Written by: Meera Pandit

The S&P 500 closed the first half of the year up nearly 17%, a sharp divergence from expectations at the beginning of 2023. This welcome but surprising rally has investors slightly uneasy, wondering if it is durable. Beneath the surface are two market dynamics: the megacap tech stocks, which account for the lion’s share of positive market performance year-to-date, and everything else.

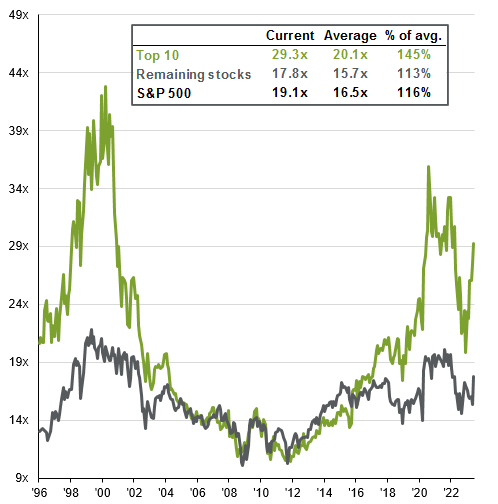

This narrow rally has resulted in two issues for the market: valuations and concentration. First, the overall valuation of the S&P 500 looks rich, at 19.1x. However, as shown on page 11 of the 3Q23 Guide to the Markets, the top ten stocks, which are predominantly megacap tech, are 45% more expensive than their long-term average, compared to the rest of the S&P 500, which is 13% more expensive compared to its long-term average due to the recent rotation into the rest of the market. Areas with high valuations are vulnerable to correction if volatility picks up, so investors ought to consider opportunities outside of the biggest names which sport more favorable price tags.

In addition, the weight of the top 10 stocks in the S&P 500 is 31.7%, a record concentration dating back at least three decades. However, the earnings contribution to the index of those top 10 stocks is just 21.5%. In 2021, the weight and earnings contributions were essentially commensurate, but these names are no longer pulling their weight in terms of profits.

AI enthusiasm has vaulted valuations and future profit expectations, but this theme will take years to play out, with many eventual beneficiaries that may not even exist yet. For the current winners, it’s difficult to capture the upside potential of the many applications of AI, but also similarly difficult to handicap some of the geopolitical or regulatory risks. Therefore, it is important for investors to find other sources of exposure to this theme, like Asian public equities and private equity. Asia tech ex-Japan has kept pace with U.S. growth stocks over the past decade, as highlighted on page 51 of the 3Q23 Guide to the Markets, but lackluster confidence in China and EM equities has weighed on overall valuations abroad. Fewer companies have been going public over time or have been staying private for longer, resulting in greater access to opportunities in the private markets. As highlighted on slide 39 of the Guide to Alternatives, private equity has triple the exposure to tech than the Russell 2000, which could yield many emerging opportunities in AI.

A small number of stocks have had an outsized impact on market performance and valuations in 2023. Investors ought to consider diversifying some of that exposure, while unearthing opportunities in the rest of the market which may have runway to rally.

P/E ratio of the top 10 and remaining stocks in the S&P 500

Next 12 months

Source: FactSet, Standard & Poor’s, J.P. Morgan Asset Management. The top 10 S&P 500 companies are based on the 10 largest index constituents at the beginning of each month. As of 5/31/2023, the top 10 companies in the index were AAPL (7.5%), MSFT (7.0%), AMZN (3.1%), NVDA (2.7%), GOOGL (2.1%), GOOG (1.8%), Meta (1.7%), BRK.B (1.7%), TLSA (1.6%), UNH (1.3%) and XOM (1.2%). The remaining stocks represent the rest of the 494 companies in the S&P 500. Guide to the Markets – U.S. Data are as of June 30, 2023.