Written by: Monica Kingsley

After Tuesday's bullish reversal, S&P 500 intraday consolidation came. How to read the doji just in? In today's analysis, I'll lay out the case for why I consider it to be healthy base-building – a springboard for stocks to take on the early June highs.

S&P 500 in the Short-Run

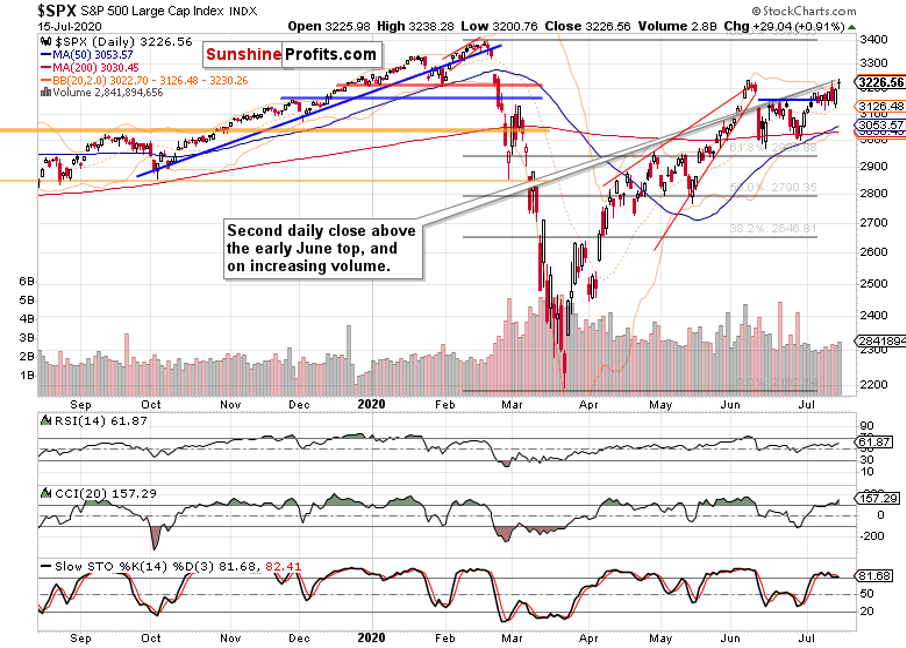

I’ll start with the daily chart perspective (charts courtesy of http://stockcharts.com):

S&P 500 opened with a bullish gap, and defended it to the close. The volume has picked up again, and the pressure to go higher is building under the surface in my opinion. I says so because should the bears be willing to sell heavily in the 3220-3230 zone (potential double top area), they would have done so – the fact they haven't been willing to push prices materially lower, is telling by itself.

Yes, the volume behind the upswing off the late June lows hasn't been outstanding, but only prices falling sharply and preferably also on rising volume, would make it a double top. Prices merely approaching previous local top don't make it so, and could trick the bulls into taking profits off the table prematurely. The battle to overcome them might not turn out to be all that fierce in the end.

Yes, we have short-term indecision in the S&P 500, and the early June highs are keeping the gains in check so far. But which way are the scales really leaning?

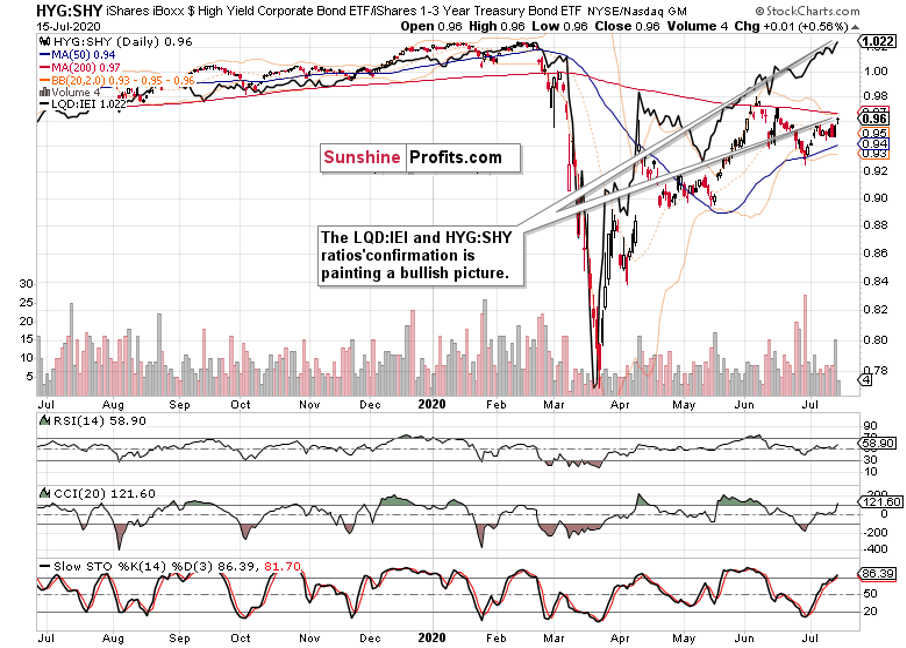

The Credit Markets’ Point of View

High yield corporate bonds (HYG ETF) also gapped higher yesterday. Sticking to their opening gains, they've left the trading range of recent sessions. While the volume hasn't been outstanding, it still hints that the path of least resistance is higher.

Both the high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) are moving in unison. The dynamic is conducive for further stock market gains as the early-May example of LQD:IEI leading HYG:SHY higher shows.

