The Federal Reserve will have to wait even longer for evidence confirming that gains in fighting price pressures are durable before it turns accommodative with this morning’s data showing higher-than-anticipated inflation. The news is sparking an equity market selloff while sending bond yields to the stars as investors once again dial down their Fed easing expectations, this time to only two rate cuts this year. Furthermore, if future data releases continue to arrive inconsistent with the Fed’s 2% inflation mandate, rate reductions later this year may be complicated by policymakers seeking to avoid the appearance of taking positions on the presidential election campaign, which revs into high gear this summer.

Price Pressures Persist

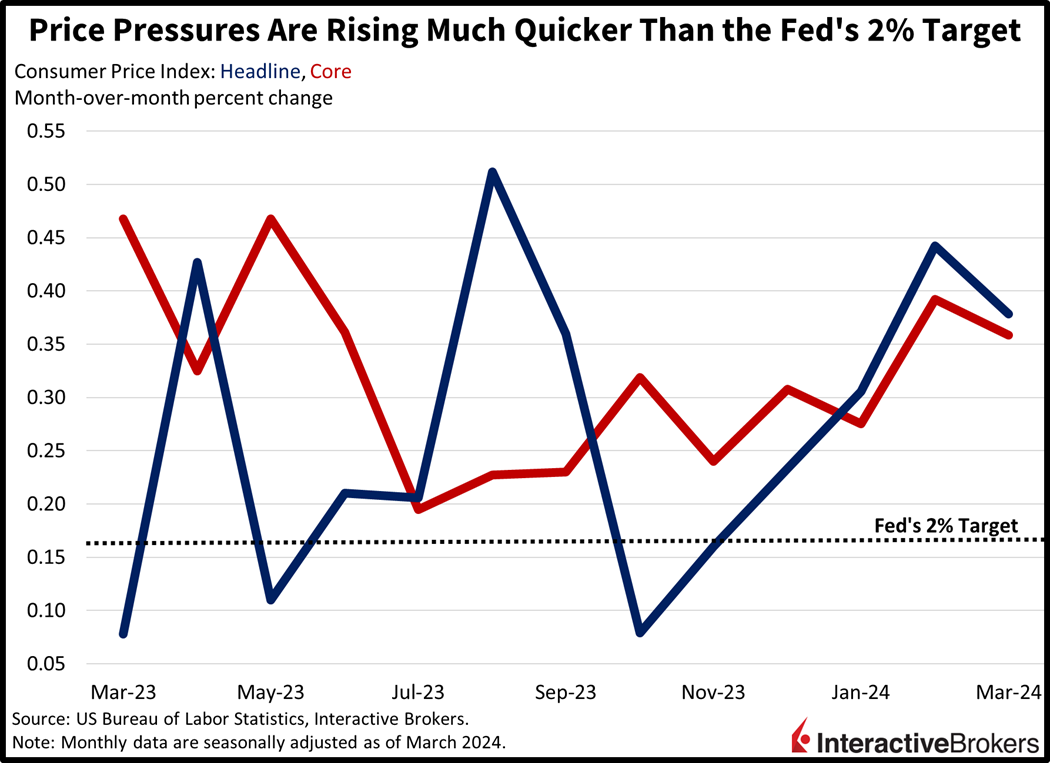

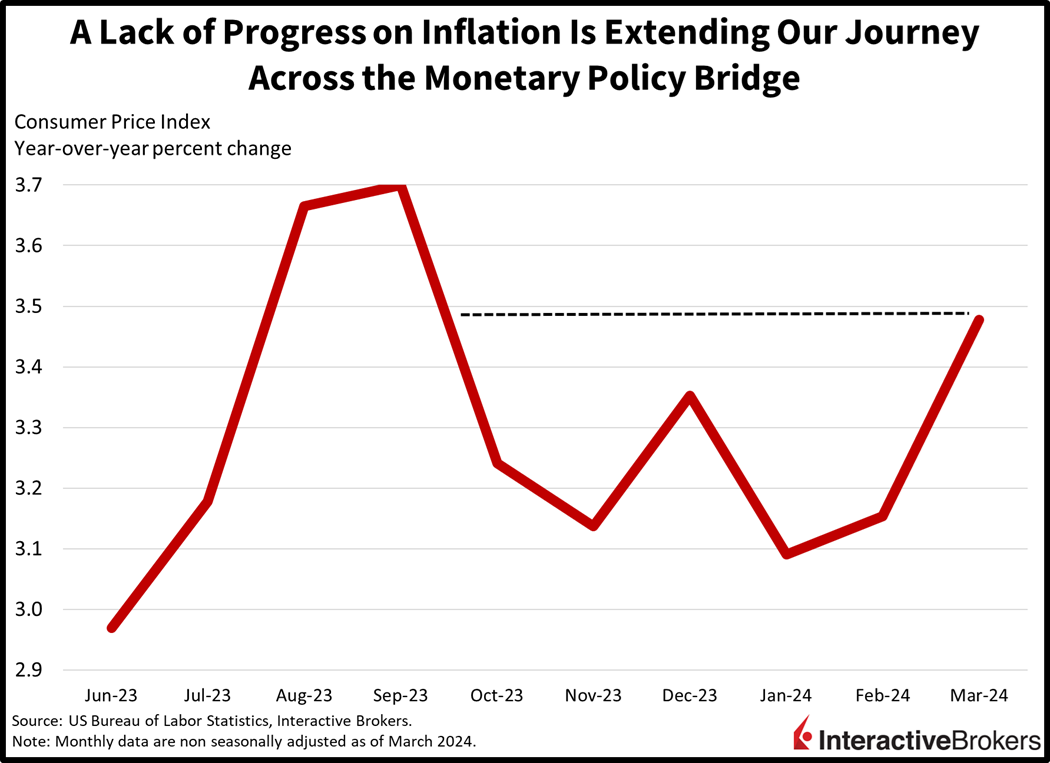

This morning’s Consumer Price Index recorded a significant 0.4% month over month (m/m) and 3.5% year over year (y/y) increase for March, exceeding projections for 0.3% and 3.4%, respectively. Inflation maintained its persistence so far this year, with February’s comparable figures coming in at 0.4% m/m and 3.2% y/y. Core prices, which exclude food and energy due to their volatile characteristics, similarly beat estimates. Core rose 0.4% m/m and 3.8% y/y, with each one a tenth of a percent higher than forecasts while arriving in-line compared to the prior month. Price hikes were broad-based across categories, with relief only present in the automobile and grocery categories. Leading inflation higher m/m were the gasoline and transportation services categories, up 1.7% and 1.5%, respectively, and energy services (electricity & heating), which increased 0.7%. Additionally, the apparel, medical care services, and shelter segments rose 0.7%, 0.6%, and 0.4% m/m. Food at dining establishments and medical care commodities gained 0.3% and 0.2% m/m while food at supermarkets remained unchanged. Used and new automobiles prices declined 1.1% and 0.2%, respectively.

Fed Expectations Shift Meaningfully

