We’ll get to talking about oil and energy in just a moment, but first I have something important to share with you all.

As many of you know, aside from being the chief executive of U.S. Global Investors, I also serve as the interim chairman and interim CEO of HIVE Blockchain Technologies, the first publicly listed company engaged in the mining of cryptocurrencies.I’m incredibly honored to play a role in this emerging and very promising digital industry, and it’s a responsibility I take very seriously. The search for a new HIVE CEO is underway, but in the meantime, I’m committed to the company’s success, and I see no greater duty than fulfilling my fiduciary obligation to all shareholders equally. On top of all this, I haven’t taken a salary as interim CEO.If you’ve studied corporate law, you might be familiar with duty of care and duty of loyalty, the twin pillars of fiduciary duty. Whereas the former charges officers and directors to act prudently, the latter says that they should refrain from benefiting themselves at the expense of the company they serve.To me, that means insisting on good corporate governance and transparency. I expect that from not only HIVE’s own leaders but also those at Genesis, HIVE’s strategic partner and largest shareholder. Sadly, Genesis seems not to be of the same mind.I won’t rehash all of the grievances here. Those curious can

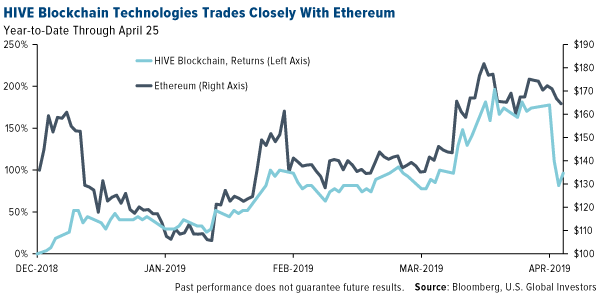

read the press release.Suffice to say, though, that ideologies clashed the weekend before last, of all weekends, when many families were celebrating Easter or Passover. After months of what I believed were good faith efforts to get Genesis to disclose all costs for mining operations—leading to a breach of contract we value at around $50 million, as per the master service agreement (MSA)—Genesis tried to “resolve” the dispute by removing all HIVE directors who were independent of Genesis’ self-interests, including myself, and replacing them with their own officers and employees.Ultimately, this boardroom dispute failed.So why am I sharing this with you? One, I wanted to give you some insight into why HIVE stock fell some 40 percent over two days this week. Before the selloff, HIVE had been tracking Ethereum and was up nearly 200 percent for 2019. As Warren Buffett might say, Mr. Market was none too pleased with Genesis’ actions.

click to enlarge

click to enlarge

And two, I take my role as interim CEO seriously. I believe that my fiduciary duties extend to all shareholders of HIVE, not just to Genesis. I seek and fight for good corporate governance. I manage conflicts of interest. And I demand transparency. These are qualities I admire in companies as chief investment officer of U.S. Global Investors.Despite all this, I’m hopeful that a satisfactory resolution can be reached between the two parties, especially now as prices of digital currencies are stirring to life. In an exciting bit of news, bitcoin not only traded above $5,500 last week but also signaled a bullish “golden cross” for the first time since 2015. To read more, jump to the Blockchain and Cryptocurrency section by

clicking here.Now let’s talk about energy! Below are three things from last week that you should know about.

1. Goodbye, Iran Oil Import Waivers. Hello, Higher Energy Prices?

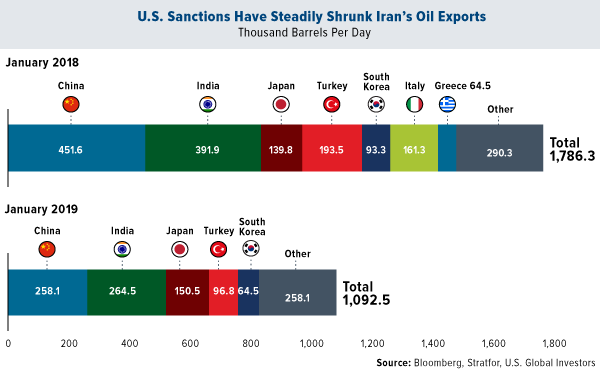

Besides Occidental Petroleum’s bidding war with Chevron for fellow producer Anadarko Petroleum, the big energy news from last week is that President Donald Trump, as expected, moved to end all sanction waivers for nations that import Iranian oil. Starting in May, countries that still buy oil from Iran could face U.S. penalties. In response, Brent crude hit $75 per barrel for the first time in six months.Oil and natural gas are the Middle Eastern country’s most important export, so the policy is intended to hit Tehran where it hurts. The plan,

announced last summer, appears to be working so far. Between January 2018 and January 2019, Iranian oil exports fell by nearly 700,000 barrels per day (b/d). (The data could be inaccurate, though, since Iranian oil tankers are believed to be

turning off their transponders in an effort to conceal themselves from satellite tracking systems.)

