Written by: Brighthouse | Brighthouse Financial

It can help protect your family while providing long-term care coverage, should you need it.

Mike and Anne Cooperman1 have one child: their daughter, Catherine. Six years ago, when their financial advisor asked the New Hampshire couple, who are in their 50s, how they planned to pay for long-term care if they someday needed it, the conversation focused on their daughter, not on dollars.

“We didn’t want to place the burden on Catherine of paying for our long-term care or moving to take care of us herself,” says Mike Cooperman, a retired property and vehicle insurance executive. “My wife and I just went through end-of-life care with my elderly mother. We know how difficult it is.”

They visualized Catherine taking care of them, and that sparked an urgency to act. They purchased a traditional long-term care insurance policy: You pay premiums for life, and if you need long-term care, you can claim benefits. “There was no question about it,” he says.

The U.S. Department of Health & Human Services estimates that more than half of Americans age 65 or older will need long-term care services at some point.2 But many don’t like the traditional insurance solution because they can’t get past the “use-it-or-lose-it” feature of those policies, according to Kim Garcia,3 a certified public accountant and principal with a wealth management firm in Greensboro, North Carolina.

With traditional long-term care insurance, you pay premiums for life, and if you need long-term care, you can claim benefits. If you don’t need care, you don’t receive any benefits.

“People want to protect against long-term care costs, but they don’t want to feel like they’re throwing money away, so to speak, on something they may not need,” Garcia says.

Hybrid Life Insurance and Long-Term Care Policies Offer Value, No Matter What

A newer, alternative option is a hybrid life insurance policy with long-term care coverage. These policies combine life insurance with long-term care coverage.

A hybrid policy provides benefits in two ways:

- Long-term care benefits: If you end up needing long-term care, you use part of the policy’s death benefit to help pay for medical and nonmedical expenses related to everyday care, including qualified home care or assisted living.

- Life insurance benefits for loved ones: Unlike traditional long-term care policies, if you never use the policy’s long-term care benefits, your loved ones will receive the death benefit in full when you pass away.4 If you do tap the policy’s long-term care benefits, loved ones get a portion of the death benefit.

The bottom line: One way or another, you’re guaranteed to get some returned value from a hybrid life insurance policy.5

Long-Term Care: What It Is and What It Covers

Long-term care is a general term for a wide range of services that people may need if they’re chronically ill or have disabilities. Services typically include personal care or other aspects of everyday living, according to the Department of Health & Human Services.

Generally, individuals qualify to claim long-term care insurance benefits when they’re unable (temporarily or permanently) to independently perform at least two of six activities of daily living:

- Bathing

- Continence

- Dressing

- Eating

- Toileting

- Transferring (for example, moving in and out of a chair, bed, or wheelchair)

Developing a severe cognitive impairment like Alzheimer’s disease can also qualify someone to need long-term care.