Market players are now expecting the Fed’s first rate cut to arrive in September, as today’s CPI can’t be blamed on seasonality following unfavorable readings in January and February. Indeed, June and July probabilities are down to 19% and 44%, as investors project hawkish language out of the Fed Chair and his colleagues. We’ve seen differences of opinion between the Fed Chair and some of the other committee members in recent weeks, with regional presidents offering a much more hawkish perspective relative to the governors in Washington. Perhaps the regions are hearing more anecdotes from locals relative to committee members in D.C. It is indeed much tougher for regular people on the street to make it these days, and while disinflation is cheered by Wall Street, Main Street considers the cumulative rise in the price level since 2020, which is up 20% in a four-year period.

Inflation and Labor Challenge Small Businesses

Meanwhile, the National Federation of Independent Businesses (NFIB), in a report released yesterday, says small businesses believe their biggest challenge is inflation and that 37% of companies are unable to fill job openings, largely due to a lack of skilled candidates. The level, which is unchanged from February, is the lowest since January of 2021. Hiring is the most difficult in the transportation, construction, and services sectors. More broadly, 56% of businesses reported hiring or trying to hire in March. Overall, the NFIB study found small business optimism had declined by 0.1 of a point to 88.5, its lowest level since December of 2012 and its 27th consecutive month below its 50-year average of 98. Conditions may ease as the year progresses, as consumer demand may begin to soften. Various airlines and travel agencies have opined that leisure and hospitality demand will be strong this spring and summer, but the post-pandemic surge in traveling is likely to fade later this year. One saving grace may be an uptick in business travel with the US Travel Association forecasting that volume will reach 95% of its 2019 level this year, up from 89% last year.

