Written by: Brighthouse | Brighthouse Financial

Fifty-two percent of people turning 65 today will one day require long-term care – help performing activities of daily living, such as bathing, dressing or eating.1

When deciding how to pay for long-term care costs, self-insuring (paying out of pocket) or long-term care insurance coverage are two main options. Each impact taxes in different ways.

Below are some general tax considerations, but remember to consult with your tax and legal advisors for advice about your particular situation before buying a policy or using policy benefits.

Tax Effects of PayingOut of Pocket

If someone pays for long-term care costs from their own income or assets, they first pay taxes on the income when it’s earned. They could also pay taxes on invested assets they sell, if there are taxable gains. This means they may need to account for taxes (in addition to the amount needed for care) if they’re using taxable investment assets to pay for long-term care expenses.

Long-Term Care Coverage:How Hybrid Policies Are Taxed

If paying out of pocket isn’t possible, long-term care insurance coverage could be a strong option.

One increasingly popular route is a hybrid life insurance policy with long-term care riders.2 With a hybrid policy, loved ones can receive a partial or full life insurance death benefit, and you can use part of the policy’s death benefit to help pay for long-term care expenses, should you need it.

Here are three main features of a hybrid life insurance policy with long-term care coverage.

Death Benefit

Because a hybrid policy is a life insurance policy, it provides a life insurance death benefit in addition to long-term care coverage. The death benefit may be reduced if the policy’s long-term care benefits are used. When the life insurance death benefit is paid, it is generally paid to your beneficiaries free of federal income tax.

Long-Term Care (“LTC”)Benefit Payments

Policies that are structured to provide qualified long-term care insurance may provide benefits that are income tax-free, up to certain limits under the tax law.3 Exceptions may apply that could cause long-term care benefits to be taxable.

Cash Value

Because it is a permanent life insurance policy, a hybrid policy typically provides cash value. The cash value generally grows tax-deferred. If you surrender the policy or access cash value through a policy loan, those distributions may be taxable and could reduce or eliminate coverage, including the policy’s long-term care benefits.

Traditional Long-Term Care Insurance

Another type of long-term care coverage is traditional long-term care insurance. With these policies, you typically pay an annual premium for life in return for long-term care coverage, if you need it.

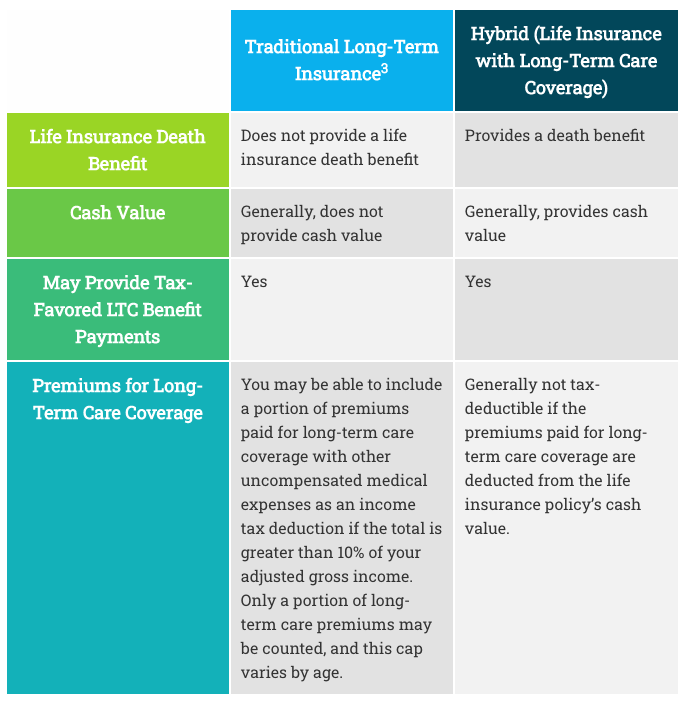

Below is a summary of some of the general differences between traditional long-term care insurance and hybrid life insurance with long-term care policies. Your financial advisor can provide a complete comparison and help you determine which type of policy may best meet your needs

When it comes to long-term care insurance in general, there are differences you should keep in mind, although how they’re taxed is just one of many factors to consider when choosing a policy, said Larry B. Harris,4 a certified public accountant and certified financial planner.

“There is no right or wrong answer,” Harris said. “This is a decision that should involve your financial advisors and an elder-care attorney.”

Talk to your financial advisor about options for long-term care coverage and tax implications to determine which solution best suits your needs.