That “sucking through the teeth” sound you heard last week is a function of everyone being on edge since February…In fact, I feel like it’s been this way since 2008. Maybe even 2001.

I say that because for the two decades I’ve been in this industry, “the next big sell-off” has been a reoccurring concern. And because we have come really far, really fast, the anxiety is amplified right now.

No one needs me to tell them how crazy this year has been, but for context, let’s review.

The S&P 500 Index peaked on February 19th and then careened into a bear market and hit a low on March 23rd…losing 34%. Fast forward 50 trading days, and the S&P 500 gained 40%.

Those 50-days mark the best rally for the S&P 500 since 1957.

So the anxiety is understandable, especially when you look out on the horizon and see nothing but uncertainty and potential events that could spell trouble for the markets.

While there seems to be clear visibility into future bad news, there isn’t. You can’t predict the future. As an example, I’ll challenge ANYONE to show me someone who was calling for a 40% positive run off March’s low as we all sheltered in place and stopped the economy.

In fact, let’s have a quick refresher…

But people still think they can see the future…and unfortunately, it does real harm.

Here’s an example. According to a report out of Fidelity, 33% of all investors 65 years or older sold all of their stocks between February and May.

33%

That’s really unfortunate…maybe even devastating. Sure, those folks are getting ready to retire, and their money has to last, so on the surface protecting it seems logical. But, most will likely live 20 more years, so they actually still need growth.

Selling low and sitting in cash out of fear just CRUSHED their returns and potentially unraveled a lifetime of savings.

What’s worse is that the same report said 18% across ALL AGES did that.

Instead, what if those folks had 12-18 months of cash as part of their portfolio, giving them some breathing room?

As any regular reader knows, I like facts, probabilities, statistics, and using history as a guide rather than gut feeling guesses. Gut feeling guesses are what drives those 33% and 18% of investors to make bad choices.

Take a look at the facts…the history…the stats. Use them to formulate a plan and exercise some patience and discipline.

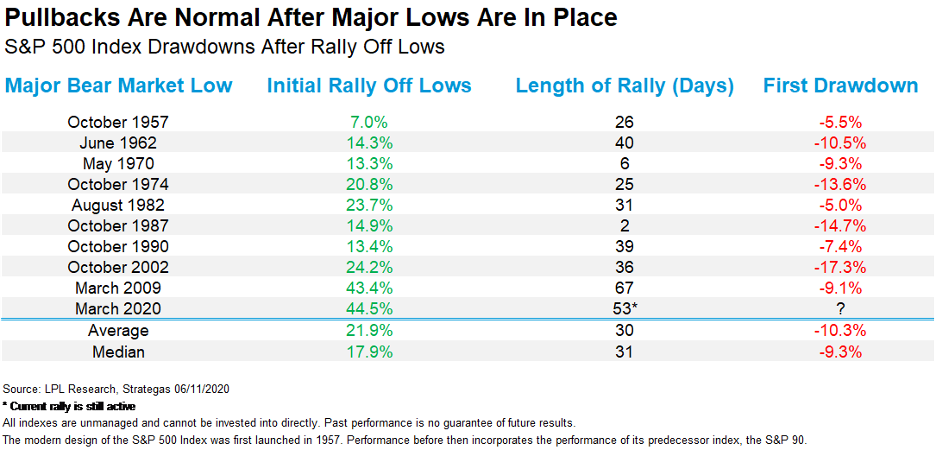

Let’s look at the facts as they relate to rallies and drawdowns, as presented by LPL Financial.

You’ll see below that big pullbacks tend to happen after markets initially rally off the lows…like last week. On average, stocks rally for 30 days after a major bear market low for a +21.9% return and THEN a subsequent drawdown of -10.3%.

The fear of getting in a car crash or breaking down on the highway doesn’t keep people from driving to work because drivers exercise risk management (safe driving) and have a backup plan for breaking down (call a tow truck and an Uber from your cell phone).

No one pulls over to the side of the road and quits driving because they get a gut feeling they may crash their car.

This is no different. Use the facts and stats to create a plan, exercise patience and discipline, use cash as a hedge, and have a portfolio that’s appropriate for your balance of risk and reward.

I know it sounds basic, and people may be tired of the broken record…but apparently, 33% (or 18%) of people still don’t get it.

Right now, there seems to be a few different types of investors – those who are smarter than everyone else (or believe they are), those who think they can see well into the future, and those who recognize those shortcomings and excel at investing by making good risk management decisions over a long period of time.

Vincent Van Gogh once said, “Great things are done by a series of small things brought together.”

Keep looking forward.

This first appeared on Monument Wealth Mangement.

Related: Some of Wall Street’s Best Strategists Have Changed Their Outlooks – What Now?