Written by: Kirt Walker | Nationwide Financial

Not long ago, my parents took the next step in their retirement journey and moved into an assisted living residence. This decision was not an easy one, and, like many going through this transition, my parents and family have experienced the highs and lows that come with it.

I’m grateful my parents took steps to ensure they would be prepared for this move. Their small-town background instilled a sense of self-reliance that they have carried throughout their lives. They always knew how important it was to think about the future, and thanks to their planning — and the foresight to buy long-term care insurance, an annuity and life insurance — this tough process was a little easier. I couldn’t help but imagine how much harder retirement could have been had they not made these preparations in advance.

Regrettably, most Americans feel unprepared for retirement. According to the 2019 Nationwide Retirement Institute’s Long-Term Care Costs in Retirement Survey, only 25% of older adults currently have long-term care insurance for themselves or someone else. In addition, only 41% of older adults are confident in their plan to pay for long-term care expenses.1

Tips to help clients prepare for elder care

As advisors, you’re in a unique position. While most older consumers with a financial advisor trust their advisor to prepare them for retirement 2, only 34 percent of advisors tell us they’re “very confident” in having long-term care (LTC) and elder care planning conversations with their clients.3 One reason for this may be that most advisors spend their career learning how to give sound financial advice — but anyone who has helped someone live in retirement knows there is more to it than that.

Elder care planning is one of the hardest conversations a family can have, and families often avoid discussing related issues due to the uncomfortable nature of the topic. Advisors have a huge opportunity to add value at these moments with tips and pointers that go beyond money management.

Today, I’ll share some tips for an important first step that will make the process easier for everyone involved: gathering the right information. In my next post, I’ll share some pointers to help families “have the talk” about how they will align around a plan.

What information do I gather?

One thing that helped my family was working with my parents to gather everything we would need when the time came to transition their care. This included making sure legal documents were up-to-date, and anything related to identification, health, banking and finances was in the possession of those acting as their advocates. We even created a laminated card with all my parents’ passwords for online accounts. Remind your clients it’s a good idea to store anything with sensitive information in a properly secured safe or lock box.

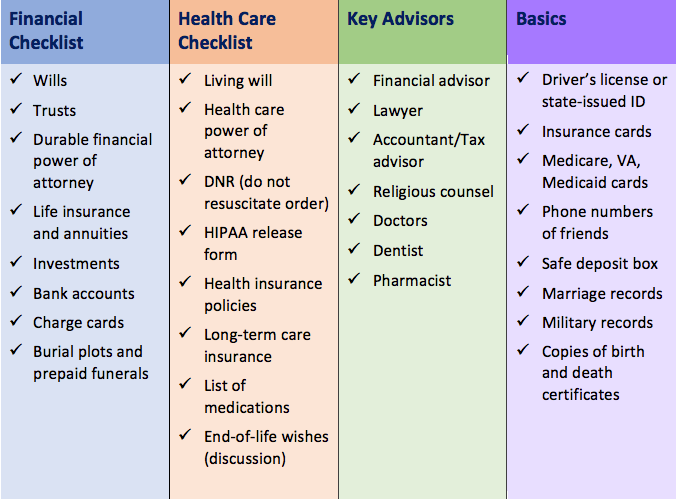

Whether your clients are nearing retirement, living in it, or supporting older loved ones, they should start by gathering information. Here’s a helpful checklist that outlines some of the information your client should have up-to-date, organized and available for designated family members.

The Checklist: Gathering the right stuff

When it comes to planning for elder care, there’s a lot to think about — which is why it’s important to have these discussions with clients sooner rather than later.

Even if your client has a plan, this checklist can assist them in making sure they haven’t forgotten anything. Better to know what’s missing now, and what can be addressed before it’s too late.

In my next article, I’ll provide tips you can share with clients for an important next step in the elder care planning process: having the talk.