This morning’s hotter-than-expected inflation data is falling on deaf ears as equity traders instead focus on Oracle’s positive artificial intelligence (AI) statements from the company’s earnings call last night. Bond traders are cautious though, demanding more compensation in light of accelerating price increases ahead of a 10-year note auction this afternoon. Overall, however, market participants doubt that Fed Chair Powell is troubled by 3% inflation considering his dovish rhetoric at last week’s Congressional testimonies, when he emphasized that rate cuts are right around the corner.

Price Gains Pick Up Steam

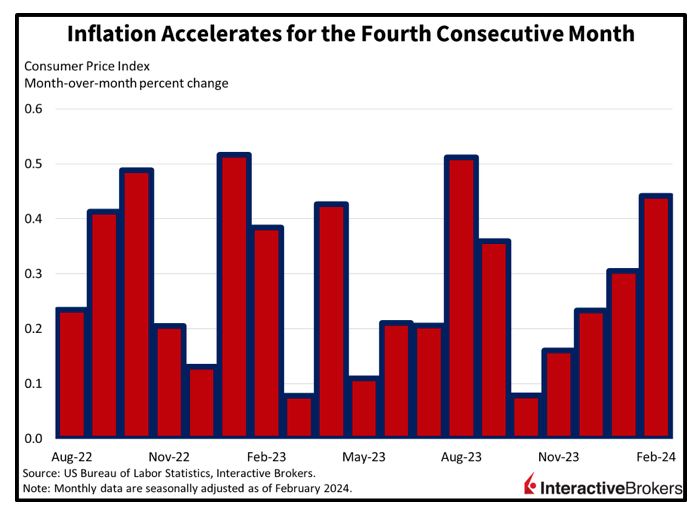

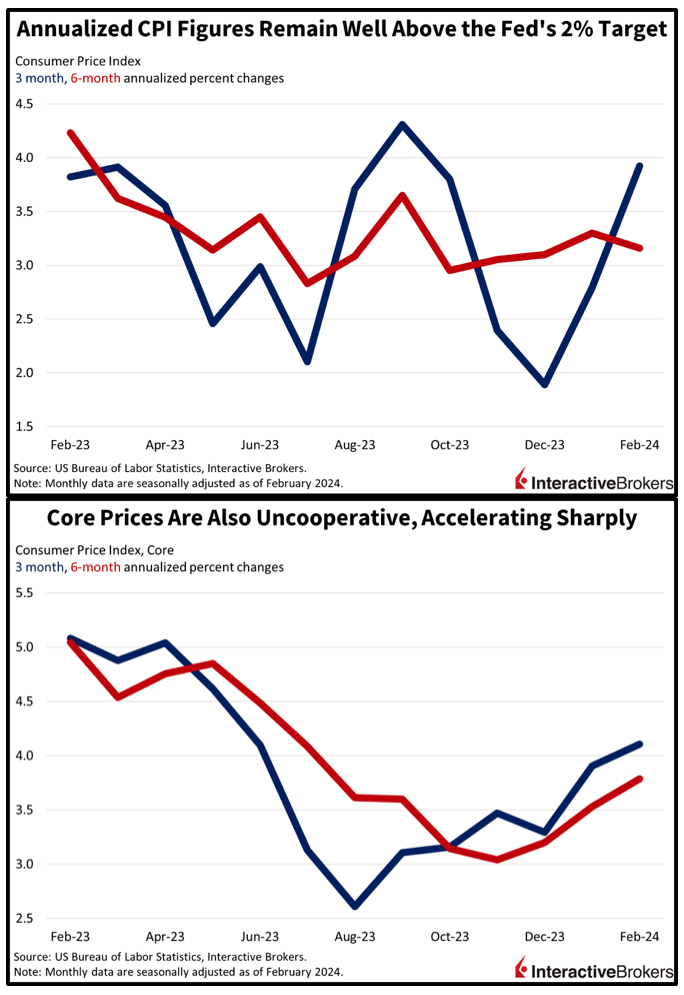

Inflationary pressures accelerated for the fourth consecutive month in February with the overall level of prices rising 0.4% month-over-month (m/m) and 3.2% year-over-year (y/y) from 0.3% and 3.1% in January. The pivotal core segment, which excludes food and energy, rose 0.4% m/m and 3.8% y/y from 0.4% and 3.9% during the previous month. Most figures arrived hotter than expectations with the Street projecting 0.4% and 3.1% for headline and 0.3% and 3.7% for core.

Gasoline Costs Shift from Laggard to Driver

While this morning’s report depicted broad-based price increases, gasoline costs shifted from a headwind to a tailwind, rising for the first time since September. Indeed, gasoline led the charge last month, increasing 3.8% m/m while transportation services were the second-largest gainer, increasing 1.4%. Other significant categories and their noted increases included the following:

- Energy services (heating and electricity), 0.8%

- Apparel, 0.6%

- Used automobiles, 0.5%

- Shelter, 0.4%

Food at dining establishments and medical care commodities rose a modest 0.1% each while food at markets was unchanged. Prices for new automobiles and medical care services both declined 0.1% during the period.

