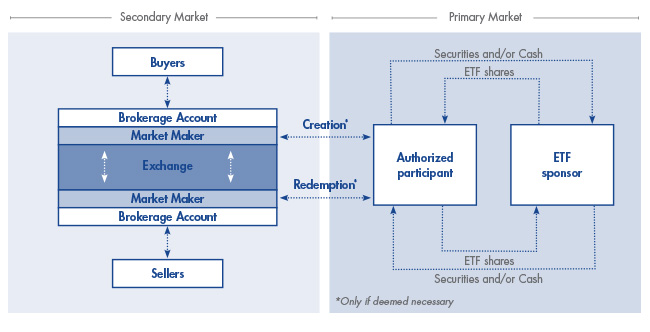

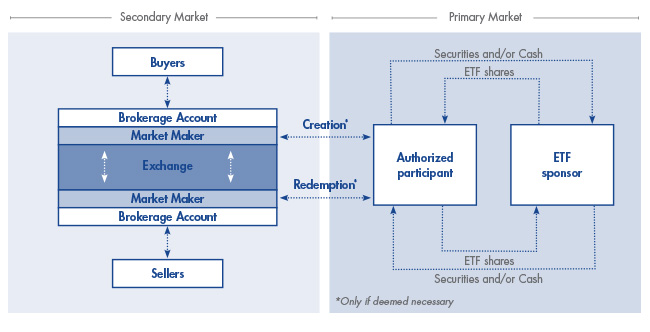

Although the creation and redemption of ETF shares takes place largely behind the scenes for most investors, the process is a defining feature of the ETF structure.

Setting the Stage

As a starting point,

let’s discuss the differencesbetween the secondary and primary markets for ETF shares.The

secondary market, which includes the widely recognized securities exchanges, is where investors buy and sell existing shares of ETFs. For example, if you wish to buy 2,000 shares of an ETF, you typically place an order with a financial advisor and purchase those shares at market price from other sellers in the secondary market.The

primary market refers to where ETF share creations and redemptions take place in large specified units of 50,000 shares or multiples thereof. It provides an additional “layer”, or source, of liquidity that can be accessed for large orders or when demand exceeds supply, or vice versa, on the secondary market. Typically, large financial institutions, authorized participants, and market makers1 transact in the primary market. Market makers buy and sell ETF shares in the secondary market to provide liquidity and may also serve as authorized participants.

Authorized Participants

Authorized participants (APs) are an important part of the creation and redemption process. Usually large broker-dealers or custodial institutions that have executed an agreement with the issuer, APs are the only entities that may transact directly with the ETF issuer, and as such, play a critical role in helping ensure fair pricing and ETF liquidity. When the secondary market price of an ETF falls out of line with its net asset value (NAV)2, an

AP may create or

redeem shares of the ETF, bringing prices back in line with the NAV.

Carefully Crafted Creations

When there are not enough ETF shares available on the secondary market to satisfy demand, an ETF may begin trading at a

premium (its current market price is higher than its NAV). When this happens, an AP may step in and create new shares.To create new passively managed ETF shares, the AP generally acquires shares in all of the underlying securities that compose the ETF, in the same proportions as the fund’s index. On the primary market, the AP then delivers this basket of securities to the ETF issuer, and in exchange, receives shares of the ETF in blocks known as creation units3. The AP then sells these ETF shares in the secondary market. The additional supply of shares tends to bring the ETF’s price back in line with its NAV.

Road to Redemptions

The process described above also works in reverse when demand is low. For example, let us imagine that an ETF begins trading at a

discount (its current market price is lower than its NAV). The AP leaps into action, buying up 50,000 shares of the discounted ETF on the secondary market and tendering these shares to the issuer for shares of the ETF’s underlying securities.Redemptions reduce the number of ETF shares available on the secondary market. As a result, the discount shrinks or disappears as the ETF share price moves closer in line with its NAV.

A Tax Efficient Edge

When ETF shares are redeemed by the AP,

they are typically tendered in kind to the ETF issuer. The ETF issuer is not selling any securities in this transaction, so the exchange is not viewed by the IRS as a taxable event. This allows ETF issuers to reduce what could otherwise be substantial capital gains taxes. The cost savings helps keep expenses low for end investors, and contributes to the well-known tax efficiency of the ETF structure.A note on mutual funds: When

mutual fund shares are redeemed by investors, the issuer must sell the underlying securities to raise cash—a taxable event which can impact performance and trigger a capital event which can have tax implications for the remaining mutual fund shareholders.

Sources of Liquidity

So, there are actually two primary sources of ETF liquidity: the secondary or open market, consisting of shares bought and sold throughout the day, and the primary market managed by APs. Most ETF investors rely on secondary market liquidity.Primary market liquidity draws on the liquidity of the underlying securities comprising the ETF. Very large trades can tap into the deeper liquidity source of the primary market, where large blocks of ETF shares can be either created or redeemed.

In Summary

Creations and redemptions are critical to the structure and liquidity of ETFs, as well as key drivers of ETF tax efficiency. Through these twin mechanisms, the supply of

ETF shares in the open market can be brought in line with demand, thus fairly pricing ETFs.Related:

Gold and the Cycles of History1Market makers: Specialized traders who seek liquidity for a set of securities on an exchange.2Net Asset Value (NAV): The total value per share of an ETF’s underlying securities, less its liabilities.3Creation unit: Large blocks of ETF shares created by ETF issuers. Creation unit sizes can vary by issuer and fund, but usually consist of 50,000 shares or multiples thereof.