Technically, the Dow and S&P snapped their 7-day winning streak.

Technically.

I hardly consider a decline of 0.03% and 0.11% for the Dow and S&P, respectively, a down day.

Meanwhile, the Nasdaq and Russell saw a record close for who knows how many consecutive days.

Can the market keep this up? Who even knows anymore. Everything seems to defy expectations and logic. Yeah, it's possible. But I'd be surprised if we don't see at least one sharp pullback before the end of the week.

The sentiment is surely rosy right now. The economic recovery appears to be gaining steam, and the Q1 decline everyone predicted might not be as swift as we anticipated- if at all. President Biden's stimulus could officially pass within days as well and provide much-needed relief to struggling businesses and families.

Have you seen the vaccine numbers lately, too? More people in the U.S. have now been vaccinated than total cases. On Monday (Feb. 8), vaccine doses outnumbered new cases 10-1. New daily COVID cases have also reached their lowest levels since October.

With Johnson and Johnson's (JNJ) one dose vaccine candidate seemingly days away from FDA approval, the outlook is certainly more positive at this point than many anticipated.

But we're not out of the woods yet, and three non-pandemic related factors still concern me- complacency, overvaluation, and inflation.

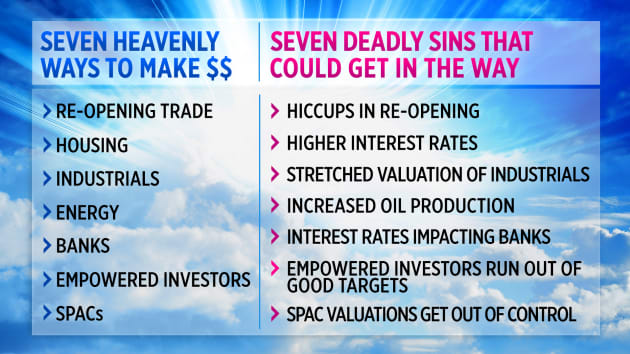

Jim Cramer's "Seven Deadly Sins" from Mad Money Monday night (Feb. 8) reflect many of my concerns too:

Source: CNBC

Yes, I know I keep saying to beware. I also know that earnings are on pace to rise by over 20% in 2021. Since 1980, only 12 years have earnings increased by 15% or more. Except for 2018, the market gained an average of 12% in all of those years.