Looking under the hood of the S&P 500 thus reveals that stocks aren't getting vulnerable and extended in any dramatic way. Their upswing continuation is amply supported by the credit markets.

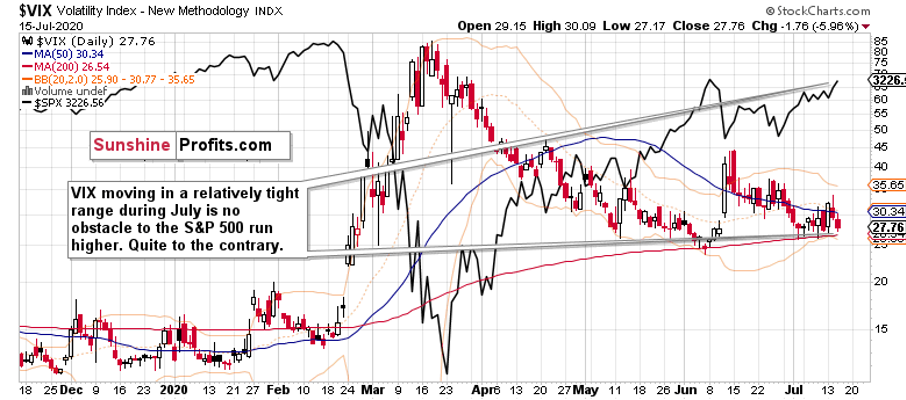

Volatility, Smallcaps and Sectoral Analysis Weigh In

The $VIX has been confined to a relatively tight range throughout July, yet stocks kept their upside momentum. And I expect the upcoming volatility readings not to throw a spanner into the stocks' works.

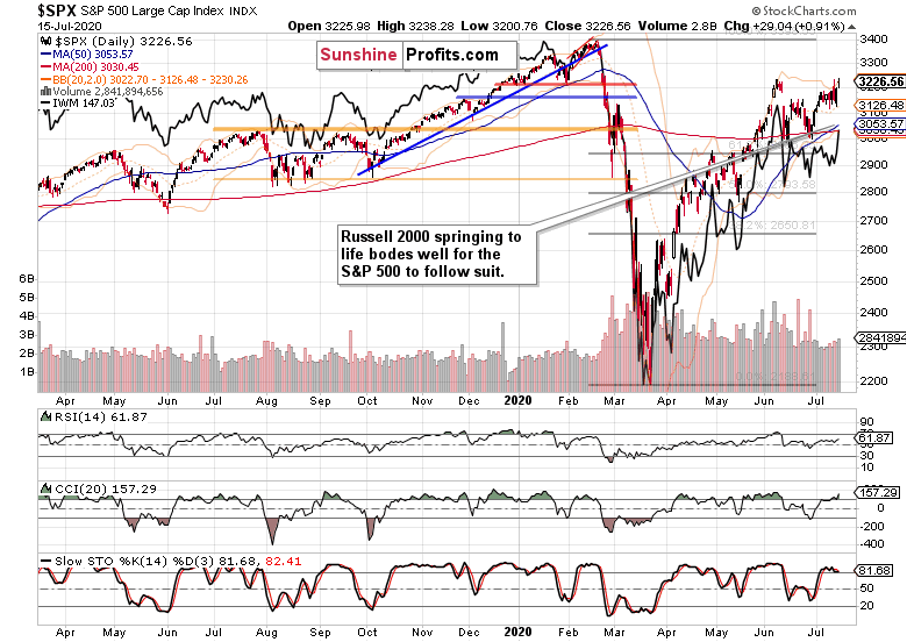

Yesterday's move in the Russell 2000 (IWM ETF) is a groundbreaking development. After weeks of lagging behind within the lower bounds of the smallcaps' relative performance, the IWM ETF finally sprang higher.

The IWM chart shows the strength behind yesterday's move precisely. Sizable opening gap, extension of gains throughout the session, and finishing near the intraday highs. Coupled with strongly rising volume, that's a bullish combination – especially that this is another attempt to overcome the 200-day moving average.

The tech (XLK ETF) bulls are ready to buy every dip, aren't they? While its heavyweight stocks are bidding their time, the semiconductors (XSD ETF) keep their relative strength, and have actually closed at new 2020 highs. Once the Amazons and Microsofts of this world decide that their consolidation is over and join in, the S&P 500 stock bulls would get a mighty ally.

So far, healthcare (XLV ETF) is doing the heavy lifting, joined by financials (XLF ETF). Yes, cyclicals are firing higher as the materials (XLB ETF) or consumer discretionaries (XLY ETF) show. Both energy (XLE ETF) and industrials (XLI ETF) ticked higher yesterday, too.

Summary

Summing up, given that tech keeps largely dragging its feet in the short run, the S&P 500 rendezvous with the early June highs just underscores the cyclicals taking the baton. Talking other short-term signs of life, the Russell 2000 has unequivocally spoken yesterday. Credit market signals, emerging markets outperformance and very long-term Treasuries pausing also raise the odds for the stock upswing to continue once tech is done with its consolidation. And chances are it would soon be, because semiconductors are quietly making new highs.

Forget U.S. – China tensions, the Fed's rare weeks of cautious tightening, or new lockdown fears. Banking Q2 earnings have been largely met with market applause, and there seems to be a never ending stream of positive vaccine news that boosts the bullish spirits. The yesterday-mentioned strong stomach to withstand sudden downturns in market perceptions of risk, might not be called upon all that often, after all.

Related; S&P 500 Equity Risk Premium History