Written by: David Kelly and Stephanie Aliaga

The November CPI report showed consumer prices rising at their fastest pace in nearly 40 years as surging gasoline prices, vehicle prices, and owner’s equivalent rent continued to drive inflation upwards. Headline CPI met consensus expectations, rising 0.8% m/m and 6.8% y/y. Excluding the volatile food and energy components, Core CPI still rose at a rapid clip of 0.5% m/m and 4.9% y/y, the highest in 30 years.

Energy prices rose 2.5% m/m and 33.3% y/y as gas prices continued to soar. Vehicles costs also accelerated, with prices for used cars climbing another 2.5% and 31.4% from a year ago. Food costs also climbed by 0.7% m/m and 6.8% year-to-date, as prices for beef, pork, and other food items were up sharply. Travel and leisure sectors showed recovery from their delta wave, with airline fares rising 4.7% after declining in recent months and hotel prices recovering by 3.2% as consumers seem more willing to take trips as booster shots become available. Apparel prices also rose 1.3% after a few months of declines, reflecting higher holiday season demand against strained inventories. Shelter costs rose another 0.5% for November as the lagged effect of higher home prices continues to feed into the owner’s equivalent rent component. While gains in auto and energy prices can be tied to supply issues, and hotel and airfares tied to reopening, housing costs are more likely to be sticky. However, fading fiscal support should help ease demand across a range of sectors, and perhaps most notably in the food category.

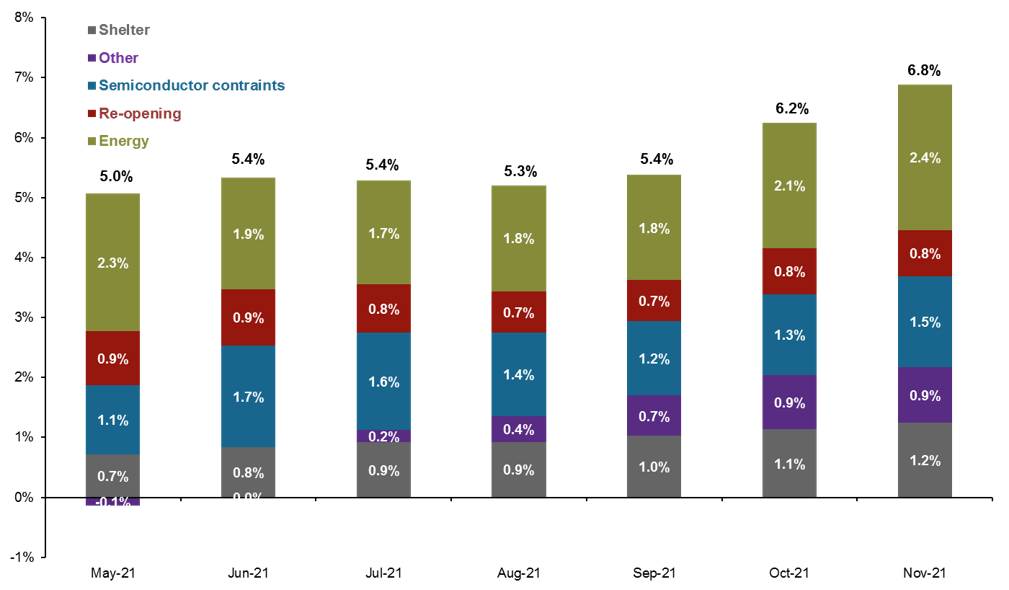

The good news is that most of this is transitory, but with prices that have remained elevated for many months and will likely continue to stay high into the first half of 2022, we should redefine “transitory”. In a year from now, we should see the rate of change of prices moderate significantly due to both elevated base effects and an easing of supply chain constraints. Given this, we should be at peak inflation from supply chain issues and energy prices right now. Reopening, semiconductor constraints, and energy components make up a majority of the inflationary heatwave we’ve seen this year, and all of these should see moderation in 2022, as we show in the chart below. However, today’s report should reinforce expectations that the Fed will accelerate its tapering at its meeting next week and potentially raise rates as soon as June 2022, as both the improvement in the labor market and the stickiness of inflation have proved to be stronger than earlier believed.

Contribution of themes* to headline CPI

year-over-year % change

Source: Bureau of Labor Statistics, Bloomberg, J.P. Morgan Asset Management. *Semiconductor constraints is represented by new and used car CPI, re-opening is represented by food away from home, transportation services, and lodging away from home. Values may not sum to headline figures due to rounding and underlying calculations by J.P. Morgan Asset Management. Data are as of December 10, 2021.

Related: Is Jerome Powell Here To Stay?