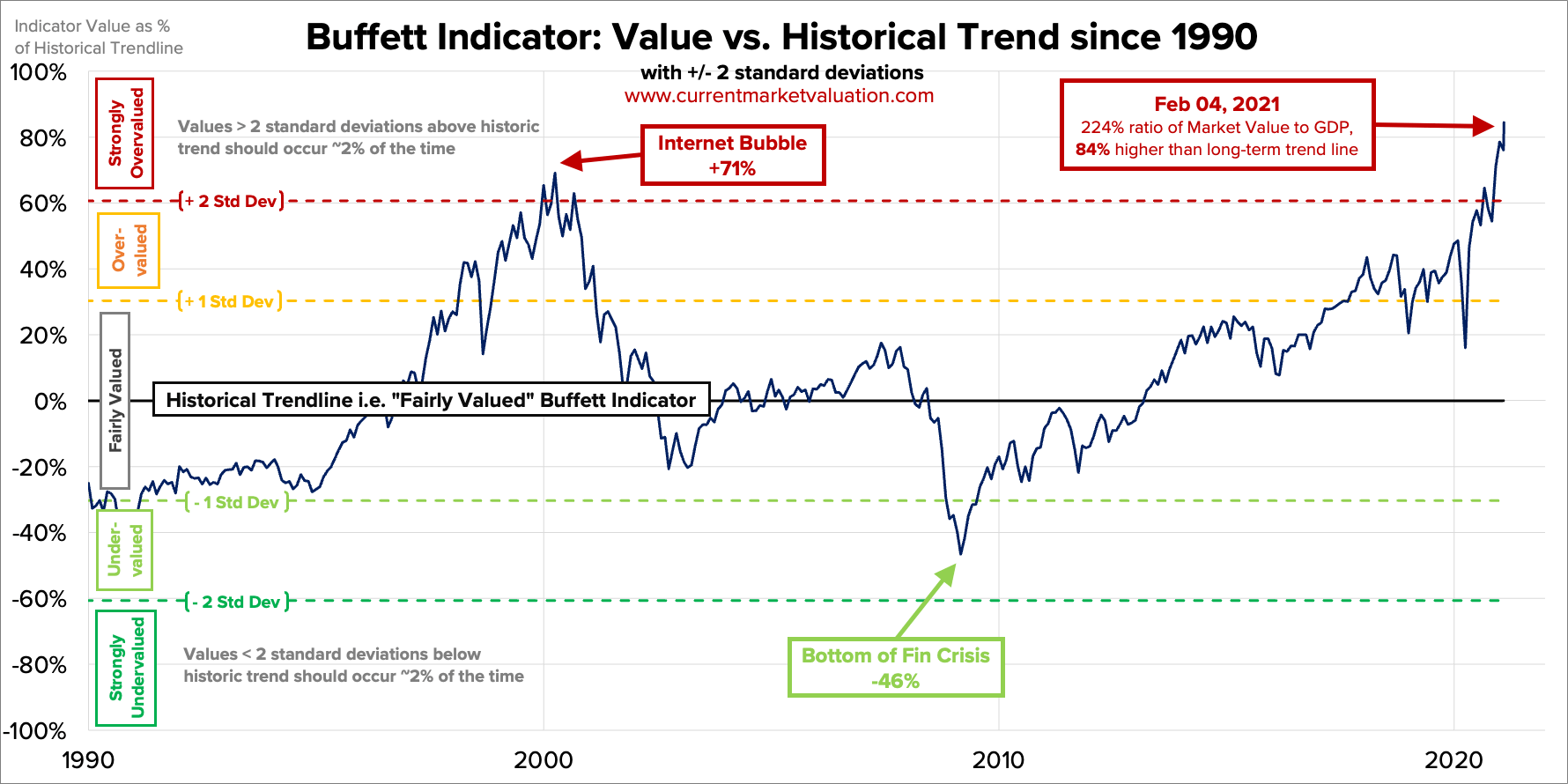

But consider some valuation metrics that scream “bubble.”

As of February 4, 2021, the Buffett Indicator , or the ratio of the total US stock market valuation to the GDP, was at a level not seen since the dotcom bubble. If you take the US stock market cap of $48.7 trillion and the estimated GDP of $21.7 trillion, we're nearly 224% overvalued and 84% above the historical average.

Keep in mind; this chart was dated February 4. This number has only grown since then. Tuesday (Feb. 9) was hardly a down day. If anything, it was plain dull.

Fears of a bubble are genuine. The S&P 500’s forward 12-month P/E ratio is back to above 22 and well above the 10-year average of 15.8. The Russell 2000 is also back at a historic high above its 200-day moving average. Tech stock valuations are again approaching dot-com bust levels.

Bank of America also believes that a market correction could be on the horizon due to signs of overheating.

While I don’t foresee a crash like we saw last March, I still maintain that some correction before the end of Q1 could happen.

Corrections are healthy and normal market behavior, and we are long overdue for one. They are also way more common than most realize. Only twice in the last 38 years have we had years WITHOUT a correction (1995 and 2017).

A correction could also be an excellent buying opportunity for what could be a great second half of the year.

Bank of America also echoed this statement and said that “We expect a buyable 5-10% Q1 correction as the big ‘unknowns’ coincide with exuberant positioning, record equity supply, and ‘as good as it gets’ earnings revisions.”

The key word here- buyable.

My goal for these updates is to educate you, give you ideas, and help you manage money like I did when I was pressing the buy and sell buttons for $600+ million in assets. I left that career to pursue one where I could help people who needed help, instead of the ultra-high net worth.

With that said, to sum it up:

While there is long-term optimism, there are short-term concerns. A short-term correction between now and the end of Q1 2021 is possible. I don't think that a decline above ~20%, leading to a bear market will happen.

Hopefully, you find my insights enlightening. I welcome your thoughts and questions and wish you the best of luck.

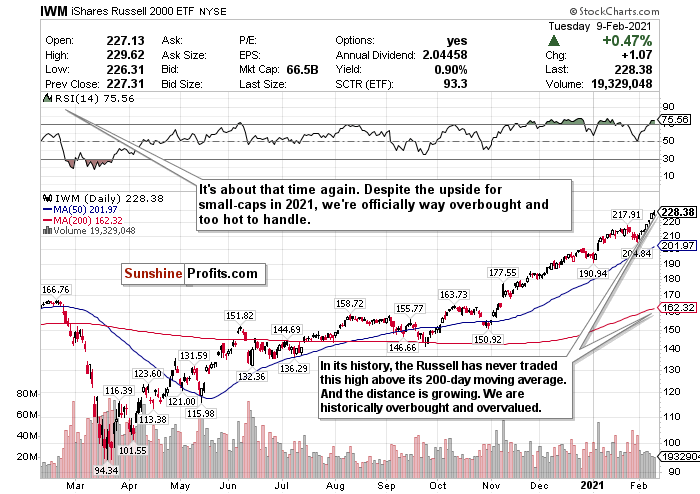

Small-Caps are Officially Overbought

Figure 1- iShares Russell 2000 ETF (IWM)

This pains me to write this because I love Russell 2000 small-cap index in 2021.

