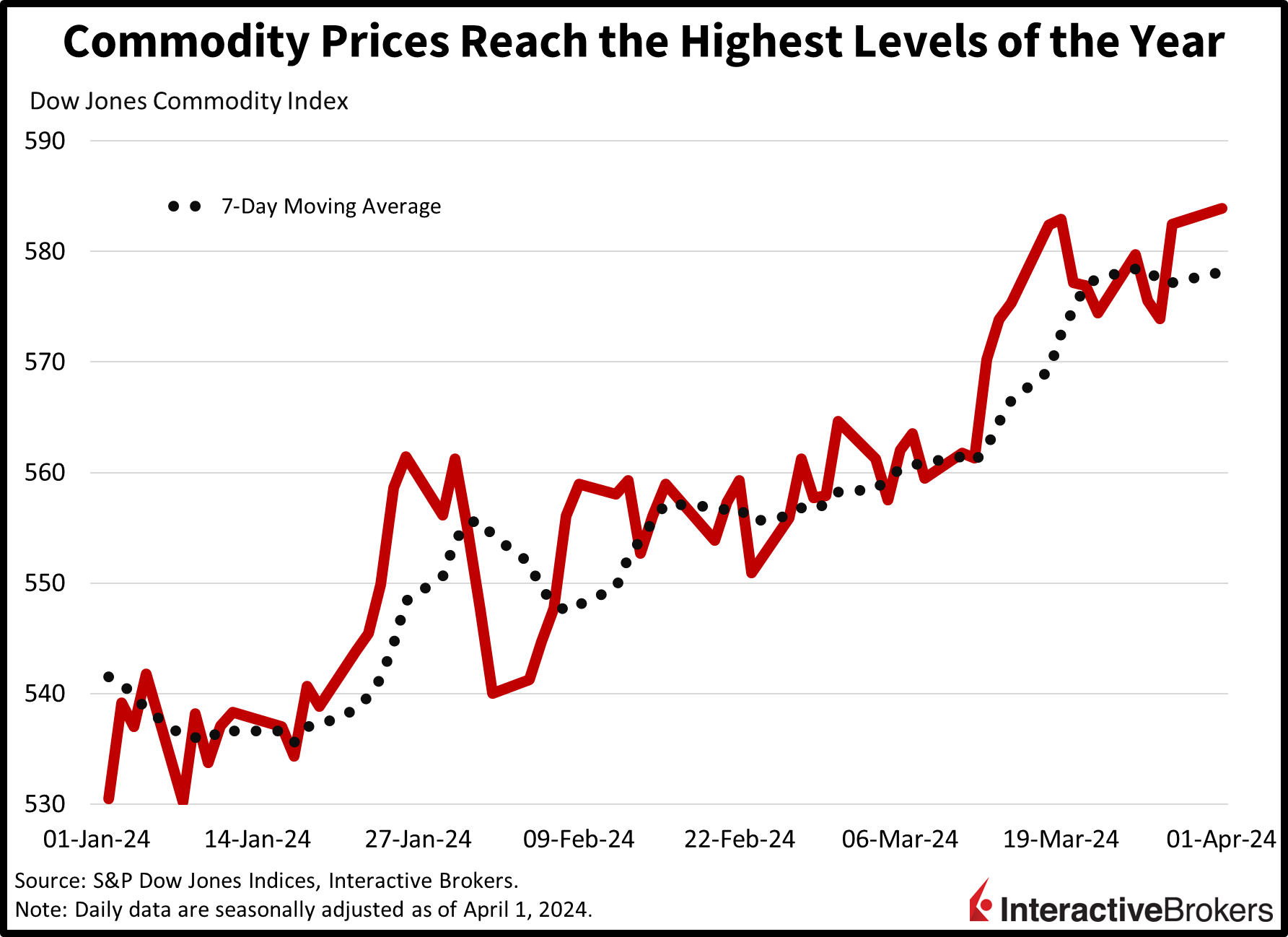

Markets are getting hammered while oil prices are climbing on the back of escalating geopolitical tensions in the Middle East with rhetoric between Tel-Aviv and Tehran growing more aggressive. Higher oil prices are adding to inflation fears, driving the 10-year Treasury yield to its loftiest level of the year and gold to a fresh all-time high as a combination of buoyant price pressures and unsustainable government borrowing has captured investors’ attention. From the central banking angle, market players are realizing that the sharp rise in commodity prices may incrementally delay the Fed’s first rate cut, extending our journey across the monetary policy bridge to price stability. Economic data out at 10:00 am ET failed to come to the rescue, with job openings and factory orders arriving above analyst projections.

