Written by: Jordan Jackson

For many Americans, 2020 presented significant financial challenges as sweeping lockdowns led to soaring job losses, and even though some government support was provided to cushion the blow, millions had to adjust their spending behaviors. In April alone, we saw an overall reduction in spending between 20-50% depending on wealth level for both steady earners and retirees. While no one could have predicted how the pandemic would create financial challenges for so many people, the reality is many could have been better prepared if they had budgeted for emergency situations.

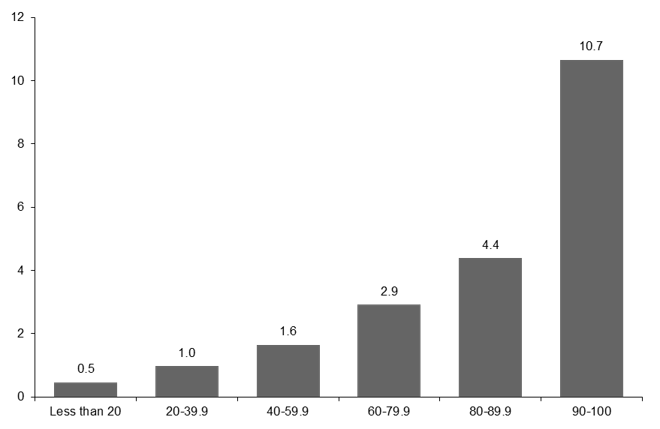

A key retirement planning recommendation is to maintain 3-6 months’ worth of total living expenses in cash for emergencies so that your investments can stay the course. Unfortunately, many had to experience the pandemic-related hardship without that buffer in place, leading them to make what could be costly financial mistakes. As highlighted, our analysis using recent data from the Federal Reserve’s Survey of Consumer Finances and the Consumer Expenditure Survey showed that in 2019, only the top quintile of earners had 3-6 months of liquid savings, while the bottom three quintiles did not.

This severe savings gap is evident in our research as well, which suggests that employer-based retirement plans are the only place where a majority of workers are actively saving. Given this, it is no surprise that almost 6% of workers who have been affected by COVID have had to tap their long-term investment strategy in their DC plan during the pandemic — taking advantage of the CARES Act provisions – and potentially derailing their retirement strategy.

With 2020 serving as a wakeup call for how important establishing and maintaining an emergency reserve is, households should focus on both rebuilding emergency funds and replacing any retirement withdrawals made last year in full, assuming, of course, their financial situations allows. Once you have set aside your emergency reserve fund, investors should look to invest the excess as holding more cash than necessary out of fear of investing in the market means you are losing ground. We highlight the pitfalls of staying on the sidelines or “dollar cost averaging” into the market in a previous post.

The key message for investors is “life happens” – whether it be in your own life or a global pandemic - so being better prepared going forward is critical.

Months of mandatory expenses families' could cover using liquid savings

By income quintile

Source: BLS, Federal Reserve, J.P. Morgan Asset Management. Liquid savings are derived from the2019 Survey of Consumer Finances and include median values in transaction accounts, certificates of deposit, savings bonds, directly held stocks and bonds, and pooled investment funds. *Months of mandatory expenses are derived from the 2019 Consumer Expenditure Survey and include average expenditures on food, shelter, utilities, gasoline and public transportation, healthcare, education, and personal insurance and pension contributions. Data are as of February 3, 2021.