Written by: David Lebovitz

Coming into the final quarter of 2020, we expected that U.S. economic activity would slow from the torrid pace seen during the third quarter. However, the economy was able to maintain a decent amount of momentum into the beginning of November, and in aggregate, fourth quarter growth will likely be better than originally expected.

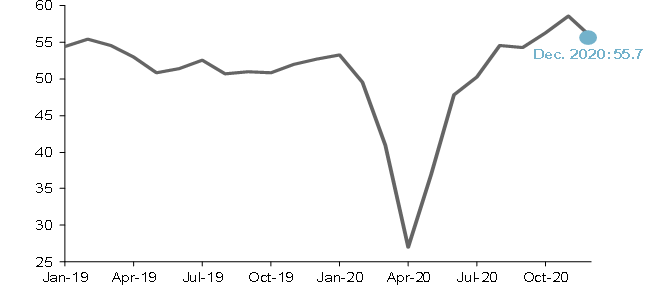

That said, recent economic data suggests that this momentum is fading. Retail sales fell 1.1% in November, as the recent surge in COVID cases has weighed on consumer spending; more broadly, the holiday shopping season has been soft, with Black Friday and Cyber Monday sales both down relative to a year prior. This is likely related to recent deterioration in labor markets, as jobless claims rose from 862,000 to 885,000 during the week ending December 12. Furthermore, the flash reading on the U.S. composite PMI hit a 3-month low in December.

Industrial production has held up a bit better, which reflects the fact that individuals are able to consume goods more easily than services. Industrial production rose 0.4% in November, as a sizable jump in manufacturing output offset a larger-than-expected drop in utility spending. That said, industrial production and manufacturing output are still 5% and 4% below their February levels, respectively.

This recent deceleration in the pace of economic activity clearly highlights the need to provide additional support for those hit hardest by the pandemic. It seems reasonable to expect some sort of fiscal package will be delivered sooner rather than later, as policymakers have focused on areas of agreement, while tabling other topics for discussion at the beginning of 2021. By our lights, this “holiday stimulus” would be comprised of another round of stimulus checks, enhanced unemployment benefits, small business aid including paycheck protection (PPP) loans, funds for vaccine distribution and testing, as well as relief for hospitals. Looking ahead to 2021, the topics of liability protection for businesses and additional aid for state and local governments look set to dominate conversations in Washington.

The magnitude of any soft patch during the coming months will be a direct function of how much fiscal support is delivered. That said, with vaccines developed and now being distributed, the second half of 2021 looks set to see a meaningful acceleration in the pace of economic growth. Equity markets remain focused on this dynamic, and assume that policy will continue building a bridge to the other side of the pandemic. If for any reason, however, this fails to be the case, we would expect volatility to tick higher and risk assets to become a bit unsettled.

The December flash PMI signaled a slower pace of expansion

U.S. composite PMI, index level

Related: Is There a Place for Bitcoin in Investor's Portfolios?