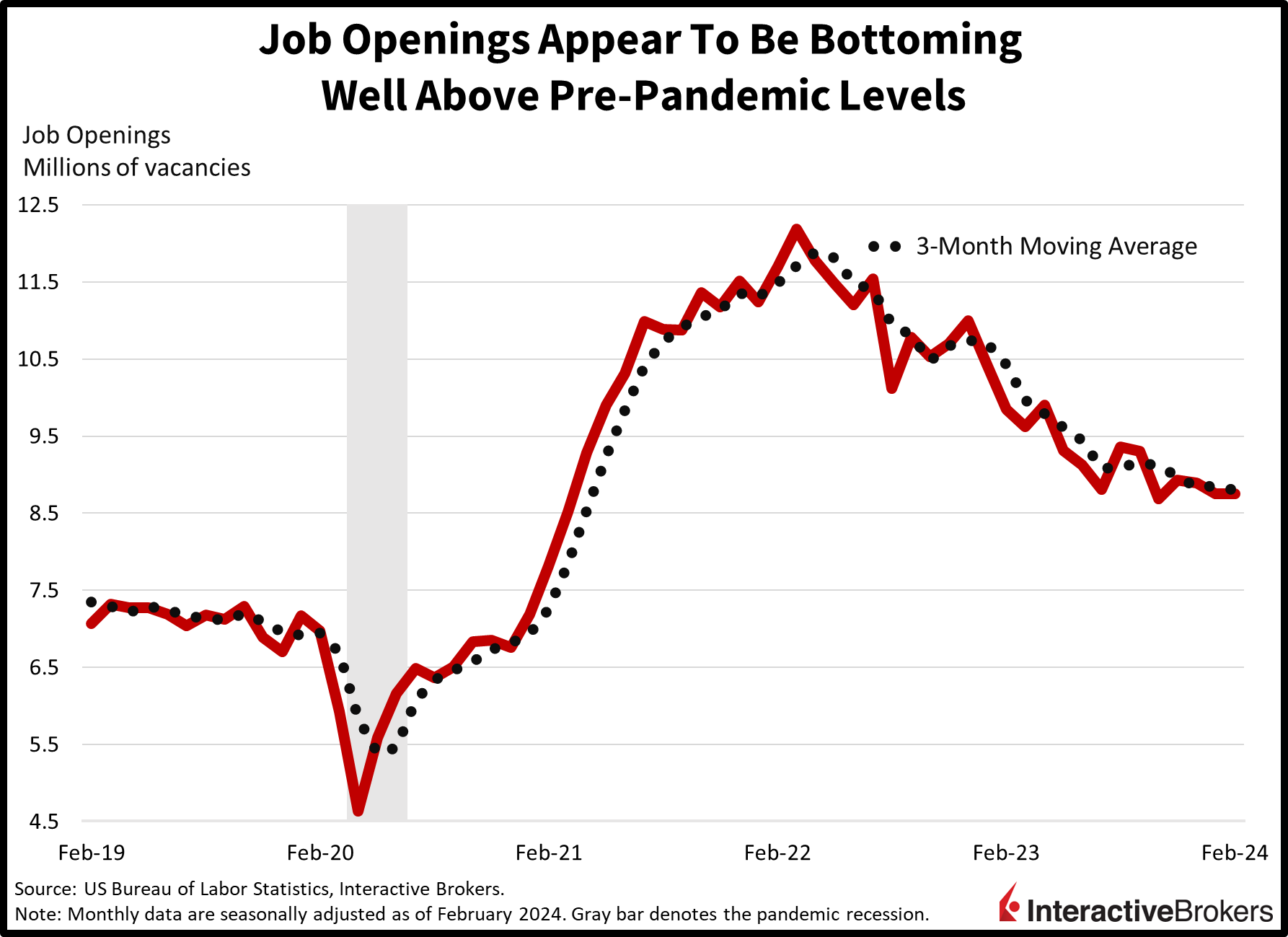

Employers Continue to Crave Workers

A persistent business appetite for labor led to an increase in job openings in February. The labor market remains tight indeed, as strong balance sheets and growth mindsets among executives keep corporate recruiters busy. Job openings rose to 8.756 million in February from 8.748 million in the prior month while narrowly beating the median estimate of 8.75 million. Among sectors, finance and insurance, and state and local government excluding the education component, were the biggest gainers, adding 126,000 and 91,000 vacancies. The arts, entertainment, and recreation category was the third-largest gainer with 51,000 new openings. Information and the federal government offset some of the increase, with vacancies declining by 85,000 and 21,000. Also, employees appeared incrementally more confident replacing their current jobs with another employer, with quits rising from 3.446 million to 3.484 million month over month (m/m).

US Factory Orders Increase

Factory orders grew in February, consistent with the preliminary Durable Goods report released last week from the Commerce Department. Passenger aircrafts remained the highlight, with purchasing activity recovering some of the lost ground from January following manufacturing and regulatory problems at Boeing. Factory orders rose 1.4% m/m, beating expectations of 1% while offsetting some of the previous month’s 3.8% battering. On a year-over-year basis, factory orders rose 2.6%, better than January’s 1.5% decline.

Tensions Escalate in the Middle East

Middle East tensions escalated yesterday following a military attack on Iran’s consulate in Syria and an airstrike in Gaza. Iran is blaming Israel for the consulate attack, which killed a senior commander in Tehran’s Islamic Revolutionary Guard Corps (IRGC) and at least six other people. It is vowing to strike back, as consulates are considered sovereign territory, which raises the stakes of yesterday’s violence. The turmoil has created increased fears of oil supply disruptions, causing WTI oil’s price to climb 1%, or $0.82, to $84.27 per barrel. In Gaza, an airstrike killed at least 7 humanitarian relief workers who were delivering food to the region.

Investors Flock to Safety