click to enlarge

click to enlarge

It’s unlikely that all countries will immediately zero-out imports from Iran. I would be surprised to see China, the number one consumer, trim its imports much further. Iran is such a key strategic player connecting Asia and the Middle East as part of

China’s Belt and Road Initiative (BRI).So who will pick up the global slack if Trump’s plan succeeds and Iranian exports go offline? Trump suggests Saudi Arabia and the United Arab Emirates (UAE) will. Secretary of State Mike Pompeo also believes the U.S. can, but this would “be a stretch,” according to Bloomberg.“Oil condensate from the Eagle Ford shale basin in Texas is similar, though a bit heavier than Iran’s light South Pars condensate. But the Eagle Ford produces only about 150,000 b/d of its product, compared with Iran’s daily output of 600,000 barrels in 2017,” the article reads.

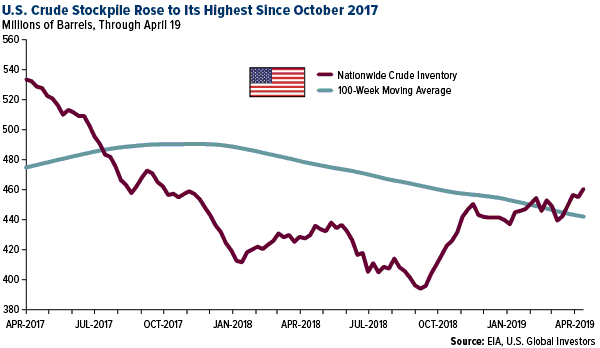

2. U.S. Crude Inventories Climb More Than Expected

But maybe there’s something to what Pompeo says after all. Thanks to its fracking industry, the U.S. is producing oil at a breakneck pace. This is turning up in domestic inventories, which have been building steadily over the past seven months or so. For the week ended April 19, oil stocks rose by 5.5 million barrels, much more than what analysts had anticipated. At 460 million barrels, total crude stocks now sit at their highest level since October 2017.

click to enlarge

click to enlarge

The U.S. is already the biggest oil producer in the world, having overtaken Saudi Arabia and Russia last year. Looking ahead, U.S. output could equal that of both countries by 2025, according to International Energy Agency (IEA) estimates. And in January, the Department of Energy said that the U.S. will become a net exporter of energy in 2020—something it hasn’t achieved in almost 70 years.Related:

Keith Fitz-Gerald: Invest in Optimism 3. Oil Prices Were Headed for Overbought Territory… Until Trump Stepped In

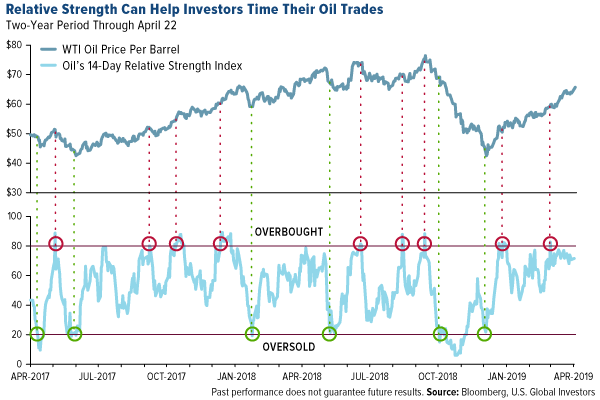

Oil prices neared overbought territory, as you can see in the chart below, which shows oil’s 14-day relative strength index (RSI). When an asset’s RSI rises above 80, it typically means that it’s overbought, suggesting it might be time to take some profits. When it falls below 20, meanwhile, it often means that the asset is oversold, signaling a possible entry point.

click to enlarge

click to enlarge

Again, oil prices looked to be on the overbought side, especially after the administration announced the end to sanction waivers. But the trend could reverse very rapidly.Case in point: On Friday, the president, who favors lower energy costs, claimed that he “called up” OPEC and told the global oil exporting cartel: “You’ve got to bring [gasoline prices] down, you’ve got to bring them down.” Which, of course, is not in Saudi Arabia’s best interest.In any case, the price of West Texas Intermediate (WTI) plunged close to 4 percent on Friday, its biggest one-day drop since mid-December. As a result, oil’s RSI sharply turned down to around 50, from nearly 72 on Monday.Depending on what happens in the next few days, oil traders might be looking at another buying opportunity.

Get even more award-winning market commentary by subscribing to my CEO blog Frank Talk!