In a surprise twist, the Nasdaq surged by a healthy 4.2%, managing to close the week at an all-time high. What’s happening to tech stocks?

Surging, gaining...come again?

Wasn't tech supposed to wither away and die thanks to be big bad Democrat boogeymen? Wasn’t the radical Biden tax agenda and regulatory framework supposed to send your favorite tech stocks plummeting? Wasn’t Biden’s tax plan supposed to take an estimated 5-10% off the earnings per share?

For now, it seems like the market is putting more of its hopes into Biden's $1.9 trillion stimulus plan and ignoring his tax and regulation plans. As Treasury Secretary and former Fed Chair Janet Yellen claimed, Biden's primary focus is aiding American families (i.e., stimulus, low-interest rates) and, for now, not raising taxes.

But nothing is for sure with this stimulus. Republicans will resist it, and some moderate Democrats may do so as well. With Vice President Kamala Harris as the only tiebreaker for a Democrat majority in the Senate, Biden needs all the support he can get to pass this aggressive stimulus.

I maintain my view that the market is too complacent, and that we are about to enter a correction at some point in the short-term. It still reminds me of the Q4 2018 pullback ( read my story here ).

For one, valuations are absurd. Tech IPOs are a circus, the S&P 500 is at or near its most-expensive level in recent history on most measures, and the Russell 2000 has never traded this high above its 200-day moving average.

While stimulus could be useful for stocks in the short-term, it could almost certainly mean the return of inflation too by mid-year. The worst part about it? The Fed will likely let it run hot. With debt rising and consumer spending expected to increase as vaccines are rolled out to the masses, the Fed is undoubtedly more likely to let inflation rise than letting interest rates rise.

Others, however, believe that the market reflects optimism that the global economy will recover with the eventual lifting of COVID-related restrictions and more widely-available vaccines. John Studzinski , vice chairman of Pimco, believes that market valuations are strong and reflect expectations of this eventual reopening and economic recovery by the second half of the year.

All of this simply tells me that the market remains a pay-per-view fight between good news and bad news.

We may trade sideways this quarter- that would not shock me in the least. But I think we are long overdue for a correction since we haven’t seen one since last March.

Corrections are healthy for markets and more common than most realize. Only twice in the last 38 years have we had years WITHOUT a correction (1995 and 2017).

A correction could also be an excellent buying opportunity for what should be a great second half of the year.

Therefore, to sum it up:

While there is long-term optimism, there are short-term concerns. A short-term correction between now and Q1 2021 is possible. I don't think that a decline above ~20%, leading to a bear market will happen.

In a report released last Tuesday (Jan. 19), Goldman Sachs shared the same sentiments.

My goal for these updates is to educate you, give you ideas, and help you manage money like I did when I was pressing the buy and sell buttons for $600+ million in assets. I left that career to pursue one where I could help people who needed help, instead of the ultra-high net worth. Hopefully, you find my insights enlightening, and I welcome your thoughts and questions.

We have a critical week ahead with the Fed set to have its first monetary policy meeting of the year and big earnings announcements on the horizon. Best of luck, have an excellent trading week, and have fun! We'll check back in with you all mid-week.

Are We in a Tech Bubble or Not?

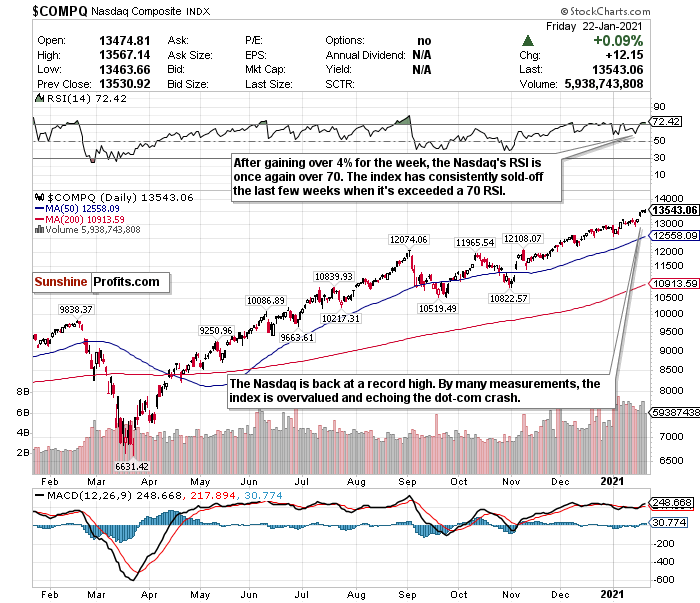

Figure 1- Nasdaq Composite Index $COMP

Some of the hottest performing tech stocks announce earnings this week such as Apple (AAPL), Amazon (AMZN), Microsoft (MSFT), Tesla (TSLA) (yes I consider Tesla more of a tech stock than a car stock), and more.

Pay very close attention.

Although I am bullish on specific tech sectors such as cloud computing, e-commerce, and fintech for 2021, I’m concerned about the mania consuming tech stocks.

Tech valuations, and especially the tech IPO market, terrify me. It reminds me a lot of the dot-com bubble 20-years ago. Remember, the dot-com bubble was a major crash in the Nasdaq after excessive speculation and IPOs sent any internet-related stock soaring. Between 1995-2000 the Nasdaq surged 400%. By October 2002, the Nasdaq declined by a whopping 78%.

I have no other words to describe it besides the Nasdaq right now as a circus. Will the bubble pop now? That remains to be seen. But the similarities between now and 2000 are striking.

I am sticking with the theme of using the RSI to judge how to call the Nasdaq. An overbought RSI does not automatically mean a trend reversal, but with the Nasdaq, this appears to have been a consistent pattern over the last few weeks.

The Nasdaq pulled back on December 9 after exceeding an RSI of 70 and briefly pulled back again after passing 70 again around Christmas time. We also exceeded a 70 RSI just before the new year, and what happened on the first trading day of 2021? A decline of 1.47%.

The last time I changed my Nasdaq call from a HOLD to a SELL on January 11 after the RSI exceeded 70, the Nasdaq declined again by 1.45%.

The Nasdaq has an RSI of around 72 again, and I’m switching the call back to SELL. The Nasdaq is trading in a precise pattern and I am basing my calls on that pattern.

I still love tech and am bullish for 2021. But I need to see the Nasdaq have a legitimate cooldown period and move closer to its 50-day moving average before considering it a BUY.

For an ETF that attempts to directly correlate with the performance of the NASDAQ, the Invesco QQQ ETF (QQQ) is a good option.

Thank you for reading today’s free analysis. I encourage you to sign up for our daily newsletter - it's absolutely free and if you don't like it, you can unsubscribe with just 2 clicks. If you sign up today, you'll also get 7 days of free access to the premium daily Stock Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!

Related: Will Consumers Loosen up Their Spending During the Recovery?