Alright, I'm taking some liberties there by assuming someone likes the combination of chocolate and peanut butter, but according to Food Business News, Reese's generates over $2 billion in annual sales for Hershey (HSY), so I think I'm right.

Confectionary talk aside, the point is something that's compelling on its own doesn't always need to be alone, yet in the debate surrounding the growth and value factors, clients are often pre-conditioned to believe when one of those factors is out of favor, it should just be ignored.

For more than a decade, it was value that lagged. Recently, with the assistance of rising Treasury yields, growth took a back seat to value. Instinctively, a client may decide to join the “great rotation” and ditch growth for now, but this is where advisors can prove their mettle, articulating to clients the advantages of deploying growth and value at the same time in a single portfolio.

“Our research also reveals that growth and value are essentially anti-correlated: One generally thrives in an environment where the other lags, and vice versa,” according to BlackRock. “This means investors can build a more resilient, all-weather portfolio by incorporating the relative strengths of both growth and value – and can potentially enhance those results by working with astute managers that can consistently beat their growth/value benchmarks.”

Better Together

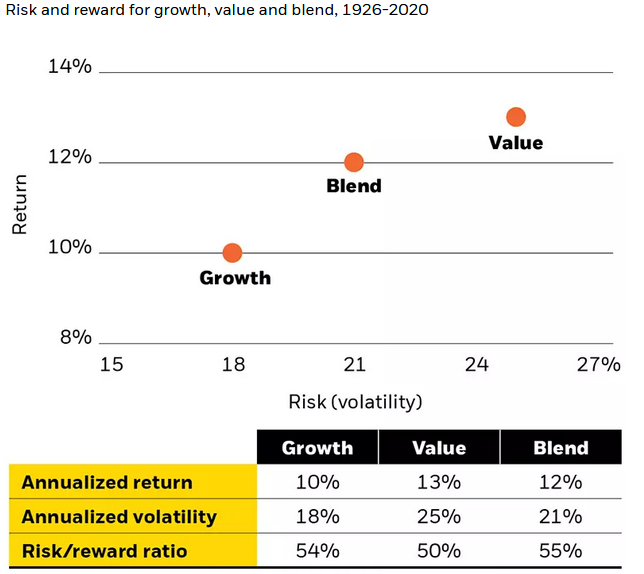

Year-to-date, as of April 5, the Russell 1000 Value Index is up 23.3%, beating its growth counterpart by a margin of more than 5-to-1. A performance gap as wide as that coupled with all the mainstream media attention currently being lavished upon value, it's reasonable that some clients will inquire about the efficacy of owning both growth and value. As the chart below indicates, advisors have plenty of fuel – all positive – to contribute to this conversation.

Courtesy: BlackRock

On its own, that chart is at least interesting, but digging deeper – and many advisors probably know this already – there's room for value to trend higher this year because money managers are under-allocated to the factor, owing to the aforementioned decade-plus of slack performance.

“The S&P 500 Index was 67% growth stocks as of mid-February 2021. Value is similarly underrepresented in investor portfolios. A BlackRock Portfolio Solutions (BPS) review of more than 18,000 advisor model portfolios at year-end 2020 showed 62% were underweight value,” according to the asset manager.

Why It Matters Today

The growth/value client conversation is increasingly relevant today for multiple reasons. Those include value's history of performing well coming out of recessions, that out-performance often being shorter in length than growth's runs and today's inflationary pressures.

Regarding the duration of growth and value topping each other, this time could be different simply because cyclical stocks were the most repudiated during the pandemic and 10-year yields have further to rise (good for financials), indicating the current value resurgence has some staying power.

However, many market observers concur there's little reason to abandon technology stocks, which account for a significant chunk of the growth universe. As the economy moves out of recovery into expansion and as rates normalize,

This year, the difference maker could be inflation. Rising prices aren't at “runaway” levels yet and may not be at any point in 2021, but they don't need to be to merit upping value exposure.

“Notably, it does not take runaway inflation for value to gain an edge,” adds BlackRock. “Value outpaced growth in the period of middling inflation, which ranges from 1.1% to 4.4%. This is more in keeping with our outlook this cycle versus the highest inflation periods that averaged 8.4%.”

Clearly, there are a lot of moving parts here and the reality is, it's hard to factor time. Really hard. So not abandoning growth or value and blending the two together could be the write prescription in 2021.

Advisorpedia Related Articles:

Correlation, Dispersion Say It's a Good Time to Embrace Sector Investing

Marvel at the Middle for Rising Rates Protection

Surprising Sector Destination to Lift Clients' Income Profiles

Emerging Markets Beckon, But Advisors Should Be Choosy