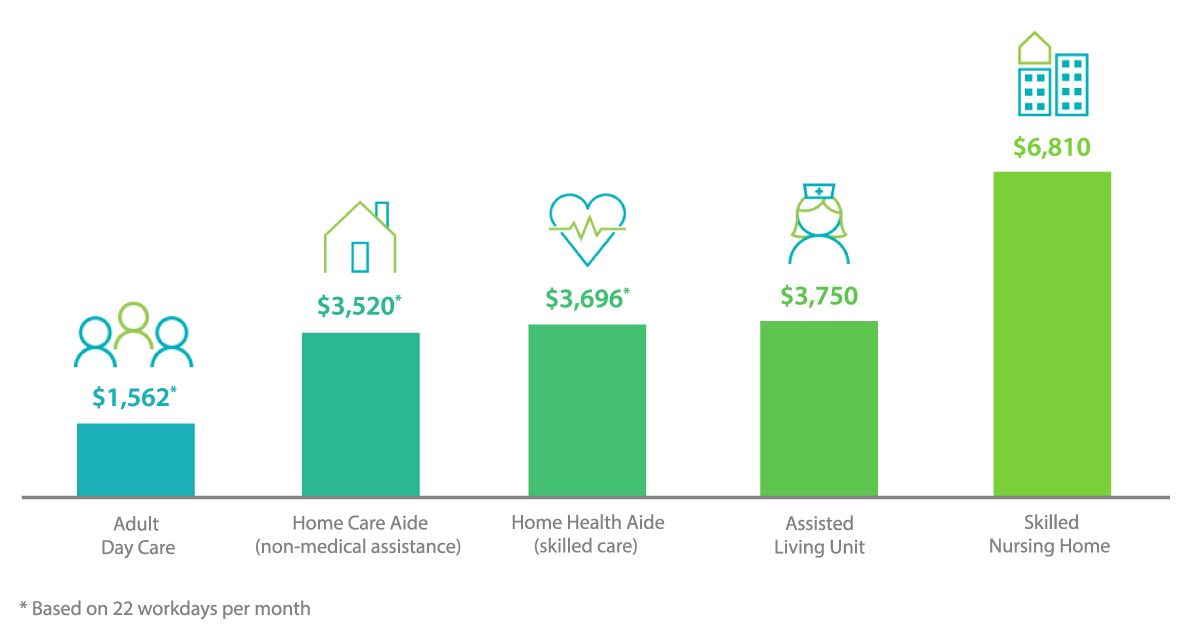

Care options can include simply hiring someone to help you get ready each morning to paying full room and board in a nursing home. The services you need determine your cost of care. Using national averages, one month of care can cost anywhere from $1,562 for adult day care services to nearly $7,000 for around-the-clock care in a nursing facility.6 The average length of a long-term care event is two to four years.7

The monthly price of long-term care

Source: “Senior Care Costs / Aging Care Calculator,” The American Elder Care Research Organization, August 2017.

Paying for these services can be challenging. Health insurance doesn’t pay for long-term care. Medicare Part A may pay a portion of a nursing home or rehabilitation center stay, but only for up to 100 days and only if the person’s health is improving.8 In order to take advantage of Medicaid coverage, you would need to meet income and asset limits.9

The remaining options are:

- Using your savings or pulling from assets to pay for services,

- Relying on family members for care, or

- Buying long-term care coverage, as the Coopermans did.

The Value of Hybrid Long-Term Care Insurance

Before you buy a long-term care policy, you need to determine whether it’s protection that makes sense for you. Your financial professional can help you understand how long-term care coverage would fit within your financial plan, and detail the products available.

In general, hybrid life insurance policies with long-term care coverage are more expensive up front than traditional long-term care policies, although you’re guaranteed to get some returned value from a hybrid policy, notes Garcia.

Recent sales figures also seem to indicate more consumers are finding hybrid long-term care insurance policies appealing.

The number of consumers buying a hybrid life insurance policy with long-term care coverage rose 50% between 2012 and 2016 (the latest available data), according to LIMRA, an insurance industry marketing research firm.10 During that same period, sales of traditional long-term care policies dropped by almost 60%.10

A hybrid policy protects your family while providing long-term care coverage, should you need it. Additional benefits of choosing hybrid life insurance over a traditional long-term care policy include:

1. The policy can work as an estate planning tool.

Hybrid life insurance policies provide a partial or full death benefit to loved ones. This death benefit is generally income tax-free. In addition, the long-term care coverage can help pay for care costs that could otherwise reduce the financial assets you hoped to pass on to future generations.

2. It’s a simple way to safeguard money for long-term care.

If you need it, long-term care coverage is there, within your policy. That coverage helps ensure that you can enjoy the retirement lifestyle you envision with confidence, knowing that if you need long-term care, you won’t spend all or a significant portion of your retirement savings on care costs.

3. You won’t pay premiums for the rest of your life.11

You may fully pay for a hybrid life insurance policy up front or have the option of a payment plan. These “multi-pay” plans may allow you to pay for your policy over a set number of years.

Once those payments are made, you make no other payments for the rest of your life.12

On the other hand, traditional long-term care insurance policies may require you to make ongoing, annual payments for as long as you live – and for some policies, even if you begin receiving benefits.

Ongoing payments can also be a stumbling block for some policyholders. Over time, policyholders could face financial hardships that could prevent them from paying their premiums.

