Written by: Brighthouse | Brighthouse Financial

Discover how permanent life insurance policies can help cover large expenses and provide tax advantages.

Most people understand the importance of purchasing life insurance to protect their loved ones.

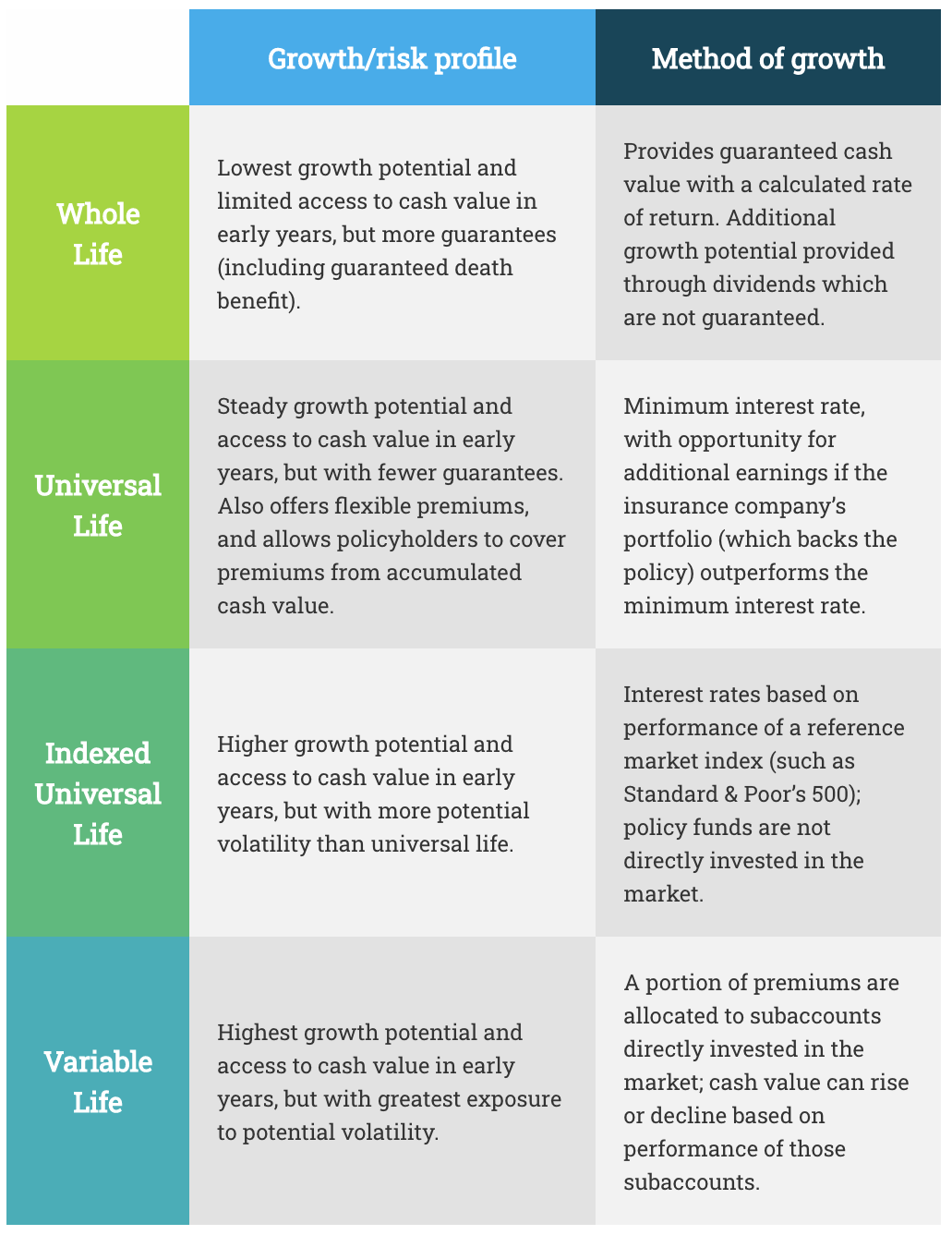

With term life insurance, they can purchase this protection for a specific period of time, and money is paid to the beneficiaries if the insured person dies during that period. In contrast, permanent life insurance lasts as long as the policy owner continues paying premiums — and will pay the death benefit whenever the insured person dies, not just during a specified term.

