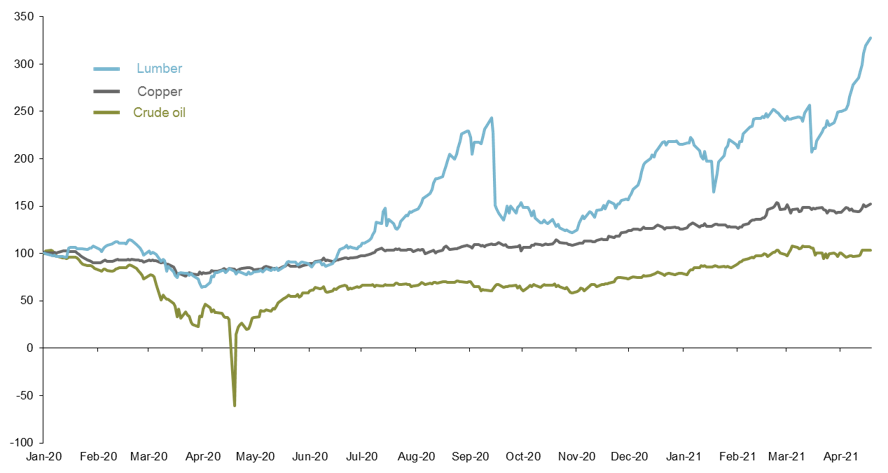

Recent U.S. inflation data showed that energy prices rose a substantial 5% for the month of March. Some of this improvement was clearly driven by base effects, with the early days of the pandemic putting substantial downward pressure on energy prices, making the comparisons very easy; but a good deal is also attributable to true changes in underlying supply and demand. At the same time, lumber prices have hit all-time highs and copper prices are near peaks last reached a decade ago. This upward price pressure for a number of different commodities may have investors wondering: are we in a commodity super-cycle?

Commodity super-cycles are typically defined as decade-plus-long periods where commodities trade above their long-term price trend. The last super-cycle occurred at the start of the millennium, fueled by the rapid growth of BRIC (Brazil, Russia, India and, most notably, China) countries and ended with the collapse in oil prices around 2015. With the global economy on the mend and a large cyclical upswing anticipated over the coming years, it makes sense that the potential of a super-cycle should be raised.

However, a number of trends seem to suggest that this thesis may not hold water.

On the energy front, further upward price pressure seems dubious. Both the U.S. and OPEC have an enormous amount of spare capacity, allowing production to increase in the face of rising prices; moreover, coordinated global efforts to address climate change will result in lower demand for fossil fuels in the decades ahead.

The sharp increase in both lumber and copper prices is due to a housing boom; in the U.S., for example, March housing starts hit a 15-year high. The question, therefore, must be about the durability of this surge. Given global policy makers awareness of rising home prices – particularly in China – and the slow rollout of any new infrastructure investment in the U.S., the red-hot global housing market will likely cool in the years ahead.

Food and precious metals round out the commodities group. A reacceleration in economic growth should temporarily boost demand for food, but poor demographics point to a slowdown in longer-term population growth; and while gold and other precious metals would typically be beneficiaries of easy global monetary policy and inflationary concerns, the rise of cryptocurrencies has taken some appetite away from this sector.

All told, the post-COVID global recovery should help to sustain commodity performance in the near-term, a boon for investors looking to hide from inflation or diversify portfolios. However, it seems premature to call this anything more than a strong recovery.

Commodities prices

Indexed to 100 at 12/31/2019

Source: FactSet, J.P. Morgan Asset Management. Lumber: Lumber Near Term CME; Copper: Copper NYMEX Near Term; Crude Oil: Crude Oil/WTI Global Spot NYMEX. Data are as of April 19, 2021