Written by: Monica Kingsley

After the sharp downside reversal late Monday, stocks refused downswing continuation yesterday. Slowly initially, then ever more forcefully into the closing bell. That seems to be a perfect definition of a reversal, right?

In today's article, I'll answer how much we can applaud it, and assess the stock upswing's prospects along the way.

S&P 500 in the Short-Run

I’ll start with the daily chart perspective (charts courtesy of http://stockcharts.com):

Stocks clearly reversed and closed again above their mid-June highs. The move happened on solid volume, which works to raise its prospects of success. It's certainly positive for the bulls to see volume on a rising path since the start of July.

Let's check next whether the credit markets support the turnaround.

The Credit Markets’ Point of View

High yield corporate bonds (HYG ETF) also rose strongly, and on a high volume. That's encouraging, and raises the odds of the move's extension. Having that in mind, the recent consolidation might be getting close to over, and unless today's trading finishes in the red on even heavier volume, the weights remain tilted to the bullish side here.

S&P 500 closing prices (black line) overlaid on the high yield corporate bonds to short-term Treasuries ratio (HYG:SHY) chart shows that stocks got a little extended relative to this metric. Not outrageously so, but still.

Considering this signal against the momentum of preceding day though, I would put more weight on the momentum. In other words, unless the ratio tanks, stocks aren't likely to suffer a material hiccup.

Yes, that means that they're ignoring Monday's California lockdown (affecting over 80% of the state's population, altogether 30 counties). This makes for an interesting dynamic though. Given that Gov. Newsom was the first to use this indiscriminate measure, and stocks together with bonds keep ignoring this development, the markets are in effect betting on this being "a red herring on par with early April Fauci raising the specter of not emerging from lockdowns until a vaccine arrives".

In other words, the markets are saying that Democrats won't have the guts to become the Party of Lockdowns, because that might very well backfire come November. I am not so sure markets are being completely right on this though. Yes, they may come to a certain degree regardless of Trump and his administration not being in the least appetite for them. Ultimately though, it’s the governors and mayors who also have their say. Let's just hope their decisions would be based on rigorous data and not on the likes of 100% positive test rates achieved by the Florida Department of Health.

S&P 500 Market Breadth, Smallcaps and Emerging Markets

The advance-decline line flipped again to the bullish territory, but could have been arguably at a higher level given where the S&P 500 closed. No reason to declare its current position as a bearish divergence though just yet. After getting today's closing prices, we'll be smarter but I think that the advance-decline line would add to its gains later today.

The Russell 2000 (IWM ETF) is coming back to life, but things aren't all peachy here. The volume for an upside reversal could be easily bigger to make it more trustworthy, but smallcaps can move with a great momentum in a short period of time too.

Yes, pressure for a sizable move is building, but its yesterday's chart is rather neutral in the IWM ETF implications for the S&P 500 in the very short run.

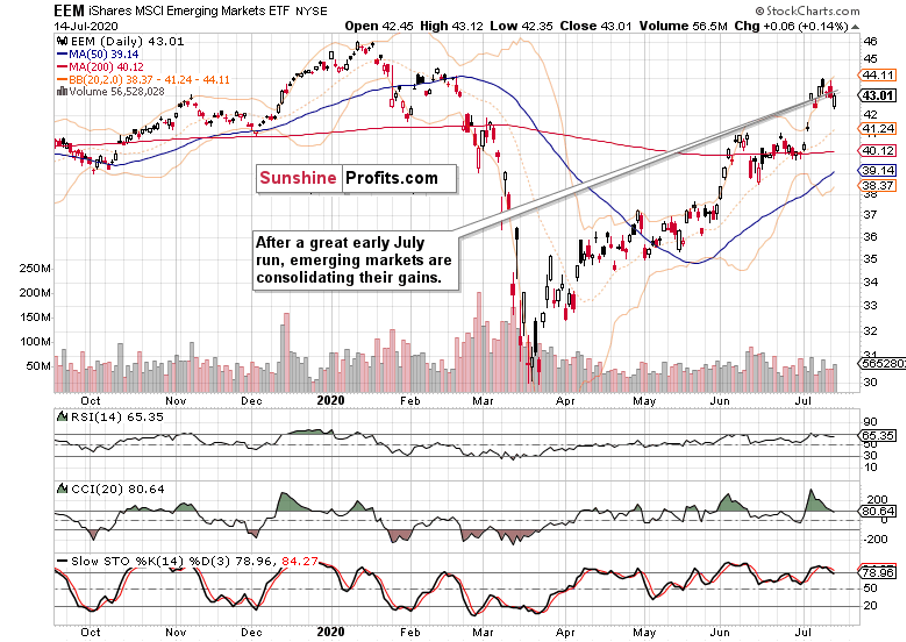

Emerging markets (EEM ETF), that's another story. They're starting to outperform the U.S. counterparts, which is encouraging for the stock bulls. Let's see the EEM performance in detail next.

The caption says it all. There's no reason to say that we're looking at an island top currently. It's in the making, thus incomplete, thus lacking implications. And given the story the volume tells, I think that it's not trustworthy. The bullish-to-sideways slant is the prevailing outlook here.

S&P 500 Sectors in Focus

Some froth has been taken off with the heavyweights' plunge. Some. Tech (XLK ETF) is still trading inside its steeply rising channel, but it must be noted that in June and July, the swings'magnitude has risen, and the momentum of increases has slowed down.

While that doesn't mean that tech is about to move away from its higher highs and higher lows trajectory, it might imply that some degree of consolidation is in its future.

Yesterday, it has reversed higher on significant volume instead of keeping the index down for a day longer. Do semiconductors (XSD ETF) point to the likelihood of a more pronounced reversal in tech prices soon?

The segment has erased more of its losses than the full tech sector. This fact gently tips the scales in favor of both the XLK ETF and S&P 500 upswing to reassert themselves.

With financials (XLF ETF) coming back to life (they really have quite some catching up to do) and healthcare (XLV ETF) rising on finely dosed vaccine hype news, this bodes well for cyclicals in general, and naturally for the full index overall. Additionally, such news help to send the USDX into a tailspin, as the risk appetite increases.

Summary

Summing up, with Monday's lockdown fears on the back burner now, stocks have reversed much of this week's retreat. Credit markets also turned, and quite a few more factors than not appear to be aligned in the stock bulls' favor. Tech heavyweights' performance later today is arguably the key short-term watchout. Just as much as a quick reemergence of another lockdown news, or the ongoing Fed tightening (when would something break?). Barring these, the factors are leaning bullish, and an open position becomes a question of risk-reward ratio preferences and a strong stomach to withstand sudden downturns in market perceptions of risk.

Related: Another Day, Another S&P 500 Reversal. Let's Cheer It!