Permanent life insurance also goes beyond basic protection by adding the potential to build cash value through interest credits, market returns, or dividends. That cash value can be used in the future for kids’ education, emergencies, retirement needs, or any other purpose, typically without triggering income tax on the withdrawals .1

It’s important to note that the primary purpose of permanent life insurance is protecting loved ones with a death benefit. It is not a savings or investment vehicle, but if needed, it can provide flexibility and access to a policy’s cash value, making it a valuable addition to a retirement plan.

Premiums for permanent life policies can be higher than for term life, because the coverage is provided for life and there is potential to build cash value that can be used in the future. Permanent life insurance policies offer several other benefits as well, including:

- No annual limit on premium payments, allowing policyholders to potentially build a larger pool of assets for future needs.

- No penalty for withdrawals taken before age 59½, providing flexibility for meeting cash needs at any age.2

- No required minimum distributions (RMDs) at age 70½, allowing assets to continue growing for longer periods and providing a potential pool of money for later in retirement.

- The potential to transfer wealth to beneficiaries tax free through a death benefit.

A diversified retirement plan typically includes a range of savings and investment vehicles, such as 401(k)s, IRAs, and assets such as stocks and bonds held in brokerage accounts. Adding permanent life insurance can complement this mix by providing a death benefit to help cover expenses if anything happens to the insured person, along with access to cash value with tax benefits.

Here are three potential uses for permanent life insurance in a retirement plan:

1. Providing a source of funds to help cover large expenses

Permanent policies typically grow their cash value relatively slowly during the first years of a policy, as most premiums are being used to fund the death benefit. That means a permanent life policy isn’t likely to be a large source of funds early in retirement. After the first 10 years or so, policyholders can tap the cash value of permanent life insurance if needed through:

- Withdrawals. Policyholders can withdraw from the cash value for any reason, but withdrawals may be especially helpful in managing large expenses during retirement, such as medical costs or home repairs. The money taken out is generally tax-free as long as long as the policy does not qualify as a modified endowment contract3 and policyholders only withdraw up to the amount they’ve paid in premiums. If the withdrawals exceed the amount paid in premiums and include some gains, the portion of the withdrawal made up of those gains will be taxed at the policyholder’s ordinary income tax rate. However, withdrawals will permanently reduce the policy’s cash value and future death benefit. Depending on the policy, there may be fees for making withdrawals.

- Loans. Policyholders can take loans from their cash value. While often not taxable,4 loans typically have a set interest rate and will permanently reduce the policy’s cash value and death benefit if not paid back.

It’s important to remember that the key difference between permanent life insurance and other portfolio assets is the tax-free death benefit it provides. Withdrawing too much of a policy’s cash value during retirement can reduce the amount of money available for beneficiaries as a death benefit, potentially eliminating the primary purpose of permanent life insurance policies. Policyholders should examine any near-term uses for their plan’s cash value against the potential impact on their future death benefit, seeking a balance between meeting current needs and maintaining protection for loved ones. A financial professional can help strike this balance.

2. Opportunity for tax-deferred cash value accumulation

The cash value in a permanent life policy can grow tax-deferred, meaning the policyholder won’t owe taxes on gains until they begin withdrawing money. This feature means these policies can serve as a complement to other tax-deferred savings options such as IRAs and workplace retirement plans. A permanent life policy may be especially attractive to people who max out their contributions in workplace plans and traditional IRAs and are not eligible to contribute to Roth IRAs.

3. Helping to cover healthcare costs with optional riders

Some insurance companies offer optional features (called riders) that can be added to life insurance policies to help protect against healthcare costs that aren’t covered by Medicare or other insurance in retirement. These riders either give policyholders early access to their death benefit (which permanently reduces the value of that benefit) or cover the care outright.

For example, a chronic illness rider can help pay for expenses that arise from being permanently incapacitated by a chronic illness, such as Alzheimer’s. With a chronic illness rider, a portion of the policy’s death benefit is accelerated, and funds can be disbursed in advance to pay for any need, including non-medical expenses.

For people who are eligible, selecting one of these riders may help prevent other retirement savings from being consumed by healthcare costs. A financial professional can help determine if it makes sense to add a rider to a life insurance policy at the time of purchase.

While protection is the core purpose of all life insurance, permanent life insurance can offer distinct tax advantages, growth potential, and access to cash that may help strengthen an overall retirement plan. A financial professional can help determine the right type of life insurance policy to consider adding to your retirement plan.

Related: How to Enhance Your Retirement Strategy with Cash Value Life Insurance