Markets are buckling ahead of the Powell press conference tomorrow, as this morning’s data justifies an increasingly hawkish committee. Today’s stateside economic data on employment costs and consumer confidence point to lingering inflationary pressures, while Europe has avoided recession with an upside beat on first quarter GDP. The European Union, however, is facing a similar problem as other regions: activity rebounding alongside price pressures, further disrupting the journey towards a soft landing amidst 2% inflation.

Compensation Expenses Rise Sharply

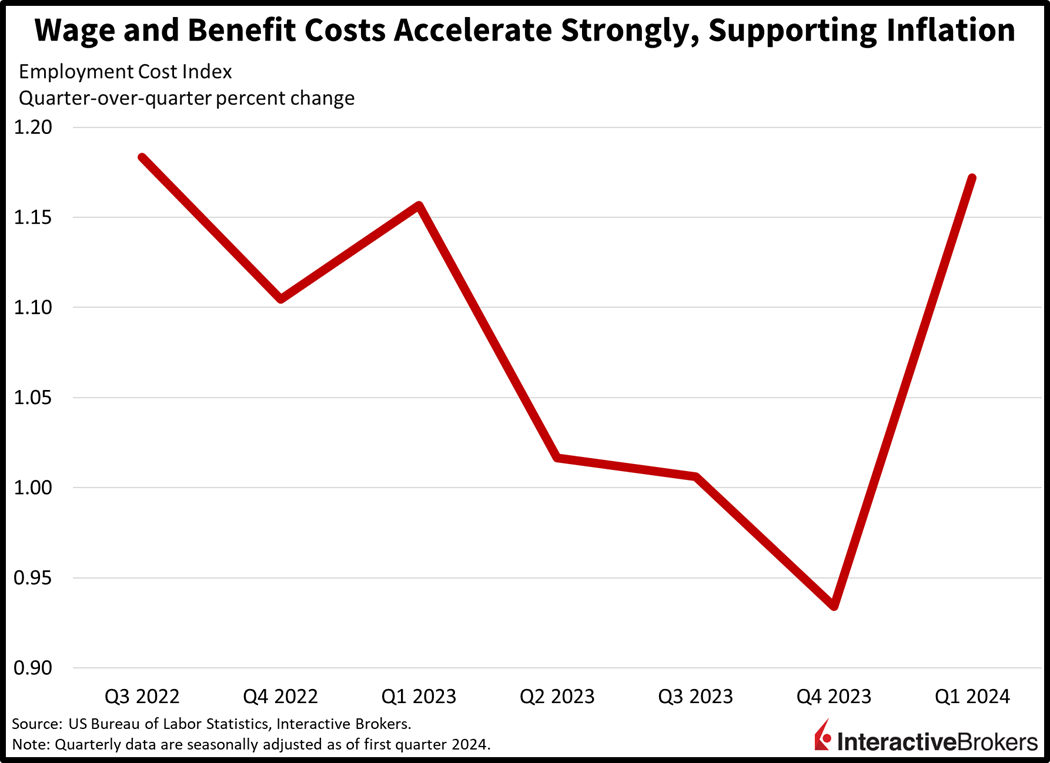

Inflation’s persistence is continuing to be supported from a powerful tailwind of rising labor expenses with workers getting fatter paychecks and increasingly pricey benefits, according to the Employment Cost Index report released today. Quarter after quarter, annualized wage growth exceeding 4% has consistently lifted the costs of services, posing significant hurdles to the Federal Reserve’s 2% inflation target. The index, or ECI, considers private company wages but also takes benefit expenses and government workers into account, unlike average hourly earnings that are published in the monthly jobs report. In the first three months of this year, it rose 1.2% quarter over quarter (q/q) and 4.2% year over year (y/y), an acceleration from the fourth quarter’s 0.9% q/q while maintaining the same y/y rate. Increases in benefit expenditures led the push, speeding up from 0.7% to 1.1% q/q, while salary growth kept its momentum of 1.1% q/q.