Tight Conditions Challenge Businesses

The labor market remains tight enough to continue pushing prices higher, with job gains, wage increases and labor vacancies remaining at robust levels that are not conducive to 2% inflation. Importantly, strong consumer demand for leisure and hospitality, which is a labor-intensive industry, is continuing to provide servicers with pricing power. On Monday, Airbnb reported that 90% of its listings along the viewing path of the solar eclipse were booked. Property owners experienced a 174% y/y increase in revenue per available night due to the strong demand. Bookings were even stronger than during major holidays in 2023. Moreover, Bureau of Labor Statistics data points to leisure and hospitality hiring rapidly, unlike many of the other cyclical sectors, which have been adding jobs a lot slower than in recent years.

Travel and Artificial Intelligence Are Bright Spots

Delta Airlines this morning illustrated how consumers’ wanderlust is still strong despite continuing inflation and that business travel is strengthening. It swung to a profit during the quarter ended March 31. Revenue grew 6% y/y while corporate sales climbed 14%. Delta shares bounced approximately 5% this morning after the company provided second-quarter guidance that exceeded investors’ expectations. In the tech sector, some investors are questioning if the growth of artificial intelligence (AI) will live up to lofty expectations. Taiwan Semiconductor Manufacturing Co. results appear to confirm the strong growth narrative for AI, reporting today that sales in the quarter ended March 31 grew at the fastest pace since 2022 and exceeded analysts’ expectations. Sales jumped 16.5% y/y, driven in large part by demand for AI chips.

Certain other industries, however, are struggling. Last night, WD-40 Co., which is well known for its water displacing oil, said sales in its Americas region, which includes the United States, Latin America, and Canada, grew only 1% y/y. While the company’s maintenance product sales were strong, sales of homecare and cleaning products declined in the US. Its share price dropped nearly 4% in early trading.

Equities Sell Off as Bond Yields Soar

Markets are getting slammed as today’s hot CPI throws a wrench into investors’ expectations for rate cuts. Stocks, specifically the most rate-sensitive ones, are getting hit the hardest. Yields and the dollar are soaring to fresh year-to-date highs meanwhile, as our journey across the monetary policy bridge appears to have been incrementally extended. All major US equity indices are down sharply, with the small-cap Russell 2000 leading the charge lower; it’s down 2.5%. The Dow Jones Industrial, S&P 500 and Nasdaq Composite indices are down a milder 1.1%, 1% and 0.9%. All 11 sectors are lower on the session, with real estate, utilities and consumer discretionary down 3.9%, 1.7% and 1.4%. The regional banking sub-sector is down 4.1% as the segment is highly levered to the prospect of incoming rate cuts. Yields are soaring in a bear flattening fashion, with the 2- and 10-year Treasury maturities trading at 4.93% and 4.49%, 19 and 13 basis points (bps) higher on the session. The dollar is responding strongly to lighter Fed easing expectations and loftier yields, with its index up 99 bps to 105.14. The greenback is gaining versus all of its major developed market counterparts including the euro, pound sterling, franc, yen, yuan and Aussie and Canadian dollars. Indeed, the Bank of Japan may begin intervening shortly, as their currency is down to 153, another fresh year-to-date low relative to its US competitor and lower by 0.8% this session. Crude oil is down 0.6%, or $0.52, to $84.76 per barrel, as a stronger greenback and stronger inventory stateside offsets supply concerns stemming from an escalation in Middle and Far East conflicts.

A Challenging Path Ahead

Today’s report reflects that progress on inflation has reversed, with goods and commodities turning from a disinflationary friend to an inflationary foe. Indeed, today’s 3.5% reading is the loftiest figure since last September. Risk assets are approaching a fork in the road. If the Fed implicitly accepts price pressures between 3% and 4%, the inflation put has been born, providing another stabilizing force on top of the traditional Fed and dividend puts. But if the central bank remains committed to 2%, hell or high water, then a meaningful correction in equities will take place. This correction could be significant with equity valuations having expanded largely due to expectations that the Fed will make significant rate cuts this year, which would help sustain corporate earnings while reducing the likelihood of the economy entering recession.

Visit Traders’ Academy to Learn More About the Consumer Price Index and Other Economic Indicators