Target-date funds (TDFs) typically reduce downside risk by lowering exposure to equities under normal conditions. But recent turbulence has demonstrated that a selective use of defensive equities can help reduce volatility through especially challenging market conditions.

For most TDFs, glide paths routinely shift allocations from equities to bonds to preserve assets near retirement. However, market uncertainty from the coronavirus crisis has been far from routine. Just reducing equity levels still exposes investors to short-term losses beyond what they can stand—and for many at a critical point in their time horizon.

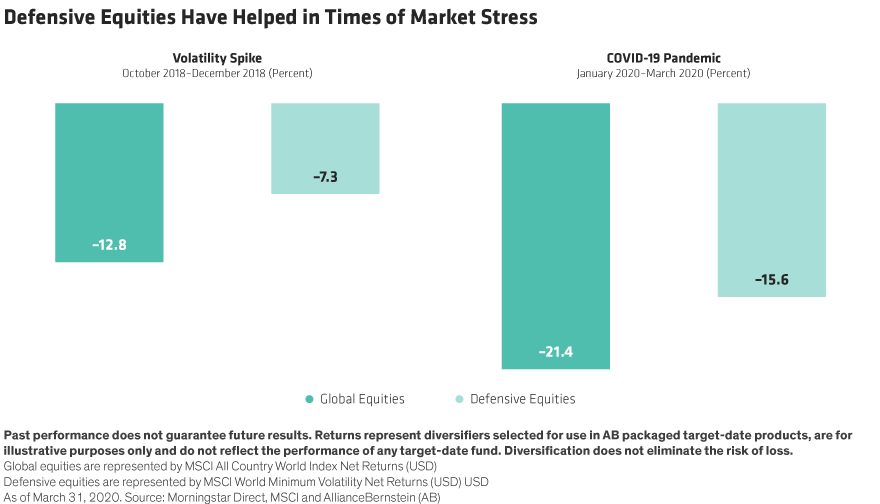

On the other hand, TDFs that selectively use defensive equities—companies with stable earnings and higher-quality cash flows in any environment—are better positioned to provide both return potential and protection from market turbulence. During the two most recent periods of volatility, for example, defensive equities offered substantial risk reduction relative to the broader market (Display).

A Glide Path Within a Glide Path to Manage Risk

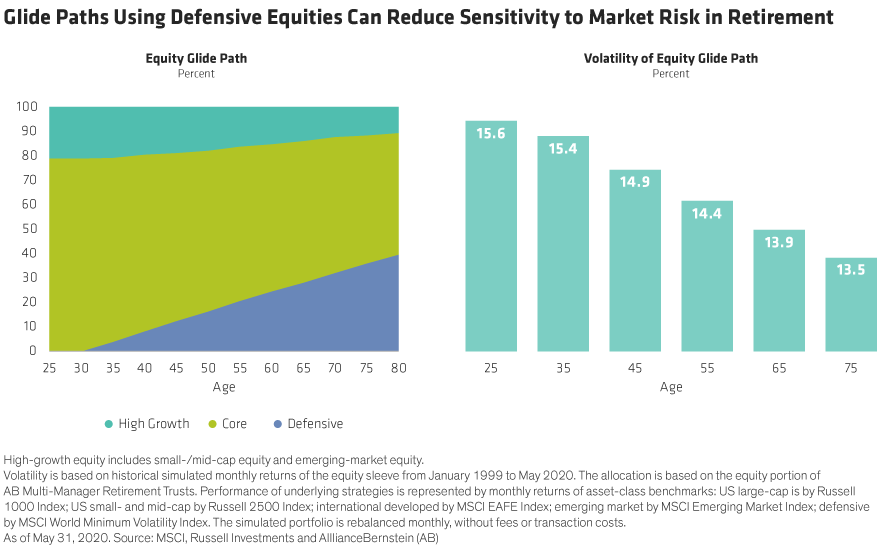

A target-date strategy’s current allocations are based on the time left on its built-in clock. Current holdings for a fund with a 2020 target date will look very different from one built for 2050. But all glide paths almost always start with a higher risk profile than when they finish, with gradual adjustments from aggressive to moderate to conservative along the way. That’s because most investors have a higher risk tolerance when they’re younger and don’t need the assets any time soon. Closer to retirement, investors can’t afford to take a big hit.

Adding more types of equities at this point might sound counterintuitive to some investors, since they’re generally perceived as a riskier asset class. But some high-quality equities can boost stability, often with less downside than the broader market.

Protecting Retirees at a Critical Juncture

The freedom to use a broader menu of diversifying asset classes brings a target-date strategy to a higher level of protection and growth potential anywhere on the glide path’s timeline. The true test, however, comes at retirement.

When a TDF’s glide path is nearing its end, defending against market uncertainty is especially urgent. At this moment, investors—approaching or at retirement—are most vulnerable because a hit to fund assets could negatively impact income for the rest of their lives.

Conversely, as people are living longer, many will need income to last 20 or more years after they leave their jobs. So the glide path must continue to deliver returns to reduce longevity risk—the risk of running out of money in a longer retirement period. That means the equity asset mix should balance growth potential with a sharp focus on buffering asset values from sudden downturns, extending its volatility protection well into the retirement years (Display).

Striking a Balance Between Growth and Risk Control

A truly effective target-date strategy should provide both protection and some growth potential for a lifetime, which is especially critical in today’s low-interest-rate world. More than ever, retirees want equity components to help maximize return, but without the higher added risk of traditional stocks. Here too, the lower risk characteristics of defensive equities, coupled with other diversifiers, can help reduce volatility yet maintain the upside potential investors need.

After a decade of steady, upward market-based growth, millions of retirement plan balances took major blows during the coronavirus panic. Including defensive equities in a TDF would have helped reduce the pain during the downturn, while making it easier to recoup losses in the subsequent recovery.

While all retirement strategies come with risk, some are better equipped to deal with it more effectively. We believe target-date strategies whose glide paths can actively draw from a wider selection of defensive equities are in an ideal position to respond to investors’ changing needs and to better protect their investment from market turmoil.