Written by: Sandra Rhouma and John Taylor

As inflation continues to ease across the developed world, markets are eager for the rate-cutting cycle to begin. The US Federal Reserve and European Central Bank (ECB) will review monetary policy at their summer meetings, and investors expect both to start cutting at that stage. That’s a realistic central case, in our view, based on published economic data.

But another factor could influence the batting order: each central bank has its own specific mandate that determines its policy response to changes in the economy.

The US economy—particularly labor markets—remains strong, prompting concerns that US inflation won’t fall as fast as expected and that the Fed may delay its first cut, perhaps for some time. In those circumstances, would the ECB stand still?

Varying Mandates Create Different Motivations

While the Fed’s dual mandate includes both inflation and unemployment targets, the ECB is mandated to focus exclusively on price stability, keeping inflation near but below 2%. So, we think the ECB would likely cut rates if the Fed were to delay the start of its cutting cycle, as long as euro-area inflation stays on a sustainable downward course toward the target.

The ECB’s decision-making should follow three principles. Essentially, the governing council must evaluate: 1) how effectively monetary policy is working to curb inflationary pressures; 2) if the underlying core components of inflation are falling and; 3) the outlook for inflation, based on available data.

The bank has stressed that it remains committed to evaluating new data as they become available, and to considering possible second-round effects in its decision-making. But based on the data we have now, we think the way would be clear for the ECB to cut first.

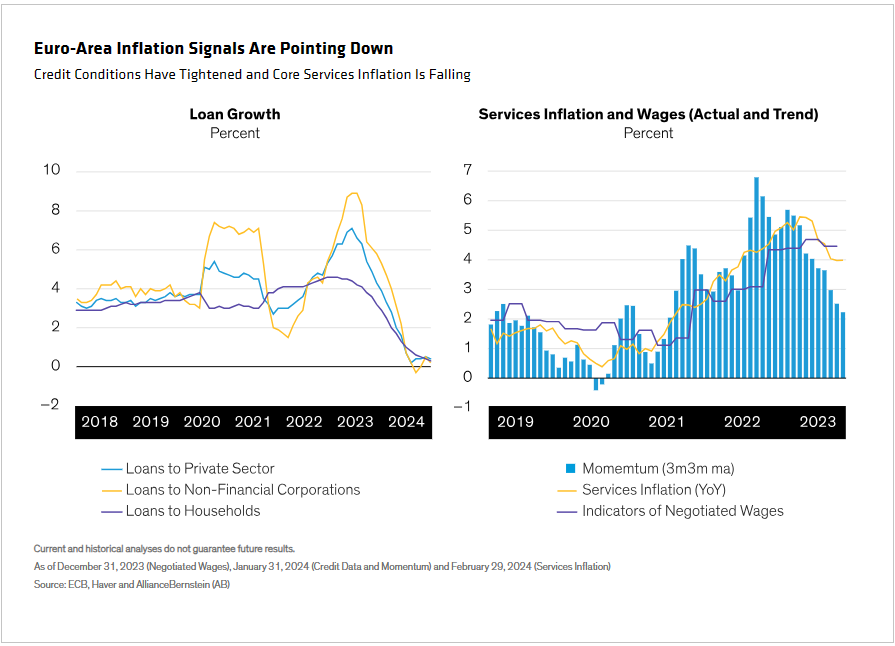

Monetary-policy transmission remains effective, evidenced by tighter credit conditions and slower credit growth. Headline inflation has fallen significantly in 2023 and continues to decline faster than expected. And though core inflation—specifically services inflation—remains slightly more stubborn, it’s slowly following a similar downward path despite strong wage pressures.

Furthermore, the ECB’s March forecast and projections showed further falls in inflation ahead: headline inflation is expected to be 2.0% in 2025 and 1.9% in 2026. Essentially, inflation is already at target in the medium term, and further downward revisions are more than likely in June.

On the hawkish side, some members of the ECB governing council remain preoccupied by wage increases. But we think the data will allay their fears: wage growth slowed slightly in the fourth quarter of 2023 and is expected to ease further in 2024 (Display).

Therefore, we believe all the necessary macroeconomic conditions will be met in the next few months for the ECB to start cutting rates in June.

