Written by: Jordan Jackson

Geopolitical risks have played a big role in markets over the past several years, and 2024 is expected to be no different. Over 40% of the world’s population is eligible to vote in their national elections this year, which began with the general election in Taiwan in mid-January and will conclude with the U.S. presidential election in November. Moreover, the continued war in Eastern Europe and the developing conflict in the Middle East may have investors uneasy about putting capital to work.

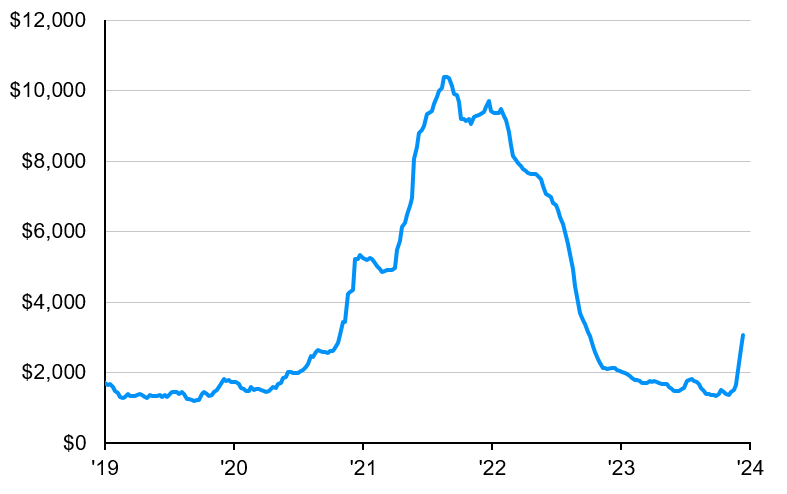

Investors have reason for concern; freight costs have spiked due to attacks by Houthi rebels in the Red Sea and, as shown below, have risen by ~130% since the end of October. As a result of the attacks, perceived oil supply disruptions led to Brent crude oil moving above $80/barrel, before falling back towards $77/barrel at time of writing.

The economic implications could spill over into commodities and core goods, as well as oil and gas prices. Core goods inflation, which has been disinflating all last year, and are in outright deflation on a 3- and 6-month annualized basis, could reverse higher, complicating the Fed’s objective of controlling inflation down to 2%. Moreover, a spike in oil prices could lead to higher prices at the pump, eroding consumer confidence and spending and further disrupting the broad disinflationary trend.

While these events pose a risk, so far, the rise in global shipping costs stemming from these tensions look modest relative to COVID-era disruption. In addition, the number of tankers transiting through the Red Sea have fallen by more than half over the past six months, suggesting voyages have already redirected to avoid routes impacted by conflict and are still transporting goods, albeit on a longer trip, around Africa. Barring any further escalation, we don’t foresee a big inflationary impact on imported goods. Furthermore, oil prices are likely capped due to declining demand globally, suggesting Brent oil should settle between $70-$90/barrel.

For investors, we continue to believe that firm labor markets and gradually cooling inflation keep the Fed on hold until the summer. At the very least, near-term supply-side risks decrease the odds the Fed will begin cutting rates as soon as March.

Shipping costs have risen in recent weeks

WCI Composite Container Freight Benchmark Rate, USD per 40 ft box

Source: Bloomberg, Drewry, J.P. Morgan Asset Management.

Related: Are Markets Too Optimistic About Rate Cuts in 2024?