“Unusual” is an accurate descriptor for the economic and financial market landscapes advisors are dealing with dating back to the onset of the coronavirus pandemic in the U.S.

The bear market in stocks that arrived in March 2020 was unusually brief by historical standards. On average, U.S. markets last 18 months. The Covid-induced bear market last a few months. Likewise, the recession resulting from the pandemic and subsequent state shutdowns was unusually brief.

Here we are today in the midst of an economic boom that's unusual in its intensity and veracity and one that's living up to historical billing in at least one regard: The recovery phase is proving particularly portent for cyclical value stocks.

With the S&P 500 Value Index up more than 12.47% year-to-date, it's reasonable some clients are pondering how much more gas value has left in the tank and whether or not they're late to the value party. Advisors should encourage clients to eschew factor fiddling, but a big part of an advisor's value comes from seeing things before clients. In this case, that means mulling portfolio positioning for the next leg in the economic cycle.

Getting Near Time for the Quality Call

As noted above, factor meddling/timing is a fool's errand and more trouble than it's worth. However, there's something to keep in mind. As the economy starts moving from recovery to expansion, there's a middle ground known as mid-cycle and in that realm, there are investment strategies that historically perform well. Moreover, those concepts have carryover value to the expansion.

Think quality – an investment strategy that's durable over the long-term and one advisors are likely already allocating to in some fashion, particularly if they are positioning clients in technology stocks or funds.

In fact, remembering quality is one of the major lessons from the coronavirus bear market because that swoon laid bare the vulnerabilities of companies with big debt burdens and weak balance sheets. Simply put, those type of companies are weak links when stocks decline. That also speaks to the long-term viability of investing for quality, but the idea has plenty of near-term relevance, too.

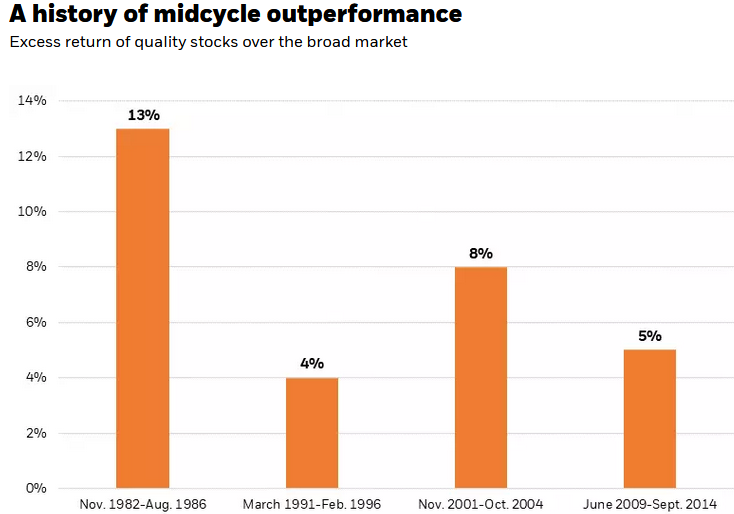

“Financial markets are anticipatory, and we increasingly believe many of the easy early-cycle investment opportunities have been acknowledged and exploited. Stocks selling at the deepest discount, the highly levered names, have outperformed the most since November. It may be time to pivot toward midcycle beneficiaries ― and chief among them are quality stocks,” according to BlackRock. “Our analysis of market cycles and stock performance by quality quintiles found that high quality has significantly outperformed in midcycle periods.”

Courtesy: BlackRock

Quality Considerations

Among the various investment factors, quality is the one with the most fluid definition, but its irrefutable hallmarks include strong return on assets, return on equity, tidy balance sheets and usually some commitment to shareholder rewards – either buybacks, dividends or both.

Owing to the fact that many technology and other growth names fit those bills, investors often have to pay up for quality, but at the moment, that's not the case.

“Our research shows quality stocks have underperformed since vaccine announcements in November, sending their valuations lower. Investors largely avoided or sold quality in favor of riskier bets that paid off in the early phases of the market upswing,” notes BlackRock. “This put higher-quality stocks at their largest discount to the broad market since the dot-com bubble of the early 2000s.”

Combine long-term endurance with compelling valuations, positioning for the next leg of the economic cycle and the ability to capitalize on a growth rebound and the time is right to make the quality call.

Advisorpedia Related Articles:

Smaller Financial Stocks Get Their Grooves Back

Just Roll With the Value Rally

Don't Lampoon the Idea of Summer Vacation with European Equities