Key Takeaways

- The journey to economic normalization is winding down, with the Fed suggesting eight policy-rate cuts on the way that will extend through 2025.

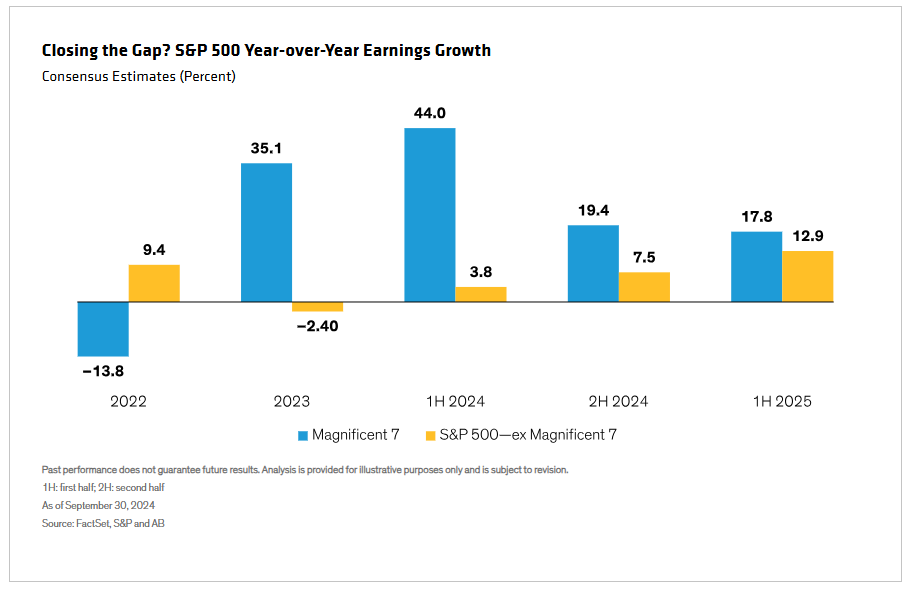

- In equity markets, growth expectations have come down for the Magnificent Seven mega-cap tech stocks, leaving relative potential in other areas of the market…the “Magnificent Others.”

- The third quarter started a new chapter for bonds, with falling rates likely to create a favorable tailwind. We think investors should consider taking advantage of still-attractive yields.

- In municipal bonds, accelerating demand is helping offset record new issuance volume. We see a sizable opportunity for investors to move off the sidelines and into the market.

The Endgame for the Long Process of Normalization

As the journey to economic normalization nears its end, markets have rallied. Year-to-date equity performance has been the strongest since the late 1990s, and bonds rode falling US Treasury yields. Rates are still at the core of asset returns—driven by economic growth, inflation and labor markets.

The Fed’s worries about the first two have waned, so we expect jobs to be the primary focus. In gauging future policy moves, the Fed will closely monitor conflicting signals such as declining hiring rates and layoffs that remain low and stable. Strong labor markets translate into a healthy environment for consumers, which we see in robust take-home pay and retail sales that stand at pre-pandemic levels.

Collectively, this picture has enabled the Fed to cut policy rates by 50 basis points so far this year. The Fed suggests eight cuts ahead—one each adjacent to the next two Federal Open Market Committee meetings and then a cut every other meeting in 2025. While the market initially runs ahead of the Fed, both markets and the central bank envision a terminal interest rate of around 3% (Display).

Equity: Watch for the “Magnificent Others” Opportunities

As the economy goes, so go profits. Recent earnings growth has improved, but future expectations are more modest. This is partly due to a sharp decline in growth expectations for the Magnificent Seven (Display). On the other hand, we expect more noticeable improvement for the “Magnificent Others,” as a steady economy and moderating inflation boost the fortunes of stocks beyond mega-cap tech. Investors will also need to consider how to navigate bouts of volatility.

Quality companies still offer a friendly neighborhood, as we see it. Conditions continue to moderate, and quality factors have historically fared well versus lower-quality exposures in the 12 months after Fed cuts start. In the growth space, we think it makes sense to look for gems beyond the popular sectors, and classic quality value factors still seem attractively priced.

We think dividend equities have been versatile and are on favorable ground, given Fed cuts. We expect volatility going forward, so some investors may find that low-volatility equities present a refuge from turbulence. We’re also seeing opportunities beyond US stocks: international stocks offer a less-crowded trade, and their earnings estimates are heading in the right direction.

Taxable Bonds: Still-Attractive Yields and Falling Rates

The third quarter marked the start of a new chapter for bonds, with rates breaking below key support levels set during the post-pandemic years (Display). Falling rates are favorable for bond investors, though we think time is of the essence to capitalize on the current attractive yield environment.

On the credit side, spreads on high-yield bonds are relatively low, but all-in yields are still above long-term averages. The starting point of yield to worst has historically been a good indicator of subsequent returns for high-yield bonds. Some spread widening is likely, but a strong backdrop seems to provide a sturdy foundation. When spreads have widened in the past, it’s largely been in the CCC-rated space.

Beyond US high yield, other sectors we find attractive include US investment-grade bonds, emerging-market (EM) corporate and EM high-yield bonds denominated in US dollars, and select securitized bonds. As always, investors need to apply their due diligence, zeroing in on the most compelling potential from a risk/reward perspective.

Municipal Bonds: Opportunity…but Not from the Sidelines

The tax-exempt side of the story featured a strong third quarter, as accelerating investor demand continues to help offset record new issuance. From our perspective, a barbell maturity structure has provided a better cushion for portfolios and offers investors a higher yield going forward.

Municipal credit has outperformed because of robust demand, with tightening credit spreads bolstering returns. Credit fundamentals, based on our assessment, remain resilient, with strong liquidity positions giving issuers the flexibility to weather an expected US economic slowdown.

Right now, we see a sizable opportunity for investors to move off the sidelines and into the municipal bond market. Tax-equivalent yields in the muni market are higher (Display) and cash rates have declined with rate cuts. More rate declines are expected, so there could be a benefit from adding duration to portfolio exposure.

From a big-picture view, we see the normalization process in its final stage. Investors should seek out equity segments with compelling valuations and where earnings-growth prospects appear attractive. In bond markets, yields are still high, and we believe that return streams will be rewarding as central banks continue easing.

Related: How the Looming US Elections Will Impact the Markets