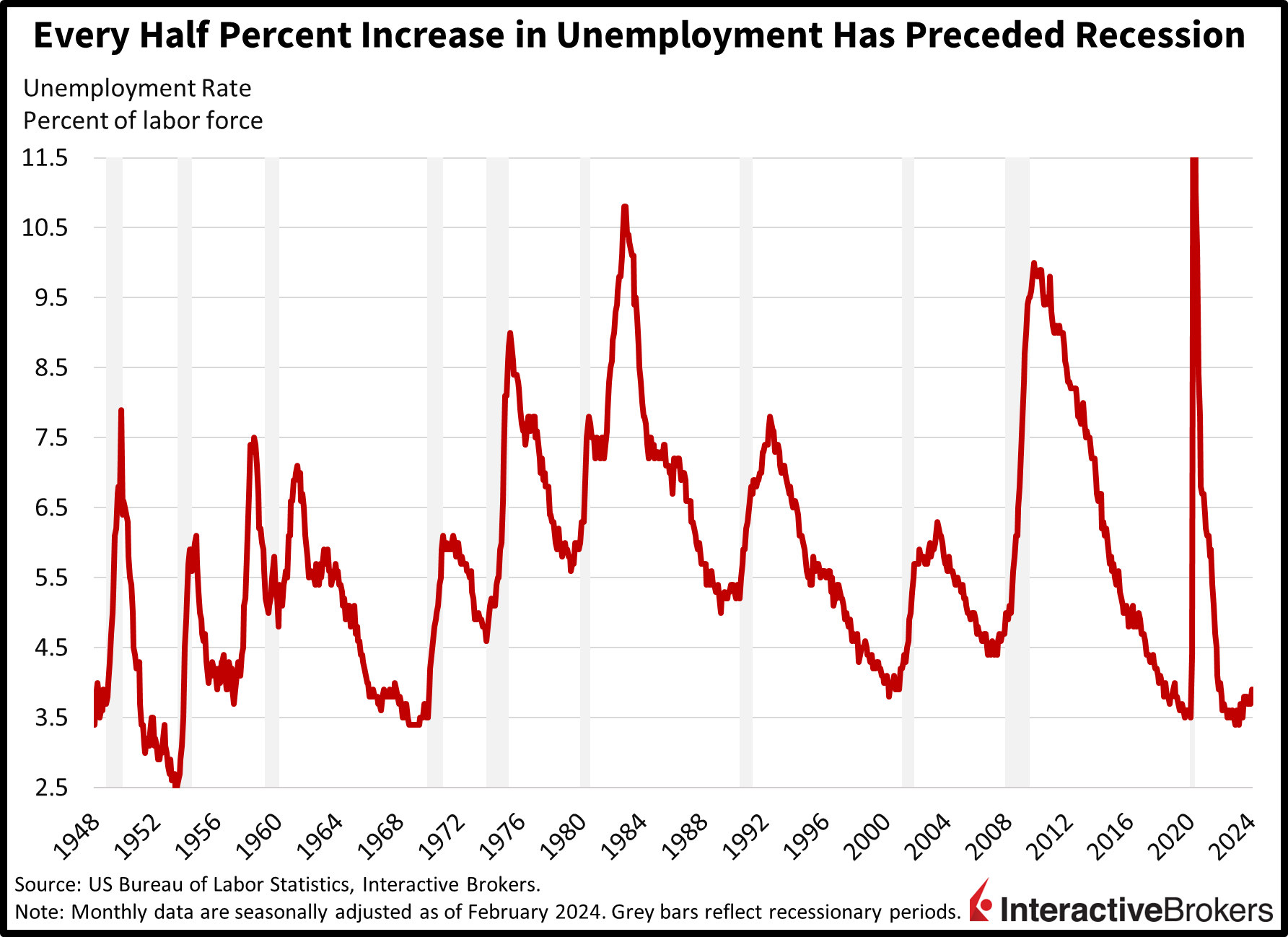

Friday's nonfarm payroll report depicted robust hiring in February while also showing an increase in unemployment, moderating wage growth, and anemic labor force participation. Bulls were focusing on the weaker aspects of the report by buying up speculative assets, stocks, and bonds, but bears are mightily trying to pull an intraday interception, as stocks have reversed from green to red. This morning’s weaker figures, which are supportive of a lighter Federal Reserve, also align with the riskiest juncture of monetary policy tightening—the potential for the labor market to deteriorate markedly before the central bank provides accommodation.

