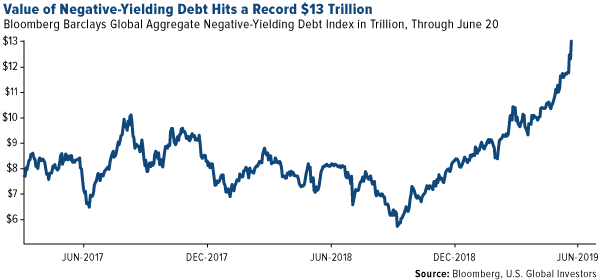

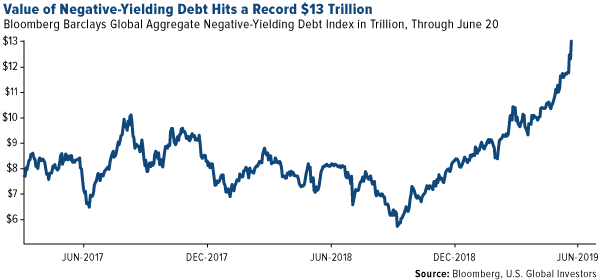

Lately it hasn’t been easy out there for yield-seeking investors. Government bonds have continued to rally around the world , pushing yields to record or near-record lows. More than a few have even fallen into negative territory. In the middle of June, the amount of negative-yielding debt globally reached a record $13 trillion, with more than half of all government debt in Western Europe below zero.

click to enlarge

click to enlarge

Until now this trend hasn’t been seen in emerging Central and Eastern Europe (CEE) economies, but that’s beginning to change. According to Bloomberg, all of the Czech Republic’s bonds were trading at negative real (inflation-adjusted) yields as of July 8, while the yield on Poland’s 10-year note was just slightly above zero.So where can investors turn?

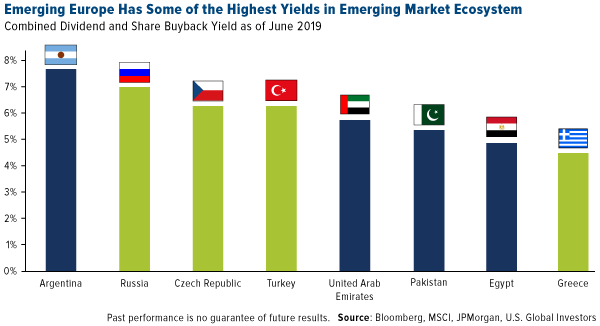

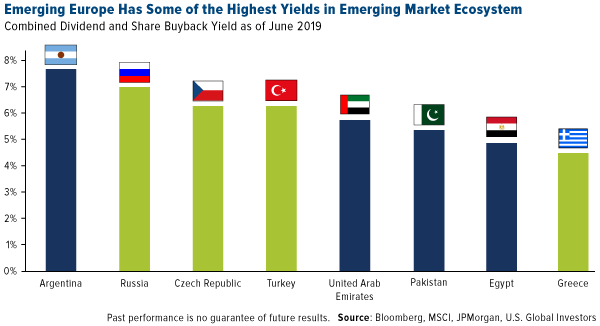

Emerging Europe Equities Offer Some of the Best Yields Right Now

I believe one of the best places in the world to find yield right now is emerging European equities, many of which feature generous dividends and stock buyback programs. Take a look at the chart below. Russia, the Czech Republic, Turkey and Greece all offer some of the highest combined dividend and buyback yields in the entire emerging market (EM) ecosystem. At around 7 percent, Russian stocks had the best yields among emerging European countries as of June, and were second only to Argentinian stocks, according to JPMorgan.

click to enlarge

click to enlarge

Our

Emerging Europe Fund (EUROX) provides access to all four countries’ generous dividends and then some, with Russia the number one country at 52.13 percent of the fund as of the June quarter, Turkey at 11.70 percent, the Czech Republic at 0.88 percent and Greece at 4.37 percent. Hungary, Poland and Romania, which also offer attractive yields, were held in EUROX at the time as well.You can see the fund’s complete regional breakdown by clicking

here.One of the most generous dividend policies, I believe, is offered by Sberbank, Russia’s largest bank as well as the second largest holding in EUROX as of June 30. The bank is paying out 43.5 percent of its net profit for 2018, which comes out to $5.62 billion, or around $0.25 per share. In a June 12 note to investors, analysts at Renaissance Capital made Sberbank one of their top equity picks for the remainder of 2019. They also recommended natural gas producer Gazprom, gold mining company Polyus and Globaltrans Investment, all of which could also be found in EUROX as of June 30.Related:

Should You Follow This Billionaire Investor Towards Gold? Russia Has Led Global Equity Rally So Far in 2019

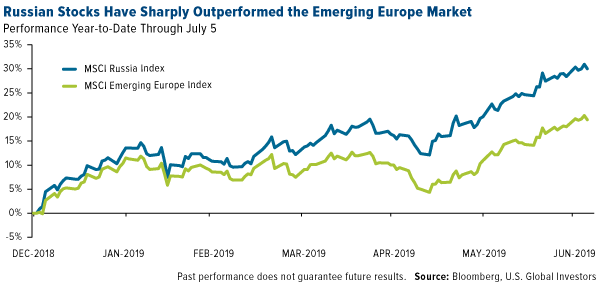

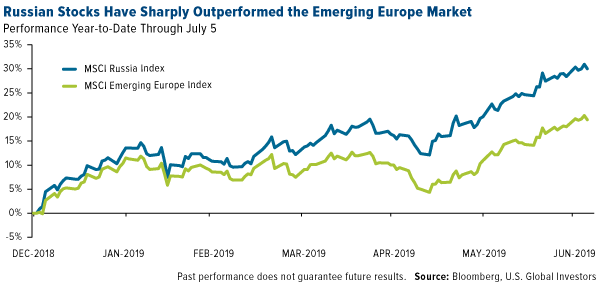

There are other reasons why I find emerging Europe so compelling, and Russia in particular. Russian stocks have had a good run so far in 2019, surging 30 percent year-to-date through July 5 on a number of factors. For comparison’s sake, the S&P 500 Index rose 19 percent over the same period.

click to enlarge

click to enlarge

Chief among the contributing factors has been the huge price rally in crude oil, responsible for approximately 60 percent of Russia’s exports and some 30 percent of its gross domestic product (GDP). Renaissance Capital reports that the country’s budget is “comfortably in surplus… with budget parameters calculated using $40 a barrel real oil prices.” Crude is currently trading above $65 per barrel.In addition, geopolitical conditions have improved. Russian stocks sold off last year, prompted by additional U.S.-imposed sanctions. However, in January, the Treasury Department lifted a number of these sanctions, and the State Department declined to impose any new ones involving the March 2018 poisoning of a former Russian intelligence agent. Investors seem confident that the U.S. won’t take any further actions—in the near term, at least—that might hurt the Russian economy.For these reasons and more, Russia’s credit rating has recently been raised to investment grade by the three major rating agencies—Standard & Poor’s, Moody’s and Fitch.Finally, Russian stocks are trading at very attractive multiples right now. According to Renaissance Capital, Russia is trading on a 12-month forward price-to-earnings of 5.9x, the second lowest among EMs.Discover the

Emerging Europe Fund (EUROX) by clicking the link below today!

click to enlarge

click to enlarge  click to enlarge

click to enlarge  click to enlarge

click to enlarge