Wages Not Enough to Deliver a Smile

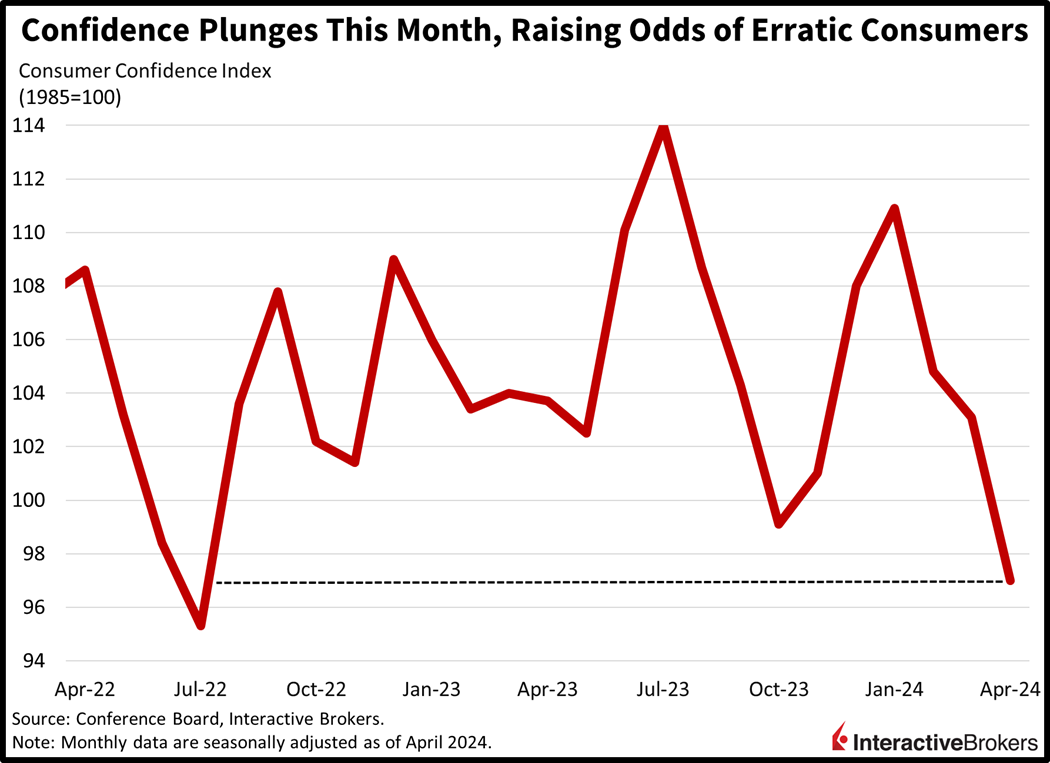

Heavier paychecks failed to widen smiles for American consumers, however, as rising charges for food and gasoline dented the spending power of wallets and pocketbooks alike. The Conference Board’s Consumer Confidence Index plunged to 97 this month from 103.1 last month while missing projections of 104 by a mile and then some. Driving the big miss, which was the lowest reading since July 2022, were deteriorating future prospects, with the Expectations sub-index cratering from 74 to 66.4 month over month (m/m). The Present Situation sub-index slipped from 146.8 to 142.9, meanwhile. Folks were incrementally less optimistic about the current job picture while increasingly pessimistic about future conditions related to income possibilities, job vacancies and labor opportunities. Plans for big-ticket purchases like homes and durable goods declined, while vacation bookings also retreated to their lowest level since last summer. Households were also concerned about geopolitical conflicts and the upcoming US presidential election.

Europe Pulls Out of a Slowdown

Across the Atlantic, the European Union shifted back to growth this year but not without persistent in inflation. Gross domestic product increased 0.3% q/q, amidst broad-based activity strengthening across the region, beating estimates and climbing from the fourth-quarter’s doughnut (0%). The recovery has been driven by improving confidence across businesses and consumers as the continent looks forward to the beginning of the European Central Bank’s easing cycle possibly this summer.

Growth was met with fierce price pressures though, as this morning’s inflation data for April, released in a separate report, depicted continued cost burdens. Inflation rose 0.6% m/m and 2.4% y/y, in-line with estimates and near March’s figures of 0.8% and 2.4%. Charges rose across the board as follows:

- Services, up 0.8%

- Industrial goods, up 0.5%

- Food, alcohol and tobacco, up 0.4%

- Energy 0.3% m/m.

