Written by: Robert Serenbetz | New York Life Investments

There are reasons to be cautious – although not negative – on technology companies in the near term.

Over the course of the past year, market performance was limited to a narrow range of companies. The limited breadth reflected investor concerns about the pandemic and the likelihood of an economic recovery. The winning stocks were those that captured the accelerated shift toward digital shopping, meetings, advertising, online entertainment, and education.

In fact, an investment across the five largest stocks in the S&P 500 index returned almost 65% in 2020. Together, their performance accounted for nearly half of the return of the market-cap weighted index. These top five companies grew their earnings a combined 4.2% in 2020 versus overall profits for the index, which declined nearly 20%. Such concentrated performance is unlikely to be sustained in 2021.

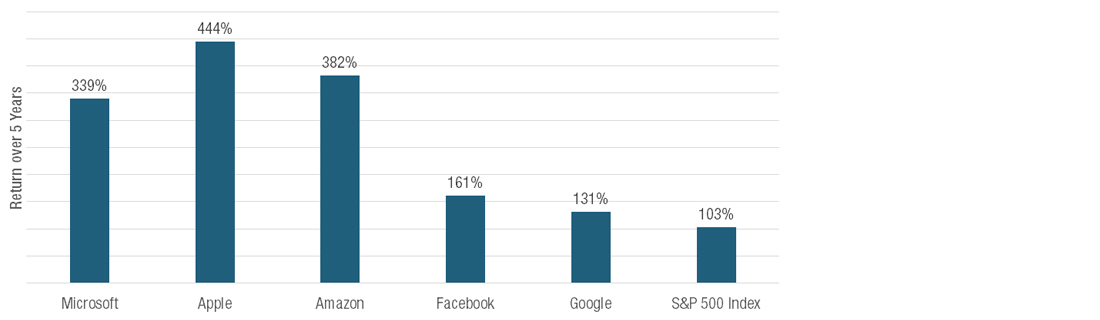

However, while the trend toward large, tech-oriented companies was accelerated by the pandemic, it is nothing new. The tech sector has outperformed the broader market in three of the last five years. During that time, owning the five biggest stocks – predominantly tech-oriented – would have also been a great strategy (Figure 1). Persistently low inflation, low yields, and slow economic growth have forced investors—both in the U.S. and globally—to chase fewer and fewer growth stocks. The result has been a durable outperformance of growth, particularly in big name tech stocks, who could acquire their growth.

An investment in the five biggest companies outperformed the S&P over the last five years

Sources: New York Life Investments Multi-Asset Solutions, Bloomberg LP, 12/31/2020. Past performance is no guarantee of future results. An investment cannot be made in an index.

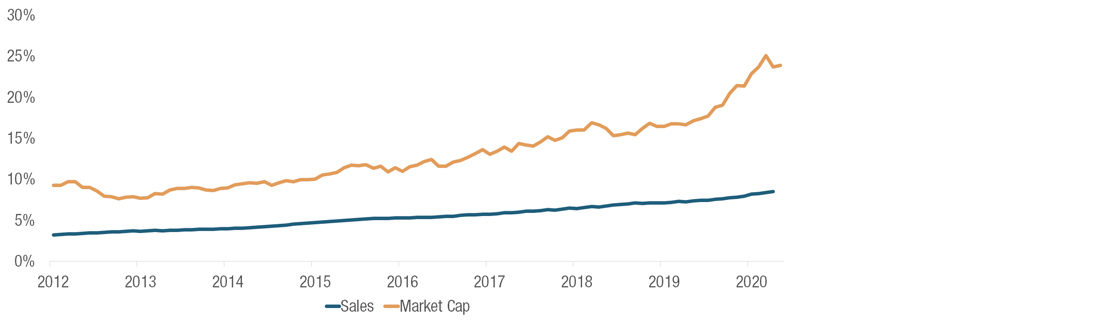

Such remarkable returns moved in lockstep with revenues. That is, until the pandemic, when the share price moved significantly higher than revenues grew proportionate to the market share (Figure 2).

A thoughtful, forward-looking investor must question if these companies will continue to capture market share and grow their revenues at their above trend pace. We expect that investors may find better sales growth among the bottom 495 companies (read more in our 2021 Market and Economic Outlook).

Mega caps' valuations have increased beyond what sales share justifies

Sales of Amazon, Microsoft, Apple, Google, and Facebook compared to the S&P 500 Index

Sources: New York Life Investments Multi-Asset Solutions, Bloomberg LP, 11/15/20. Past performance is no guarantee of future results. An investment cannot be made in an index.

We are wary of U.S. mega cap stocks over the course of 2021

There are reasons to be cautious – although not negative – on technology companies in the near term. We believe technology and innovation will be a leading source of portfolio growth in 2021.