Hiring Spree Continues

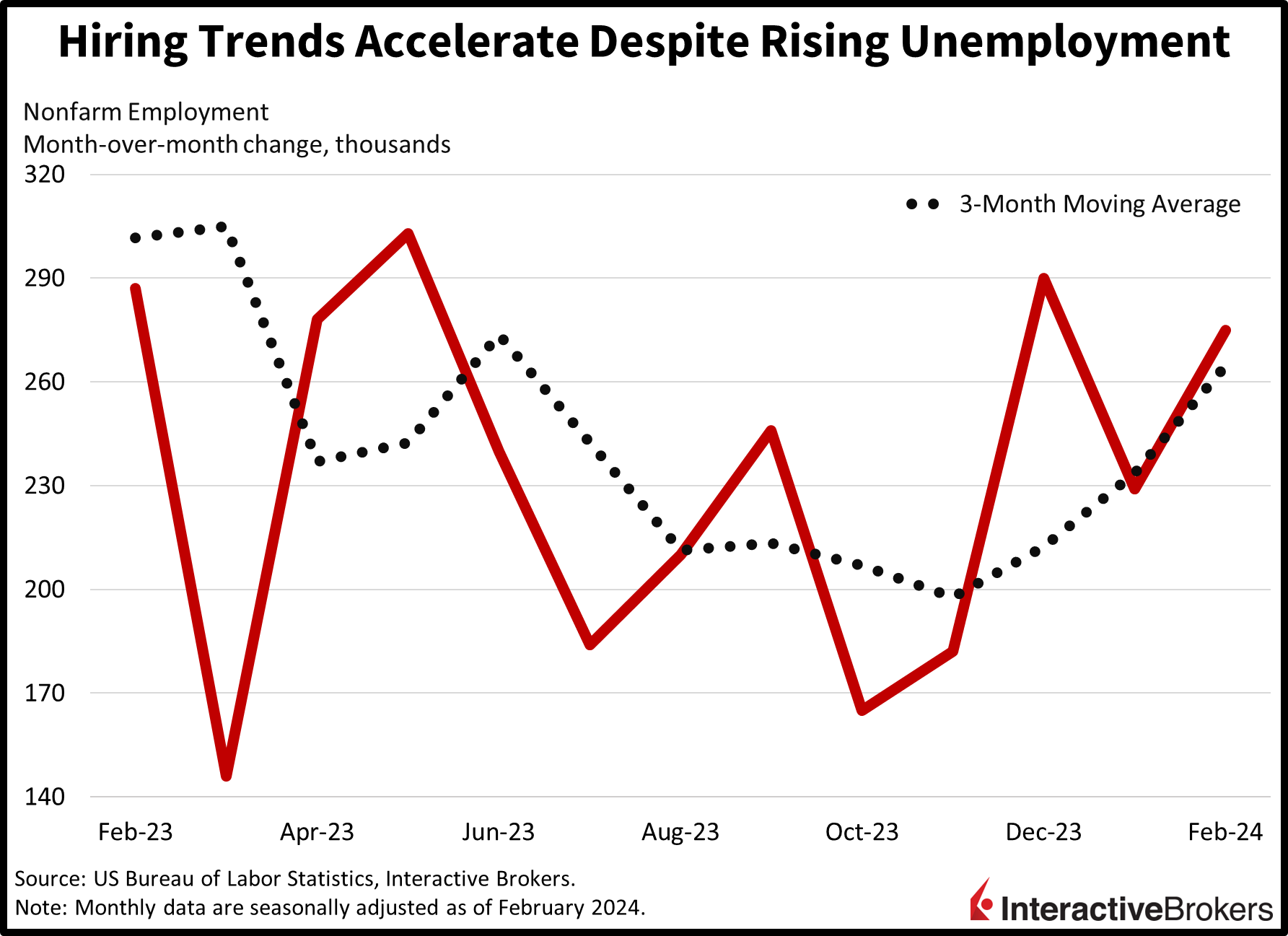

The US economy added 275,000 workers last month, exceeding estimates of 200,000 and January’s downwardly revised 229,000. The report offered a non-cyclical tilt, with education, health services, and government adding 137,000 jobs, roughly half of the headcount additions. Among the cyclical sectors, the leisure and hospitality category, the trade, transportation and utilities group, and the construction sector performed best, adding 58,000, 40,000, and 23,000 employees. All other gainers added below 10,000 jobs while manufacturing lost 4,000 and mining was unchanged. Employment in the temporary help services category, an indicator of labor demand, dropped to its lowest level since 2020.

Labor Market Cracks Emerge

While headline growth was impressive, the report depicted softening in certain areas. The unemployment rate climbed to 3.9%, the loftiest level since January 2022, while average hourly earnings grew at the slowest rate since February 2022. Average hourly earnings grew 0.1% month-over-month (m/m) and 4.3% year-over-year (y/y), much lighter than forecasts expecting 0.3% and 4.4% as well as January’s 0.5% and 4.4%. Additionally, the labor force participation rate remained at 62.5%, down from November’s 62.8%.

Retailers Benefit from Lighter Goods Prices While AI Supports Tech Companies

Recent earnings releases provide a favorable glimpse of inflation for retailers, the tailwind of artificial intelligence (AI) for tech companies, and in at least one example, businesses increasing their spending to improve efficiency. The following highlights illustrate those trends:

- Costco beat expectations for earnings but missed revenue estimates for the fiscal quarter ended February 18 despite both metrics increasing substantially y/y. Store traffic and the average shopping ticket both increased while same-store sales climbed 4.3% domestically. CFO Richard Galanti said inflation was nearly flat during the past 12 months, allowing the company to lower its prices for various items, including eyeglasses and its private-label batteries. Lower freight and commodity costs are also allowing the company to introduce new items at lower prices.

