to book and high price to book stocks was highest in the 1970s, when both actual and unexpected inflation were high, but remained resilient in the 1980s, when inflation stayed high, but came in under expectations.

The 2022 Experience

As the focus has shifted back to inflation in the last five months, it is worth looking at performance across US stocks, broken down by different categorizations, to see whether the patterns of the past are showing up in today's markets.. For starters, let's look at the how the damage done by inflation on stocks varies across sectors, looking at the 2022 broken down in three slices, the returns in the first quarter of 2022 (when Russia competed with inflation for market attention), the period from April 1 - May 19, 2022 (when inflation was the dominant story) and the entire year to date.

In 2022, the collective market capitalization of all US firms has dropped by 19.75%, with the bulk of the drop occurring after April 1, 2022. During the period (April 1- May 19, 2022), the three worst performing sectors (highlighted) were technology, consumer discretionary and communication services, and the best performing sectors were energy (no surprise, given the rise in oil prices) and utilities, old standbys for investors during tumultuous periods.

To check to see if the outperformance of small cap and low price to book ratios that we saw in the 1970s is being replicated in 2022, I broke companies down by decile (based on market cap and price to book at the start of 2022), and looked at changes in aggregate value in 2022:

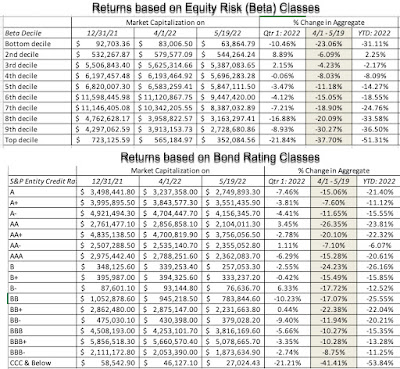

As in the 1970s, the small cap premium seems to have returned with a vengeance, as small cap stocks have outperformed large caps in 2022, and the lowest price to book stocks have done less badly than high price to book stocks. To examine the interaction and stock price performance in 2022, I looked at the aggregate returns on firms classified into deciles based upon both equity risk (betas) and default risk (with bond ratings):

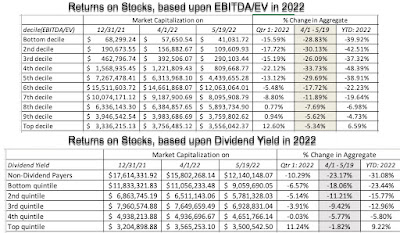

The link between equity risk and stock returns support the hypothesis that firms that are riskier are more affected by inflation, with one exception: the stocks with the lowest betas have also done badly in 2022. On bond ratings, there is no discernible link between ratings and returns, until you get to the lowest rated bonds (CCC & below). In a final assessment, I break down companies based upon operating cash flows (EBITDA as a percent of enterprise value) and dividend yield (dividends as a percent of market capitalization).

Companies that generate more cash flows from their operations and return more of that cash flow in dividends to stockholders have clearly held their value better than companies with low or negative cash flows that pay no dividends, in 2022. Looking at these results, value investors will undoubtedly find vindication for their beliefs that this is a correction long over due, i.e., a return to normalcy where safe stocks in boring sectors that pay high dividends deliver excess returns. I do think that given how consistently growth stocks have been beating value stocks for the last decade, a correction was in order, but I believe it is way too early to proclaim the return of old fashioned value investing.

Bottom Line

This has been a painful year for investors in US equities, but the pain has not been evenly spread across investors. Portfolios that are over weighted in risky, money losing companies have been hurt more than portfolios that are more weighted towards companies with less debt and more positive cash flows. Even within some of the worst performing sectors, such as technology, breaking companies down, based upon earnings and cash flows, there is a clear advantage to holding money making, older tech companies than money losing, young tech companies:

The question of whether these trends will continue to apply for the rest of the year cannot be answered without taking a stand on inflation, and the effects that fighting it will create for the economy.

- If you believe that there is more surprises to come on the inflation front, and that a recession is not only imminent, but likely to be steep, the returns in the first five months of 2022 will be a precursor to more of the same, for the rest of the year.

- If you believe that markets have mostly or fully adjusted to higher inflation, betting on a continuation of the small cap and value outperformance to continue is dangerous.

- To the extent that there may be other countries where inflation is not the clear and present danger that it is in the United States, investing in equities in those countries will offer better risk and return tradeoffs.

As I noted in my last post, once the inflation genie is out of the bottle, it tends to drive every other topic out of market conversations, and become the driving force for everything from asset allocation to stock selection.

Related: In Search of a Steady State: Inflation, Interest Rates and Value