Investors are scooping up gold bars, shares of energy producers, and utility stocks to protect themselves from possible volatility stemming from geopolitics, lofty Treasury issuance/deficits, and a Fed that may cut later rather than sooner. All major US equity indices are down but the rate-sensitive, small-cap Russell 2000 is getting hammered the hardest, experiencing a daily loss of 1.8%. The Nasdaq Composite, Dow Jones Industrial, and S&P 500 indices are lower by 1.4%, 1.1%, and 1%, meanwhile. Sectoral breadth is in the tombs with only two out of 11 sectors higher; energy and utilities are up 0.8% and 0.4%. Leading the downside are the healthcare, consumer discretionary, and technology segments, which are lower by 1.7%, 1.7%, and 1.4%. The healthcare sector is declining in response to the Centers for Medicare and Medicaid Services announcing they will only increase reimbursement rates by 3.7% in 2025, which is lower than was expected and weighs on revenue projections. Meanwhile, Tesla shares are tanking after the company said logistical challenges and weakening interest in electric vehicles are resulting in declining sales and slower production levels as a result. In fixed-income, near coin-flip odds of a June rate reduction alongside a sharp rise in oil prices are leading to a bear-steepening formation across the yield curve, with the 2- and 10-year Treasury maturities trading at 4.71% and 4.37%, 1 and 6 basis points (bps) higher on the session as investors show little interest in the instruments today. The dollar is paring some of its strong gains from yesterday, with the greenback’s index down 19 bps to 104.76 as the currency loses ground versus the euro, pound sterling, yen, yuan, and Aussie and Canadian dollars. It is gaining relative to the franc though.

The Fed and Treasury Face Growing Challenges

Today’s sell-off is reminiscent of the October downdraft, as oil prices levitated inflation expectations alongside the long end of the curve. Stronger economic data amidst heightening geopolitical tensions are certainly inflationary and problematic for the Fed. While the central bank seems comfortable with inflation 50% to 75% above target for the time being, sharp increases in commodity prices are unacceptable for the general trend of price pressures, as they’ll eventually start to prop up costs for both services and goods. Investors are taking advantage of these headwinds to book profits in risk assets and shift to safer havens. Long-end yields, however, may find support in the coming months when the Fed slows down its quantitative tightening program but remain in a longer-term bearish trend as issuance, spending, and debt levels are unsustainable.

Related: Manufacturing Recovery Met With Fiery Price Pressures