- Gap Inc. beat both earnings and revenue expectations for the recent quarter and said it is benefiting from lower input costs and fewer markdowns. Both metrics improved with earnings turning positive after the company produced a loss in the year-ago quarter. In another encouraging development, the average selling price for its products increased. While in-store sales grew, online sales, which represent nearly half of the company’s business, declined, resulting in comparable sales being flat y/y, which was better than expectations for a decline. Like many retailers, Gap trimmed its inventory, allowing it to limit promotional pricing. The company reiterated previous statements that the current consumer environment is uncertain, and it estimates that sales for the current quarter and this year will be roughly flat.

- Broadcom, which provides semiconductors and software for information technology (IT) infrastructure, posted results that benefited from customers building AI capabilities. The quarterly results exceeded both earnings and revenue estimates with the latter metric increasing 34% y/y. The company’s acquisition of VMware, which provides cloud-based IT infrastructure software, contributed to the strong revenue growth. Growing demand for Broadcom’s semiconductors, furthermore, is being driven by customers adding AI to their data centers.

- MongoDB, a provider of application development tools for cloud-based data centers, beat quarterly expectations for earnings and revenue, but provided disappointing guidance despite expressing optimism about growth opportunities associated with AI. Revenue grew 31% y/y and its net loss declined slightly. MongoDB believes the company’s developer data platform will become increasingly important for organizations seeking to leverage AI. However, the company’s guidance missed expectations, with the company providing a conservative outlook for the current quarter and full year. Guidance was partially impacted by changes in the company’s commission structures that will result in certain revenues not being realized in the current year.

- DocuSign earnings and revenue beat expectations and the company provided strong guidance for the current quarter and full year. DocuSign offers software for producing and processing digital contracts and other documents. For the quarter ended January 31, billings increased 13% y/y. CEO Allan Thygesen said the company generated strong growth from both enterprise and small business customers. Additionally, IT spending among businesses has been improving relative to previous quarters.

Related: S&P 500 Hits New Highs: Impact of Mnuchin's Rescue Efforts