But this is getting ridiculous now.

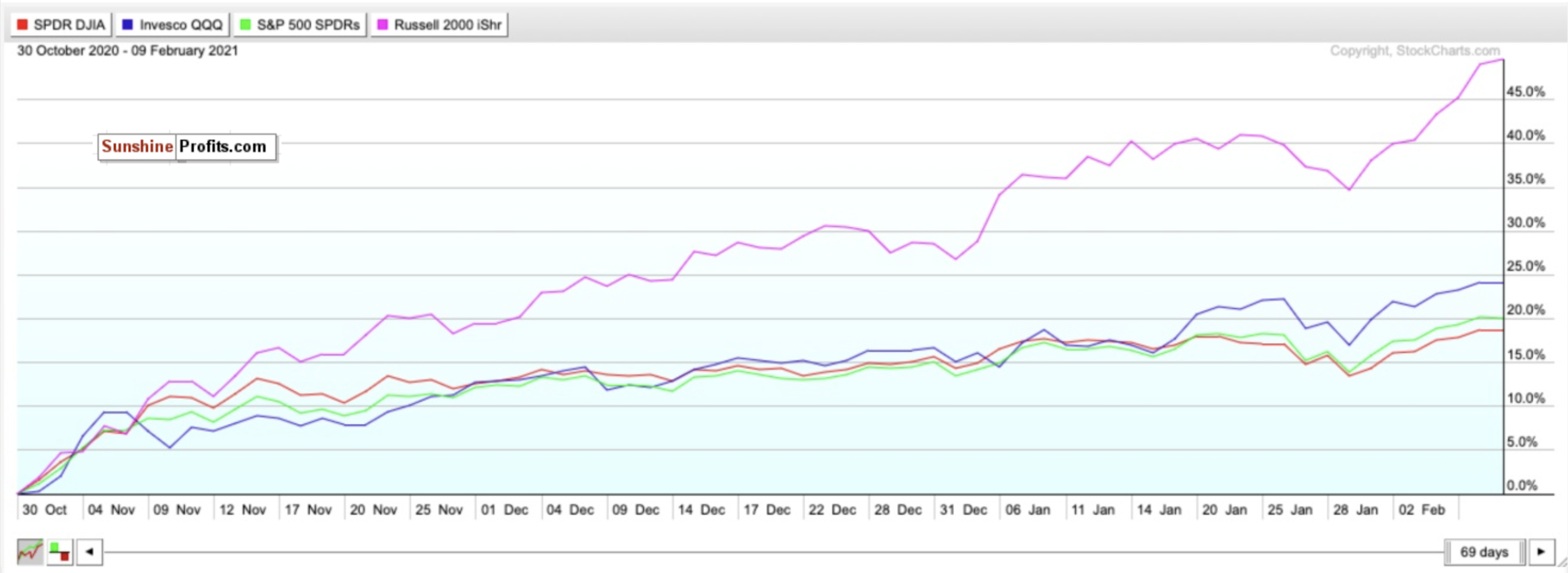

As tracked by the iShares Russell 2000 ETF (IWM) , small-cap stocks have been on a rampage since November. Since the close on October 30, the IWM has gained nearly 50% and more than doubled ETFs' returns tracking the larger indices. What happened to the Nasdaq being red hot? This chart makes it look like an igloo.

Since the close on January 29, the Russell has done just about the same again and gained 11.10%. It’s outperformed all the other major indices by a minimum of 5% in that period.

Not to mention, year-to-date, it’s already up a staggering 18%.

Small-caps are funny. They either outperform and underperform and can be swayed easily by the news. I foresaw the pullback two weeks ago coming for over a month, and unfortunately, I see the same thing happening now. But only for the short-term.

I remain bullish due to aggressive stimulus, which could be put in motion this week.

I also love small-cap stocks for the long-term, especially as the world reopens and this Biden agenda gets put in motion. It seems like things are finally trending in the right direction.

For now, though, the index is once again overbought.

The RSI is at a scorching 75, and I can't justify calling this a BUY or HOLD right now. It's an excellent time to take profits.

SELL and take profits. If and when there is a deeper pullback, BUY for the long-term recovery.

Thank you for reading today’s free analysis. I encourage you to sign up for our daily newsletter - it's absolutely free and if you don't like it, you can unsubscribe with just 2 clicks. If you sign up today, you'll also get 7 days of free access to the premium daily Stock Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!

Related: Will Stocks Be Brady or Mahomes?

The views and opinions expressed in this article are those of the contributor, and do not represent the views of IRIS Media Works and Advisorpedia. Readers should not consider statements made by the contributor as formal recommendations and should consult their financial advisor before making any investment decisions. To read our full disclosure, please click here.