Written by: Meera Pandit

Robust profit growth expectations and lofty S&P 500 price targets suggest investors are optimistic about 2025. However, there is deep uncertainty around how tariffs and tax reform may unfold, but 2018 can offer clues as to how these policies could impact profits, corporate activity, and market performance.

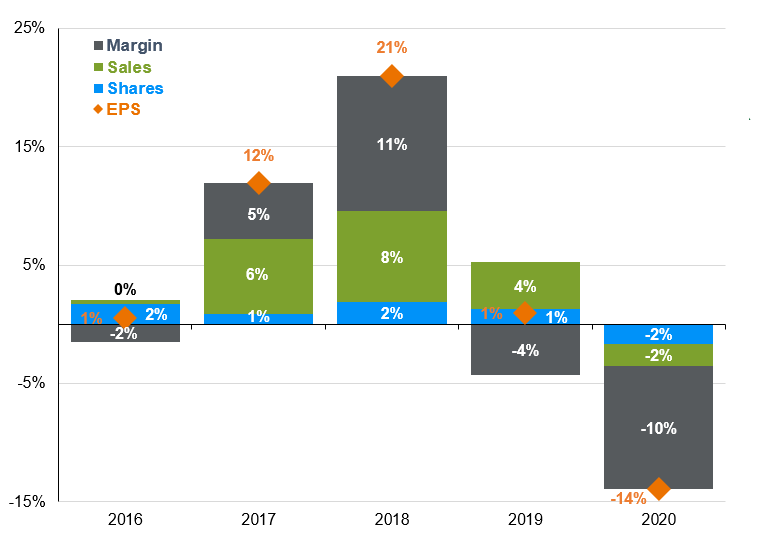

As we highlight in our 4Q24 earnings bulletin, the 2017 Tax Cuts and Jobs Act (TCJA) boosted earnings and profit margins while supporting buybacks and M&A. However, trade uncertainty may have partially offset some of those benefits by weighing on revenues and capex.

- Earnings and Margins: The TCJA lowered the corporate tax rate from 35% to 21%, adding an estimated $13 to earnings per share when implemented in 2018. Profits grew an impressive 21% that year, the fastest since 2010. Margins contributed to about half of that profit growth, as the tax cut boosted them to 12.8% by 3Q18 from 10.8% in 2017.

- Revenues: Revenues increased 7.2% in 2018, as consumers enjoyed an income tax cut. However, consumer spending decelerated throughout 2018 and the cumulative effects of tit-for-tat trade tensions, which began in February 2018, began to weigh on multinational revenue in 2019. World trade volumes and S&P 500 sales, which have a 0.81 correlation, began to decelerate in 2H18. Approximately 43% of S&P 500 revenue came from abroad, so uncertainty, a surging U.S. dollar, and weaker global growth likely diminished revenues.

- Buybacks and M&A: Elevated margins from tax cuts invited a flurry of corporate activity. Announced M&A volumes leapt in 2017 to record levels, and while momentum slowed in 2018, overall volumes and deal count remained elevated. The value of announced S&P 500 buybacks jumped 68% in 2018.

- Capex: Capex accelerated at the start of 2018; however, capex decelerated slightly as the year progressed. Based on surveys from six regional Federal Reserve banks, capex intentions peaked in 1Q18 and gradually declined, echoing a rise in economic policy uncertainty likely arising from tariffs, a measure tracked by the Bureau of Economic Analysis.

- Market performance: Profits did help the S&P 500 notch 19 new all-time highs in 2018 and look through volatility generated by trade tensions, but a hawkish Fed soured the markets in Q4, leaving markets down 6.2% in 2018. In the end, earnings contributed 16%-points to the S&P 500 return, but multiples subtracted 22%-points. While strong earnings growth underpins returns in the long run, uncertainty can derail a rally swiftly.

In 2025, trade uncertainty has ramped up, but what distinguishes it from 2018 is that any tax reform passed may not be implemented until 2026, and given high deficits, may only contain an extension of the TCJA without additional tax cuts. This, combined with uncertainty around the path of monetary policy, should remind investors to maintain sensible diversification against potential volatility. Still, projected 15% profit growth, even in the absence of tax reform, should provide support to markets.

S&P 500 year-over-year pro forma EPS growth

Annual growth broken into changes in revenue, profit margin and share count

Source: Compustat, FactSet, Standard & Poor's, J.P. Morgan Asset Management. Data are as of February 6, 2025.

Related: China's Potential Countermeasures Amid Escalating U.S. Trade Tensions