Barely Any Disinflation Last Month

Across the major segments of services, goods and commodities, nothing worked for the disinflation narrative last month, with all three categories threatening the Fed’s 2% inflation target. Among services, the labor-intensive categories continued to experience cost pressures from strong wage growth, low labor force participation, and an abundance of job openings. Shelter keeps rising, meanwhile, with home purchases and lease renewals, which are two of the sector's three largest components, reflecting no signs of slowing down. Homebuyers must contend with the least favorable mix of mortgage rates and prices in history that is badly hurting affordability, while landlords are pressured by rising interest expenses as well as higher costs for insurance, maintenance, labor, materials, etc. The cost dynamics are leading landlords to raise rents on renewals while managers of newly developed apartment complexes are offering rent concessions. Still, however, a minority of people move yearly, leaving most of the market overly exposed to home purchasing and lease renewals from an inflationary perspective. Over in goods and commodity land, looser financial conditions, lighter interest rates, geopolitical tensions, and Red Sea disruptions have complicated the inflation picture from both a demand and supply side. For the disinflation narrative to gain further steam, goods and commodities will need to cooperate this year, after paving much of the path last year.

AI and Travel Grow but Retail Fizzles

Demand for AI services is supporting the growth of cloud computing while strong travel trends combined with price increases are helping to partially offset the impact of bad weather for ski resort operator Vail Resorts. Meanwhile, weak consumer spending on goods is weighing upon results for Kohl’s department stores. These trends are illustrated in the following earnings highlights:

- Oracle’s earnings for the fiscal quarter ended February 29 exceeded the analyst consensus expectation while revenue missed estimates despite strong demand for technology that can support AI. Revenue for the company’s cloud infrastructure offering and related services jumped 25% y/y as customers increased spending to build AI services. Oracle CEO Safra Catz said the company is expanding its cloud capacity to meet growing demand and it added several “large new cloud infrastructure” contracts during the quarter. The company also expects to sign other large contracts this year for its AI-enabled cloud infrastructure services. Other business areas for Oracle were weak, with sales for on-premises products, software licensing, and hardware contracting y/y. Nevertheless, the company’s anticipation of strong demand for its cloud infrastructure caused its share price to jump more than 13% last night.

- Vail Resorts missed earnings and revenue expectations for the quarter ended January 31, a result of below-normal snowfall causing a decline in visits to its properties. The company partially offset the impact of lower visits by increasing its prices and boosting sales of seasonal passes. Ancillary spending by guests at ski schools, restaurants, and lodging rentals also supported results. While the company expects visitations to increase based on trends at resorts where snowfall has improved, it lowered its full-year guidance, causing its shares to decline more than 7%.

- Kohl’s reported another quarter of declining same-store sales and missed revenue expectations but exceeded the consensus earnings estimate. The department store operator’s guidance for the current quarter also missed expectations. The company decreased its inventory by 10% y/y and its decline in same-store sales moderated relative to past quarters. For the full fiscal year, it anticipates producing earnings per share ranging from $2.10 to $2.70. Analysts expected $2.61. The company also announced that it will add Babies “R” Us branded sections to its stores.

AI Propels an Equity Rally as Bonds Reverse

Stocks are up and bonds are down today as equity traders focus on AI while fixed-income players assess inflation’s stickiness. All major US equity benchmarks are higher, led by the Nasdaq Composite and S&P 500 indices, which are up 1.2% and 1%. The cyclically tilted Dow Jones Industrial and Russell 2000 baskets are up a milder 0.6% and 0.1%. Sector breadth is positive with technology, consumer discretionary, and communication services leading; they’re up 1.5%, 1%, and 0.9%. The only laggards are utilities, real estate, and materials, which are lower by 0.4%, 0.1%, and 0.1%. Yields and the dollar are loftier on the back of increasing inflation expectations. The 2- and 10-year Treasury maturities are trading at 4.60% and 4.15%, 6 and 5 basis points (bps) higher on the session. The dollar is gaining as the US currency appreciates against all major developed market counterparts including the euro, pound sterling, franc, yen, yuan, and Aussie and Canadian dollars. The greenback’s index is up 22 bps to 103.07. Meanwhile, in the energy space, an upbeat demand forecast from OPEC+ is leading to firmer oil prices, with WTI crude up 0.6%, or $0.50, to $78.58 per barrel.

All Eyes on the Dot Plot

Today’s CPI results have increased the significance of the Fed’s release of its Summary of Economic Projections, or dot plot, next Wednesday. Even with four consecutive months of CPI increases, investors are anticipating that the central bank will cut rates in June and make an additional two cuts by year-end. The Fed’s dot plot will provide insight into how realistic these expectations are with some members of the Fed implying that one or two cuts this year may be sufficient, rather than the three the market is pricing in. This Thursday’s retail sales and wholesale inflation reports may provide members of the central bank with more evidence in one direction or the other. In the meantime, however, patience appears to be the predominant theme at the Fed these days. A few other hot reports are likely to push back the first rate cut to July, extending our journey across the monetary policy bridge.

Related: Bears Intercept: Analyzing Nonfarm Payrolls in the Market Play