Written by: Insight Investment

With inflation having declined significantly from peak levels, real policy rates have moved from deep negative territory to the highest levels seen since before the global financial crisis (see Figure 1). It is difficult to justify such restrictive policy rates given softer economic data, which we believe has provided central banks with the flexibility to start easing, despite ongoing inflation concerns.

Figure 1: Real policy rates may have moved to overly restrictive levels

Source: Insight Investment. Data as of October 31, 2024.

Did We Miss a Crisis?

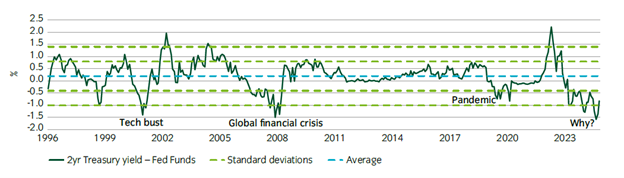

Although we agree that prudent rate cuts are necessary at this stage of the cycle in an effort to underpin growth and ensure that central banks can engineer a soft landing or mid-cycle slowdown, we question the exuberance of rate markets. Looking back at history, markets have priced in a faster easing cycle than the Internet/Tech bust, Global Financial Crisis and COVID-19 pandemic (see Figure 2). To us, this seems at odds with an economy that is still growing, and an equity market close to record highs.

Figure 2: The spread between overnight rates and 2-year Treasury yields has reached crisis levels

Source: Insight Investment. Data as of October 31, 2024.

Steeper Yield Curves Ahead?

Unless data meaningfully deteriorates in the months ahead, we believe markets are likely to be forced to reassess expectations for both how rapidly rates will decline and the terminal level of rates. We believe this is likely to put a floor under yields in the intermediate area of the curve and that yields at the very long end of the curve could even drift upward, resulting in steeper yield curves.

What Does This Mean for Investment Grade (IG) Credit?

Robust investor demand through 2024 has caused spreads in investment grade credit to compress (see Figure 3). Absolute yields have declined from their peaks, in part due to the compression in spreads, but have remained high relative to the last decade (see Figure 4). This combination of tight spreads with high absolute yields means some investors are likely waiting for spreads to widen before increasing allocations. We believe this overlooks the potential for active managers to enhance returns in fixed income markets beyond yield alone.

Figure 3: Spreads have tightened significantly Figure 4: Absolute yield remained attractive

Source: Insight Investment. Data as of October 31, 2024. Past performance does not guarantee future results. Investing involves risk of loss which may partly be due to exchange rate fluctuations.

Active Managers Have Real Potential to Add Value in Fixed Income

Many investors believe that active managers struggle to outperform or even match their benchmarks and extrapolate this idea across all investment assets. But this isn’t always true in fixed income markets, which are far less efficient and transparent than equity markets, and present inefficiencies that may be exploited by active managers. The rise of passive investing in fixed income has, if anything, exacerbated these inefficiencies.

JP Morgan forecasts that gross U.S. investment grade issuance will reach $1.5 trillion in 2024, with elevated levels of issuance expected to continue into 2025 as corporations seek to refinance debt issued around the pandemic. Euro-denominated markets have been following a similar trend. We expect this could create an environment with significant opportunities for security selectors, who can look to exploit new issue premiums and home in on idiosyncratic investment stories.

We believe it is important not to view fixed income investment via yields alone, but to also ensure that careful thought is given to manager selection, with a focus on their history of generating consistent performance in excess of market returns.

Related: Sustainable Innovation in the Trump 2.0 Era: Why It Still Matters