Timing and Growth Are Important Factors, Too

While inflation metrics are the primary drivers for ECB decision-making, the governing council will still carefully consider the question of timing and the impact of its decisions on euro-area economic growth.

The ECB could still postpone its own decision—but in our view, only until the July governing council meeting, and driven only by domestic considerations. ECB speakers (from hawks to doves) have mentioned June as a likely start point. And during the press conference following the March meeting, ECB president Christine Lagarde mentioned that the governing council has already started to discuss dialing back its restrictive policy stance. A further delay would be met with strong pushback from the doves and would hurt a struggling euro-area economy, potentially risking inflation coming in well below the 2% target in the medium term.

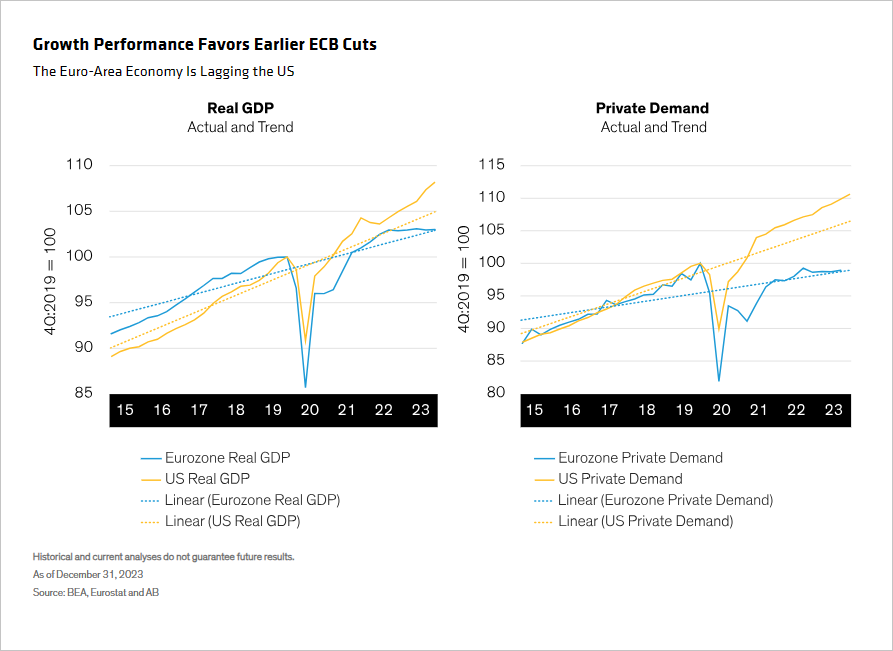

So, sustaining economic growth isn’t a formal ECB objective, but it would be a mistake for the governing council to keep rates unnecessarily high, hurting the economy and further widening the performance gap with the US. In terms of real growth, the US has conspicuously outperformed its pre-pandemic trend while the eurozone has barely recovered to it. The main drivers: different domestic-demand patterns across both regions, where the gap has massively widened since the start of the pandemic (Display). The same trend is evident across consumption and investment.

While the Fed can take its time to ponder inflation data against the backdrop of a strong domestic economy, the ECB is under more pressure. Euro-area growth is expected to pick up in the second half of 2024 but remain weak. And Germany, the largest economy, faces structural challenges that need time to resolve. Given these tough domestic constraints, we think the euro-area situation and outlook are shouting for rate cuts to start sooner rather than later.

Implications for Investors

Of course, this ECB-first scenario may not materialize. But if it does, investors need to be ready.

If the ECB leads the rate-cutting cycle, investors will see both lower euro rates and likely a weaker euro currency than the market currently expects. That has implications for positioning across both the yield curve and currencies.

ECB rate cuts would prompt falling euro-denominated bond yields, boosting prices. In this scenario, investors should benefit from holding euro bonds with the most sensitivity to changes in interest rates (the longest duration). Ultimately, lower rates should also boost consumption and investment, stimulating growth and supporting corporate issuers.

While euro-denominated bond prices will likely rise, investors should take care that currency losses from a weakening euro don’t offset their price gains. For instance, US investors should consider hedging their euro exposure back to US dollars.

As ever, it’s better to be forewarned and forearmed.

Related: Direct Lending Outlook: Anticipating High Return Potential and Increased Deal Activity