Advisors game planning for 2022 have a lot to consider and that's true across all asset class. In the essence of easing some of that burden when it comes to equities, profitability should be a point of emphasis.

That's a concept that's getting more attention in recent months and it's one that's a value-add opportunity for advisors because many clients instinctively think profitability is always fashionable and it's never advisable to own junkier companies. Advisors know better. While it's hard to “go wrong” with profitable companies, there are times when non-profitable stocks outperform.

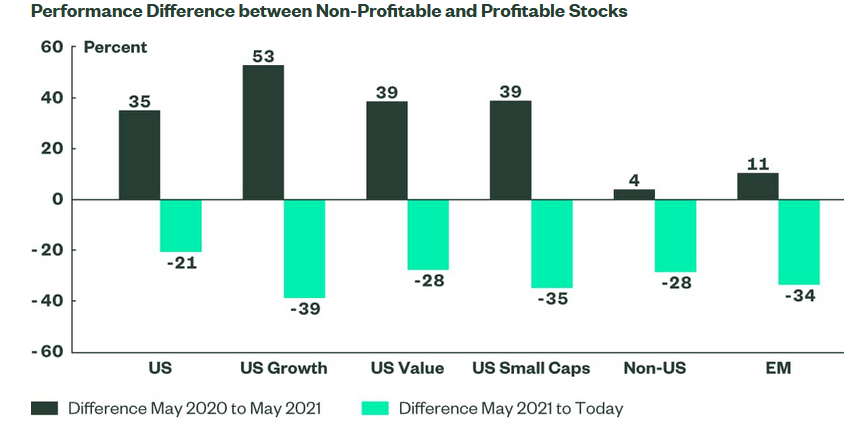

It happened during the cyclical value rally that started in late 2020 and seeped well into the second quarter of this year. What can really confound clients is that out-performance of non-profitable companies can and does occur multiple market capitalization segments and regions, as detailed by the chart below.

Courtesy: State Street Global Advisors

Considering Profitability as a Factor

Profitability isn't an investment factor per se, but it is a key tenant of quality – a factor that's coming into style again. With economic growth likely to slow in 2022, profitability and quality take on add importance in client portfolios. After all, an investor wants to be on the side of earnings growth and dependable profitability against the backdrop of potentially sluggish economic growth.

There are other reasons why the broader economic environment is turning in favor of profitability and these are factors advisors are already taking into account.

“Rates began to rise, and given that some of these unprofitable firms have lofty growth expectations, a higher discount rate weighed on valuations,” says Matthew Bartolini, head of SPDR Americas research. “Liquidity-fueled exuberance waned after the initial bump, and fundamentals were once again in focus. The price reaction ran ahead of fundamentals, as earnings sentiment has soured over the past few months – in particular starting in June/July.”

Advisors looking to implement tactical approaches to deploying more profitability within client portfolios can easily do so with sector funds. That's a potentially commendable approach because when it comes to profitability, some sectors have the goods and others are less-than-desirable.

Based on metrics such as Return-on-assets, Return-on-equity, Return-on-capital, and EBITDA Margin, energy and materials – though they've been solid performers this year – don't score well. Conversely, some familiar, popular sectors score favorably on those metrics.

“On the flip side, within the S&P 500, Health Care and Tech have the most names within the top decile of these combined profitability rankings, at eight and 18, respectively,” adds Bartolini. “They also have most on a net-basis, after considering the number of firms from those sectors in the bottom decile of quality —a slight indication that those two sectors may be of higher quality than others.”

2022 Doesn't Have to Be Tricky

No one has a crystal ball and it's entirely possible that 2022 will throw some wild cards at investors. In fact, that might be the one certainty we can bank on.

However, advisors can allay some clients' concerns and keep them out of harm's way by emphasizing profitability and focusing on fundamentals.

“The outlook for risk assets remains constructive given supportive, albeit slowing, growth and still easy monetary policies, even as tightening begins. Yet, with growth transitioning to a simmer from a boil, there has been a greater emphasis on firms with higher quality balance sheets and reliable profitability,” concludes Bartolini. “I’d expect this to continue into 2022, and investors may want to consider adding a quality overlay to portfolios —either by focusing on quality with factor exposures or by overweighting market sectors like Tech and Health Care.”