As economic expectations improve, market breadth tends to improve as well. Investors are more confident in a broader range of business activities and services. This trend was already underway by the second half of 2020, and could impact tech’s ability to outperform in 2021. Three reasons that non-tech sectors might take the spotlight this year include:

- An Improving Economy. Since the start of the third quarter, when breadth began to improve, Amazon and Facebook have underperformed the S&P 500 by 15%. As pandemic positioning unwinds and consumers are able to access more in-person retail, these companies’ margin growth could moderate. Other sectors’ performance is also likely to improve as mobility does, chipping away at mega caps’ lead

- Rising Real Rates. Tightening financial conditions would disproportionately impact these long-duration equities. It is no secret that equities in general are sensitive to changes in real yields. When the system is flush with liquidity that refuses to enter the real economy, it seeks financial assets that are complementary to low-yielding fixed-income instruments and bond-like equities. The relationship is fairly linear; real yields go up while expensive growth and tech stocks go down.

- Internet Regulation and Taxes. The Biden administration is likely to be focused on consumer protection and data security, which would also fall heavily on big-tech shoulders. Narrow Democratic control of the executive and legislative branch raises the possibility that internet regulation gathers more steam, but will make it difficult to garner support for sweeping regulation or a breakup of big tech. That means we should expect changes on important rules, or removal of certain tax breaks as President Biden will look for grounds for bipartisan support. We believe there is plenty across the aisle when it comes to higher corporate taxes or internet regulation. Ultimately these changes could weigh on earnings growth expectations – something that is not discounted across big tech at present.

Tech is still important, but there may be better opportunities this year

As the global recovery continues we expect (1) slightly higher interest rates to pose at least a headwind to very lofty valuations in tech and growth, and (2) sectors most burdened by the pandemic to begin to recover. Given these headwinds, we expect little multiple expansion during the year – any gains will be driven by improvements in earnings.

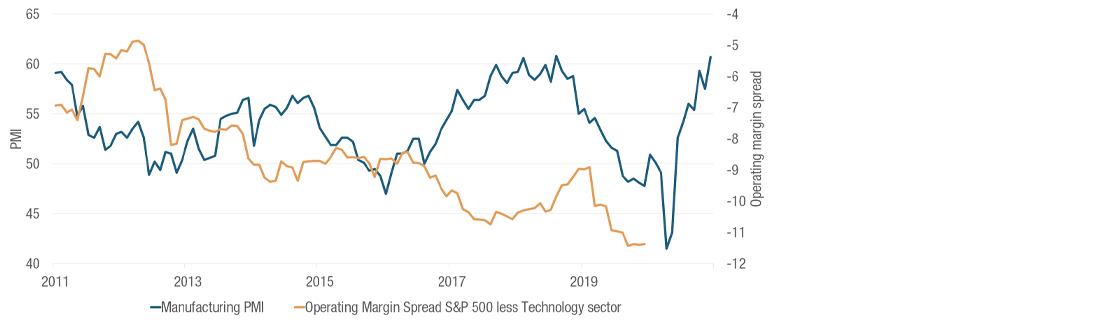

Technology companies are impressive in their ability to sustain wide profit margins. Operating margin covers just the variable costs – the percent a company earns out of total sales after paying its variable expenses like wages or materials is a good measure when looking for growth potential. It is important to note, however, that these margins are liable to change over time. As revenues grow in the rest of the Index, reflected by rising activity (in purchasing managers indices, visualized below), we expect operating margins in technology companies to also narrow—making technology relatively less attractive than the rest of the S&P 500 Index.

Operating margins are expected to improve outside of the tech sector

Sources: New York Life Investments Multi-Asset Solutions, Bloomberg LP, 11/15/20. Purchasing Manager Index (PMI) is an index of the prevailing direction of economic trends in the manufacturing and service sectors.

An opportunity for active management

Just as the unfolding economic recovery favors small, value, and cyclical companies, we believe that the investment cycle will favor active management. Market gains in 2020 were mainly driven by multiple expansion as investors paid higher prices for future cash flows. In 2021, multiples are unlikely to move significantly higher. Instead, we believe that relative differentials in sales and profit growth will become the dominant market driver.

Most active equity managers invest based on an assessment of management teams, the prospect of a business model, and the relative valuations between those respective options. Of course, technology remains an important driver of those characteristic and profit margins – importantly outside of the tech sector itself. Good managers can assess whether non-tech companies are leveraging technological improvements to advance efficiency and thus profitability.

Finally, active managers also employ good portfolio construction technique and risk controls that can build resiliency to large market rotations in sectors, themes, and investment styles. A passive investment approach that seeks to match, not beat, the market, can be well diversified, but can also sometimes lead to unintended risks. For example, investing in a fund that tracks the S&P 500 Index means that you are investing more than 25% of your capital in the top five largest companies. All investing involves risk, including the loss of principal, however, the average S&P 500 company – not the largest – is likely to regain market leadership in 2021.

Related: Shifting Factors as the Cycle Turns