If you are not separating tech from everything else, you should.

This is looking less like a tech-led market and more like a tech-only meltup. Late summer is often a time for low stock market volatility, low trading volume, and low market visibility.

As always, I try to share with you what I think are significant observations from my ongoing investment research. 2020 has reminded us that any investment offers potential return. What is different in each situation is how much risk of major loss is attached to each of those return possibilities.

My late-summer chart work is getting “louder” in one respect: the tech sector is showing signs that it doesn’t care that the rest of the stock market may be stalling out after a monster “bounce” off the March disaster lows. No, tech doesn’t care. That sector has the makings of a meltup.

What is a “meltup?”

I would characterize a meltup as follows:

- Big rally has just occurred

- Many investors cannot fathom why the rally went this far

- Investing has quickly gone from a discipline to a sport (or casino game, pick your analogy)

- Hoards of new investors are piling in. After all, this is easy, isn’t it?

- The “market” goes up, even though many sub-sections of it don’t. This usually has something to do with the S&P 500, the most popular estimate of “the stock market,” reaching the point where a small number of companies dominate the weighting of the index. This is like the stock market’s version of wealth inequality.

The year 2000: now THAT was a meltup!

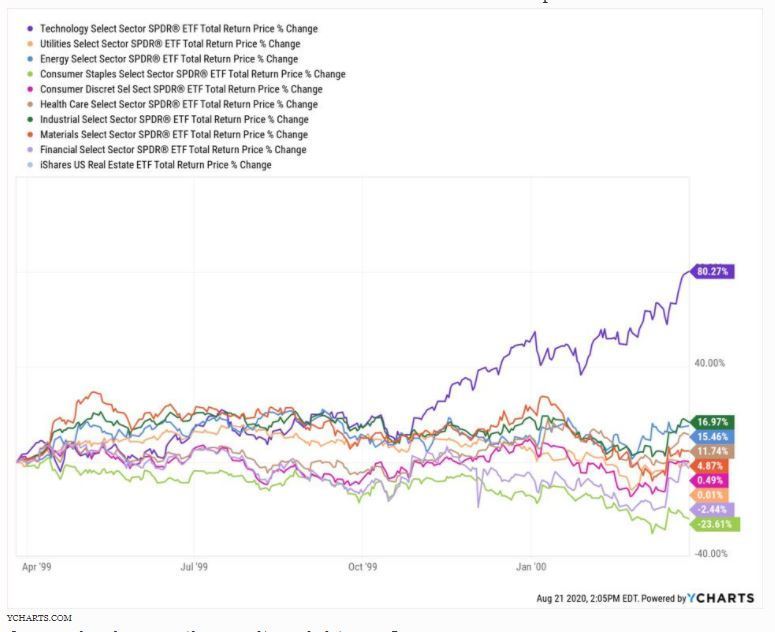

This chart shows what happened from late March 1999 through late March 2000. That 1-year period started as a very even-handed rally. You can see that Tech was one of many S&P 500 sectors charging higher. But like a race where one contestant breaks out of the pack to win easily, Tech left the rest in the dust. By the end of that 1-year period, the “Market” was up around 19%. But no sector other than Tech was up as much as the market was. In fact, half of the other sectors shown here were flat or down. That’s a Tech meltup.

Are we having another meltup right now?

Meltups are the kind of events that are easier to judge in retrospect. After all, you could argue that the February, 2020, market highs were the end of a meltup. The S&P 500 then fell 33% in 5 weeks. And then, it came back as if nothing bad had ever happened.

Next steps

S&P 500 Index investors, and equity market participants in general, have been given a “reset.” What each one does with that gift is up to them. As I see it, there are a few things you can do to navigate through the rest of this year and keep your priorities straight.

- Acknowledge that the seeds of a tech-centric meltup have been sown. Will it grow into a year-2000 style crescendo, with the Nasdaq and S&P 500 Tech sector leaving the rest in the dust? If so, as in 2000, will investors not realize it and think “the market” is great, when in reality the market “leadership” is all that is appreciating?

- Look to adjust your portfolio this potential reality. That may be no more than determining how much of your stock market allocation is in Tech versus everything else.

- Realize that in 2020, ANYTHING can happen. A balanced approach to pursuit of return, and risk of major loss is the best plan. Tailoring that plan to your particular situation is your call.

- For those who embrace a more tactical approach within their overall portfolio, a meltup can be a time to capitalize. While everyone is looking at the “market,” if you focus on what is happening beneath the hood, so to speak, you might just find ways to participate in the meltup, but stay well within your acceptable range of risk.

My chart work leads me to this “handicapping” of the current market conditions. That has always been my north star. So, the Nasdaq NDAQ -0.1%/Tech sector obsession probably has more life to it.

However, the similarities to the year 2000 should promote extreme caution. Risk is not low, even if the potential for temporary large reward (”meltup”) could continue to be higher than usual.

Since this article was about the meltup, I only showed you the good part of the year 2000. The next 3 years from there saw the painful unwinding of the Dot-Com Bubble, the Tech meltup, and the confidence of millions of investors. Don’t allow yourself to be a part of that, next time around.