Earnings Reports Provide Mixed View of Consumers

Consumer spending in the first quarter varied among firms reporting earnings this morning. PayPal noted resilient spending while Coca-Cola, 3M and McDonald’s experienced weakening sales to differing degrees.

- PayPal said consumer spending has been strong and that its first quarter payment volume jumped 14% y/y. Earnings and revenue both surpassed analyst consensus expectations and the company increased its guidance for both metrics. PayPal’s earnings guidance fell below last year’s result, which was aided by the one-time event of the company selling Happy Returns, a company that helps consumers return items to retailers. For this quarter, earnings were also supported by the company laying off 9% of its workforce. The company’s stock price was up approximately 4% in early trading.

- Coca-Cola’s first-quarter earnings and revenue exceeded analyst consensus expectations despite the company experiencing flat sales volume in the US. Globally, its sales volume, which is a metric based on units sold rather than dollar values and exchange rates, climbed 1% while its sparking soft drinks, such as Coca-Cola, climbed 2%. Its revenue climbed from the company hiking prices 15% with a significant portion of the increase driven by hyperinflation in Argentina. Coca-Cola said it anticipates additional price hikes in markets experiencing strong inflation and said it expects earnings for the full year to increase in the low-to-mid single-digit range. Coca-Cola stock gained approximately 6% this morning.

- McDonald’s earnings and same-store sales missed analyst consensus expectations. CEO Chris Kempczinsk says consumers are being increasingly selective with their day-to-day spending, which is creating challenges for fast-serve restaurants. For the quarter, same-store sales increased 1.9%, missing expectations of 2.6%. Sales were also challenged in Israel due to boycotts started after the company rolled out discounts for the country’s soldiers. Shares of McDonald’s climbed 1% in morning trading.

- 3M Co. said its revenue declined 3% y/y and missed the analyst consensus estimate while earnings exceeded forecasts. Sales of consumer products were weak as individuals have focused their spending on food, traveling and other services. Despite having spun off its health care division, the company, which is well known for its Post It products, expects sales this year to range from flat to 2% y/y. Its share price increased 4% this morning despite the company announcing that it is reducing its dividend.

Markets Brace for an Unhappy Fed Chair

Stocks, bonds and the dollar are all frontrunning the possibility of a frowning Powell at tomorrow’s interest rate decision. All major equity indices are much lower with the Russell 2000, Dow Jones Industrial, Nasdaq Composite and S&P 500 down 1.2%, 0.8%, 0.7% and 0.6%. Sectoral breadth is negative with all segments lower, led by consumer discretionary, energy and materials; they’re losing 1.5%, 1.4% and 1.3%. Treasuries are being unloaded, with the 2- and 10-year maturities trading at 5.01% and 4.66%, 3 and 4 basis points (bps) heavier on the session. The greenback is gaining on loftier inflation expectations, rising rates and an outlook for the Fed to remain tight relative to other central banks. The Dollar Index is up 41 bps to 106.07 as the US currency gains versus all of its major counterparts, including the euro, pound sterling, franc, yen, yuan and Aussie and Canadian dollars. Crude oil is retreating as traders see light at the end of the tunnel in the Middle East amidst US Secretary of State Anthony Blinken pushing for a peace deal. WTI crude is down 0.6%, or $0.46, to $82.19 per barrel. Gold and copper are also seeing selling pressure, with prices down 2.1% and 1.7%.

Oh, to Be a Fly on the Wall

As we all wonder about the specifics of policymakers’ discussions during the first day of the Fed’s two-day meeting today, the importance of tomorrow’s press conference following Powell’s presentation is escalating for market participants. From the beginning of the year to today, rate expectations have shifted significantly; we’re down from seven estimated cuts to only one for 2024, as economic and inflation data has surprised to the upside all year on an aggregate basis. Another important consideration will be plans for tapered quantitative tightening (QT), or the process of the Fed allowing Treasuries and mortgage-backed securities to roll off their balance sheet without replacing them at a more subdued pace. Powell is especially attentive to these liquidity risks, as he probably perceives himself as too draconian when rates spiked in 2019 as a result of scarce bank reserves. Presently, however, there may be room for a positive surprise, with yields and stocks effectively setting up for a hawkish Powell. An upside case may flourish if the chair constantly reminds us that despite his firmness, the committee has the tools to loosen financial conditions acutely if the labor market turns.