Selling your business is a difficult but rewarding journey. Going through an exit or liquidity event can feel like hitting the jackpot and for many it feels like the culmination of your life’s work. However, the reality is there’s still work to be done in order for you to fully enjoy, and feel secure in, your post-exit lifestyle. It may require a redesign of your portfolio to support your new reality.

Designing and managing a portfolio for the long term that meets your post-exit goals has its unique challenges. Primarily, the difficulties arise out of trying to balance two seemingly contradictory goals: cash flow and growth. That is, you need a portfolio and financial plan that provides enough cash flow to support your living expenses while also achieving sufficient long-term growth that helps your assets last for decades, so you hopefully don’t run out of money.

At Monument, our goal is to help business owners make prudent, data-driven investing moves to help maximize and protect their accumulated wealth that provides enough money to last a lifetime.

Cash and Cash-Planning are King

Just because you’ve sold your business doesn’t mean your life is over. To the contrary, it means the opposite. Owning and operating a business is a time-consuming endeavor, and now that you’ve transitioned away from it, there are endless ways to fill your time after you cashed in. Your lifestyle may have changed, but you still need enough cash to meet your living expenses.

After selling a business and transitioning into retirement, you’ll likely replace daily expenses like commuting with different expenses, such as healthcare and travel. But it won’t just be your expenses that get replaced. You’ll also need to replace the cash flow that once came from your business. This is when, and why, cash-based planning becomes even more critical.

A well-crafted cash strategy should help you keep enough cash to carry out your plans, while also avoiding selling assets from your portfolio during “bad” or volatile markets. There isn’t some perfect level of cash that can help you withstand any and all market volatility, but we usually recommend our clients carry around 12 to 18 months of living expenses in something that is liquid and earns a competitive yield. The key is to determine your own “standard” cash bucket amount. With your cash bucket full and ready to be used during turbulent times, the goal is to meet the needs of your daily expenses while also being able to ride out the inevitable market swings without having to pull money from your portfolio.

In other words, the goal is to never be a forced seller during market pullbacks. If you’re selling during tough market environments, you might be locking in losses that could otherwise only be temporary if and when the market recovers. And selling your investments when the market is down can be detrimental to your financial longevity thanks to Sequence of Return Risk.

Before your exit, your business probably supported your day-to-day income needs, but now you’ll need to fund your new lifestyle using the proceeds from the sale through your investment portfolio. However, to be clear, cash flow is not the same thing as income. More on this in the next section.

Look at the Total Portfolio, Not Just Its Income

When you go through a business exit or liquidity event, your proceeds should be incorporated into your portfolio. This becomes the engine that supports your cash needs for the foreseeable future. Most people believe this means their portfolio needs to generate the full amount of cash they need strictly from its income, but it really isn’t that simple. It’s really about your portfolio’s total return, which is comprised of two pieces: Price return and Income return. Both of these returns contribute to meeting your cash flow needs.

For example, let’s say you invest $3,000,000 in a mix of stocks and bonds today, and over the next year it grows by just over 8% to $3,250,000. Your price return would be $250,000 or 8.33% to be specific. However, if you also collected $100,000 of income through dividends and interest along the way, or an additional 3.33%, then your total return is actually $350,000 or 11.66%. This total return is made up of $250,000 in price return and $100,000 in income return.

If you myopically focus on the income generated by your portfolio, you might only believe that you can spend your income return, or in this case $100,000. But in reality, you can spend up to your total return of $350,000 (in this scenario) while still preserving the $3,000,000 you initially invested. If you don’t need the full $350,000 to support your annual expenses, you can always leave the excess invested and let it continue to grow alongside the rest of your portfolio.

Now, it’s important to remember that price return is driven by market movements making it normally a bit more unpredictable than income return. Meaning that, in order to potentially increase your overall cash flow, you must accept some additional market risk and volatility. Instead, if you wanted to remove almost all the uncertainty from your cash flow, you could invest everything into a fixed income asset and simply collect its yield. However, this also has its own set of consequences. It likely means you’re limiting the overall amount of cash flow you can take from your portfolio while also possibly reducing its long-term growth potential.

The bottom line is, if you can focus on building a portfolio focused on total return, you are actively working to balance the opposing goals mentioned earlier: cash flow and growth.

The Hardest Part is Managing Behaviors

While it’s important to have a cash-flow based plan and a total return strategy, it’s even more vital that you stick to them over the long term. Too often, investors lose faith in the process and make changes to their allocation. Often times, this turns out to be harmful to their long-term returns and goals.

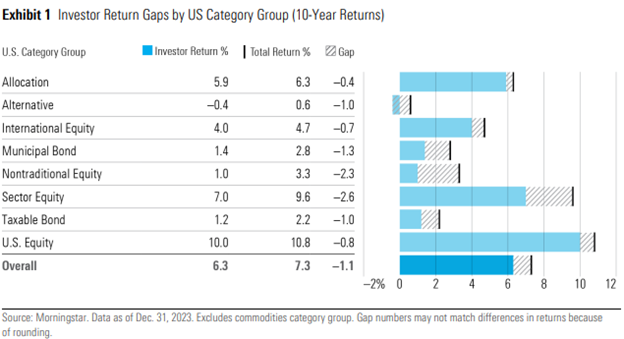

If you want to see how impactful your behavior can be, all you need to do is look at Morningstar’s annual report that analyzes a metric called Investor Returns. The goal of this study is to measure how much of a fund’s return investors actually capture across various asset classes. Morningstar calculates the difference between the buy-and-hold returns and what they call investor returns by looking into the inflows and outflows for each investment group in an attempt factor in the timing of investor decisions.

The strongest takeaway from this data comes from looking at the U.S. Equity group. Over the 10 years ending 12/31/2023, investors only achieved roughly 10% returns while the group overall had a 10.8% total return, meaning investors had -0.80% lower returns, likely due to mistimed buy and sell decisions. Roughly the same sentiment applies to other asset classes as well – just check out the chart below. In the end, if investors had simply stayed the course and remained invested in their chosen strategy, they would’ve done noticeably better according to this Morningstar study.

The behavioral and psychological aspects that allow entrepreneurs to be successful are quite different from the behavioral and psychological traits of successful investors.

There exists a massive difference between the skills and techniques needed to become wealthy versus the skills and techniques needed to stay wealthy. Entrepreneurs and business owners are always looking to innovate or shift towards the next bright idea. That might be a great trait when you’re aiming to grow a business, but when it comes to investing, constantly chasing after the current or next hottest idea can be your worst enemy.

Patience (Alongside Planning) is a Virtue

In our experience, patience, discipline and the guts to stick to your strategy (i.e. not making emotional decisions) can be a valuable asset. Especially when it’s coupled with a data-driven financial plan that prioritizes cash flow management. In the end, it’s your behavior that determines your success in life more than any other factor – including when it comes to managing your wealth.

Having and sticking to a cash-based financial plan that includes a total return strategy are relatively simple concepts. However, implementing and managing them can be quite complex. Now that you’ve exited your business, you might have the necessary time to do it all, but if you’d rather enjoy the time and peace of mind that comes with hiring a wealth advisor, we encourage you to find a team of experts who align with your values.

When you were running your company, you likely had a trusted CFO to help manage your business financials. Post-exit, it might make sense to have a “CFO” for your personal financial life as well. That way, you can focus on whatever’s most important to you in this new and exciting next chapter of your life while leaving the day-to-day management of your wealth to someone you trust.

Related: Top 5 Year-End Tax Planning Strategies for High-Income Earners