A 2015 study by the Center for Retirement Research at Boston College revealed that more than one in four people who buy traditional long-term care policies at age 65 eventually stop making payments.13 And when a policyholder stops paying premiums – no matter how long they’ve owned their policy – they forfeit all of that premium and their long-term care benefits. (although non-forfeiture options may apply).

4. You pay a set price for your policy.

With a hybrid life insurance policy, your required premium amounts are known. Your rate may never increase, even if your health changes.14 With traditional long-term care insurance, annual payments are not guaranteed to stay flat; they can increase. Even now, traditional long-term care insurance rates continue to rise regularly.15 Unexpected rate increases are one of the primary reasons people stop paying their premiums and buying traditional long-term care insurance policies.14

5. If you change your mind, you can get some of your money back.

Some hybrid life insurance policies offer a return of premium. If you decide at some point that you no longer need or want the policy, the insurer will refund a percentage of your original payment amount.

Your exact refund depends on your insurance company’s rules and how long you’ve owned the policy; however, the return of premium feature should be clearly spelled out in your insurance contract.

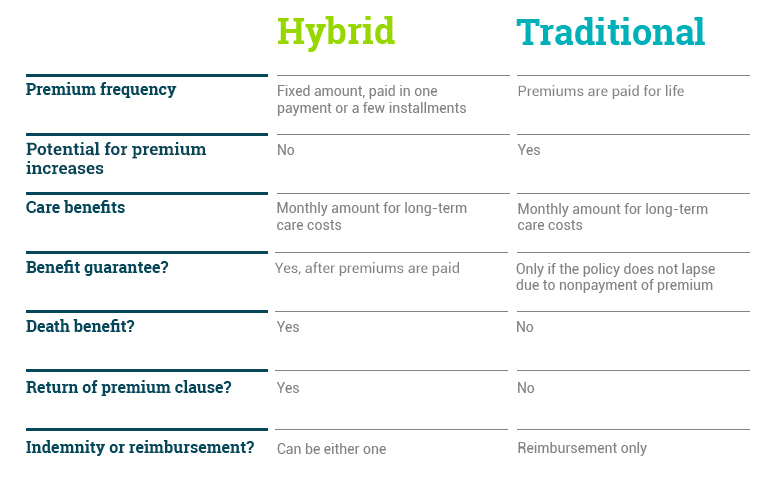

6. Traditional policies are always reimbursed, whereas hybrid policies can be either.

Indemnity benefits

Indemnity benefits set a monthly benefit amount and will pay that full amount once you qualify for long-term care benefits.

For example, if you buy $5,000 per month in indemnity long-term care benefits and you have only $3,000 per month in long-term care expenses, the policy will pay you the full $5,000 that month. You can decide how to spend the excess $2,000.16

Reimbursement benefits

Reimbursement long-term care benefits will pay to reimburse you only for the long-term care expenses you have incurred once you qualify to draw benefits. These expenses must be qualified in order to receive the reimbursement.

For example, if you buy a reimbursement benefit for $5,000 per month, but the cost of your long-term care expenses is only $3,000 per month, the company will reimburse you the $3,000. The extra $2,000 you did not use that month will still be there and can be used at the end of the benefit period. It can be used only for long-term care expenses.

Comparing hybrid and traditional long-term care insurance

Tips for Buying Long-Term Care Insurance

Regardless of which type of long-term care coverage you’re considering, it’s important to be a careful consumer:

- Shop as early as possible: The younger and healthier you are, the more coverage you may be able to get. It also may be easier to budget for up-front or installment premium costs while you’re still working, rather than once you’re retired.

- Gather multiple quotes: Consider policies from several companies and work with your financial advisor to carefully compare benefits, premium prices, and medical underwriting requirements for each policy.

- Know your rights: • Most states require insurance companies to give you 30 days to review your policy after you sign it. If you change your mind, you can return your policy during this time and get a full refund.

- Prepare some key questions: • Asking your financial advisor the right questions can help you feel confident in your long-term care coverage decision. Here are some you might want to start with:

- Do my retirement savings and income plan have me covered in the event I need long-term care?

- Would a long-term care event impact other valued assets such as my home, business, or gifts I want to make to my grandchildren?