The world of finance is littered with acronyms and at an investable level, GARP, or growth at a reasonable price, is one seasoned advisors likely know well.

From the jump, GARP sounds enticing. Many clients know about and want to be allocated to growth stocks. In theory, GARP is the act of picking up quality growth names at attractive multiples, meaning there's an element of value investing here, too.

“GARP managers also look for companies that have been ignored or overlooked by market analysts and that are therefore still selling cheaply,” according to Morningstar. “Like value investors, GARP investors try to find companies that are only temporarily down and out and that have some sort of catalyst for growth in the works.”

While GARP is an investing acronym – one bandied about in business schools, investing conferences and in the mainstream financial press – it actually strikes to the heart of some rather raw, primitive human emotions, including desire and fear of missing out (FOMO). Makes sense. After all, many clients are captivated by a great growth story and they all love a good deal/perceived value,

GARP Quirks...There's a Lot

Put simply, the concept of GARP is enticing, but it can also be a crutch for some forecasters.

“The concept of GARP ('Growth At a Reasonable Price') is an all-time favorite of market strategists in their year-end outlooks: who does not like growth ? Who wants to buy stocks at 'unreasonable price'?,” writes StoneX's Vincent Deluard. “Who wants low-quality stocks?Touting GARP stocks does not offend the distribution teams who sell growth or value funds. Moreover, such vague, feel-good calls are a great insurance against career risk.”

Said another way, forecasters and strategists like leaning on GARP because it absolves them of making a more direct call, such as deciding between growth and value. This year, prognosticators leaning on GARP are getting lucky because the S&P 500 GARP Index is up 19.15%, beating both the comparable growth and value indexes. That performance is impressive, but it's not a guarantee of future returns and it belies some of the flaws associated with relying on GARP.

“Given the level of valuations in 2021, the notion of GARP is a chimera from an economic and accounting standpoint,” says Deluard. “However, GARP stocks still exist in the all-powerful eyes of index providers. 896 stocks with a combined market capitalization of $13 trillion are found in both the Russell 3,000 growth index and the Russell 3,000 value index. Google is the largest example of these ubiquitous stocks, even if older investors may struggle to understand how a stock trading at 7 times book value, 8 times revenues,and 29 times earnings can be classified as 'value.'”

Dare I Say GARP Isn't All It's Cracked Up to Be?

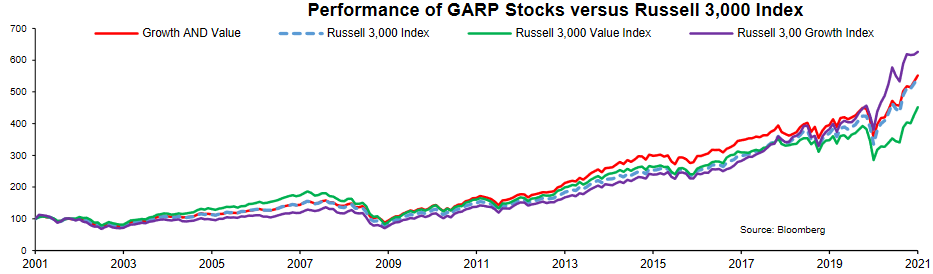

As advisors well know, factor timing is no less difficult than broader market timing. Value lagged for more than a decade until it started working late last year. Those shifts in leadership are hard to forecast. Likewise, as the chart below indicates, GARP enjoyed some good times, but it doesn't always outperform broader benchmarks.

Courtesy: StoneX

“A GARP approach worked well between 2011 and 2017 when investors piled into defensive sectors with predictable earnings, but it has underperformed growth massively in the past four years and has not delivered sustained alpha for two decades” says Deluard.

For advisors, the best prescription may just be forgo wooing clients with acronyms and if growth exposure is appropriate for some clients, quit trying to cherry pick it and just embrace growth over GARP.

Advisorpedia Related Articles:

Dividend Growth Matters More as Rates Rise

Put the Top Down to Convertibles Upside as Rates Rise

There's Value and There's Deep Value. The Latter Merits Looks, Too.

With Value in Style Again, Advisors Should Size Up Shareholder Yield