Written by: Chaoping Zhu

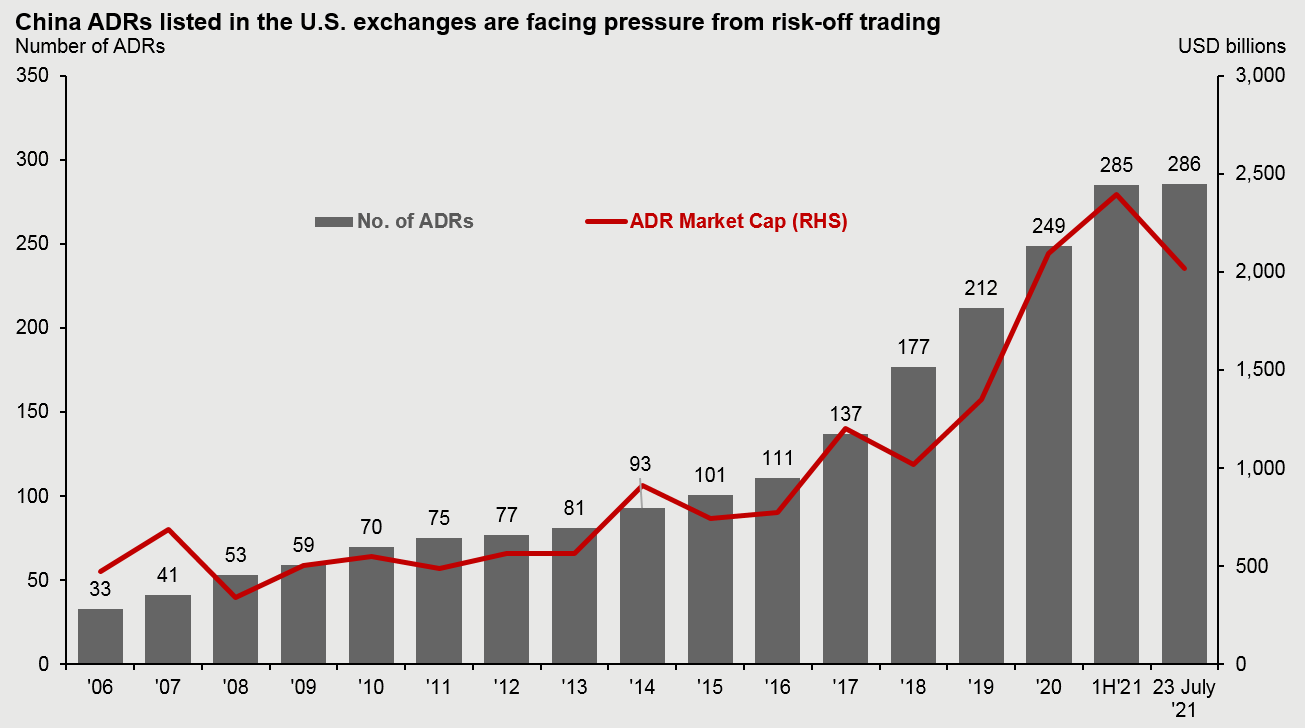

New reforms intended to relieve burdens on students and their families have created selling pressure in Chinese stocks listed overseas. On July 23, led by the private tutoring sector, the 286 American Deposit Receipts (ADRs) listed in U.S. stock exchanges lost 6.1% or USD 131.8billion of their aggregate market cap.

According to the new rules, the Chinese government will no longer approve the setup of new private tutoring companies. In addition, existing companies which tutor school curriculum will be required to transform into non-profit institutions and will be restricted from raising capital on public markets or receiving injections of foreign capital.

The key goals of these new rules are to strengthen China’s K-9 stage (kindergarten to junior high school) education system, and to relieve the economic and mental burdens on students and their families. Authorities view educational challenges as one factor contributing to China’s declining birth rate in the recent years.

These announcements come on the heels of increased regulatory scrutiny being applied to the technology sector as well as actions taken to stabilize the housing market. On July 23, the People’s Bank of China Shanghai Headquarters coordinated a mortgage rate hike as part of the authorities’ sustained efforts to control the property bubble. These actions may increase concerns of further regulatory intervention in various sectors.

However, the circumstances surrounding the education sector are somewhat unique. We do not see these actions setting a widespread precedent for other sectors, nor are they indicative of Chinese policymakers’ broader intentions towards the operations of private sector companies or the use of foreign capital.

In fact, recent interventions by regulators aimed at China’s internet companies have been clearly focused on improving overall market competitiveness to enable more private companies to thrive over the long term. All of this suggests to us, on balance, that Chinese authorities continue to regard domestic and foreign capital as positive elements for the functioning of Chinese markets.

Given there are also education companies listed in China, the U.S.-China relationship does not play a direct role in the latest policy shift, in our view. That said, U.S.-listed Chinese companies remain subject to ongoing regulatory uncertainties from both the U.S. and Chinese authorities. This could prompt companies to seek secondary listings in Hong Kong or mainland China.

EXHIBIT 1: CHINA STOCKS LISTED IN U.S. EXCHANGES

Source: Wind, J.P. Morgan Asset Management.

Data reflect most recently available as of 26/07/21.

Investment implications

We retain our long-term positive stance on Chinese equities, with a focus on structural growth areas such as technology, healthcare and domestic consumption. While some sectors face regulatory headwinds, others could enjoy policy support. For example, semiconductors and software are benefiting from the effects of the import substitution, set out by the 14th Five-Year Plan. Carbon neutrality is another policy focus. It is important for investors to diversify, both in terms of companies and sectors, to navigate the evolving regulatory landscape.

In addition to the growth opportunities in China, investors should also consider the income generation capabilities of Chinese equities and fixed income. The shift towards a more neutral stance in monetary policy should help to keep Chinese government bond yields stable in the second half of 2021.