I’m writing you from the plane on my way back from Singapore. I was there for the most important crypto gathering of the year, TOKEN2049.

It consisted of jam-packed days of one-on-one meetings and talking “shop” with the brightest minds in the markets.

I’ll have a lot more to say next week...

But one big takeaway is just how global crypto is. I shook hands with people from every corner of the world.

Here’s the view of Singapore Bay from one of the rooftop afterparties:

More to come. But today, some important notes on the markets...

We’re halfway through what’s historically been the worst month for stocks.

Stocks rallied 20%+ from January to July... fell in August... and have gone nowhere the past couple weeks.

As I warned you two weeks ago, it’s perfectly normal for stocks to take a breather here.

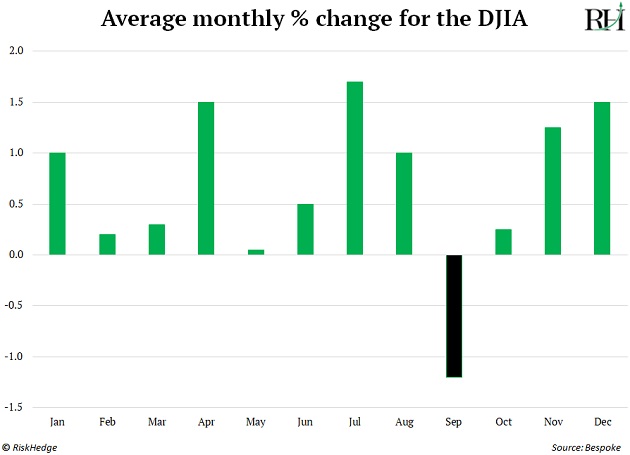

September is typically the worst month for US stocks BY FAR.

It’s the only month in which stocks have averaged a decline over the past 100 years, as this chart shows:

For investors, what month we’re in rarely matters. You don’t think, “Oh, it’s March. I better buy stocks.”

September is the one outlier. For whatever reason, stocks consistently fall in September.

This insight is like the “you are here” map at the mall. Without it, less knowledgeable investors might panic like lost little kids with markets struggling.

I’m using weakness as an opportunity to load up on great businesses profiting from disruptive megatrends. One of my favorites to add to is chip giant ASML (ASML).

Moving on...

Here’s why I’m not worried about rising interest rates… and you shouldn’t be, either.

Super-investor Warren Buffett (more on him below) calls interest rates “the most important item” for stock prices.

He’s compared them to gravity, saying: “Interest rates are to the value of assets what gravity is to matter.”

In other words, when interest rates rise, stocks often fall.

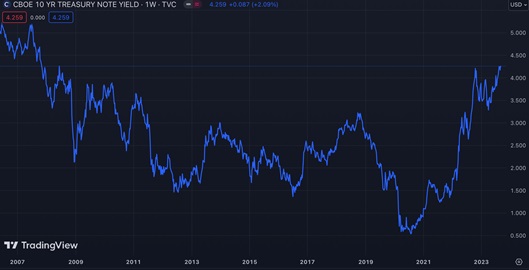

Rates are breaking out to new multi-year highs right now, which is spooking investors.

Below is a chart of the US 10-Year Treasury yield—the “benchmark” for interest rates. You can see rates spiking to highs not seen since before 2008:

Source: TradingView

I ran the numbers on every rising rate environment over the past 50 years. And guess what?

Stocks typically go up during these periods.

There have been 11 rate-hiking cycles since the 1970s. Stocks went up in nine of those cycles, with average gains of 13%/year.

That’s roughly double the S&P’s long-term return of 7%/year. Now, there’s something they won’t tell you on CNBC!

What gives? It turns out stock valuations do fall when rates rise. But stocks can grow their earnings even faster than valuations decline. When they do, they can sail right through tougher times.

That’s why I recommend owning companies that can grow their earnings year after year regardless of what the stock market or interest rates are doing. That’s what my colleague Chris Wood and I are focused on in our flagship advisory, Disruption Investor.

Bottom line: There’s always something to be worried about. But when you invest in great, fast-growing businesses, the rest takes care of itself.

And finally...

Happy (belated) birthday, Warren Buffett!

Buffett turned 93 a couple weeks ago.

The Berkshire Hathaway CEO bought his first stock while he was in middle school… and 80 years later, he’s still at the top of his game.

I learned two big things from reading and listening to Buffett over the years.

#1: Find what you love to do and do it until you die.

Many folks count down the days until they retire.

Buffett had enough money to stop working and put his feet up years ago, yet he’s still grinding away.

That’s because he LOVES to invest. His job is his passion, so why would he ever retire? Buffett will work until the day he dies.

The idea of retiring is depressing as hell to me! I’m obsessed with investing, and it also happens to be my job. I hope I’m lucky enough to do this until the day I die, too.

#2: Never bet against America.

In a shareholder letter a few years ago, Buffett wrote: “For 240 years, it’s been a terrible mistake to bet against America.”

Every time I turn on the TV or open a newspaper, “experts” are bashing the country. We’re told the US is falling apart.

This is just plain wrong. Having lived on four continents, I can tell you America is the most innovative, resilient, and welcoming place on Earth.

It’s no coincidence 16 of the 20 most valuable companies in the world are American… or that six of the 10 richest people in the world built their wealth in the US.

Don’t listen to the haters. Never bet against America.

In the mailbag…

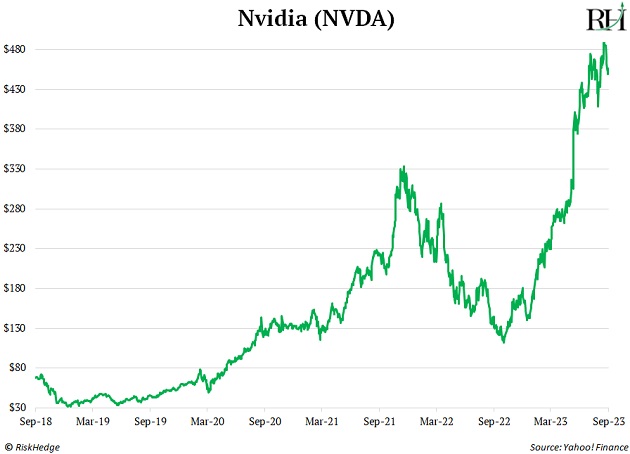

A RiskHedge reader wrote in with a comment about Stephen’s most recent article on Nvidia (NVDA):

“Stephen,

I am an avid follower of yours and RiskHedge and own NVDA and believe it's a great investment today... BUT, you need to mention you said in 2018 that NVDA would double in two years. It's (been) five years and it's not doubled from the $272 in 2018 when you wrote this.”—William

Stephen’s response: Thanks for writing in, William.

Nvidia had a 4-1 stock split in July 2021. Split-adjusted, shares have risen roughly 553% from my original 2018 article to today:

Related: The #1 Problem With Renewable Energy