It has been close to four weeks since my last viral market update, and I could come up with a whole host of excuses for the delay, but the truth is that I have not had much to say that is original, and I am naturally lazy. That said, markets have settled in, mostly with an upward bias in these last few weeks, and the big question, as US equities climb back towards pre-crisis levels is whether the market has lost its bearings. After all, the news, whether on macroeconomic indicators or company-level earnings, is not just bad, but historically so, and it seems incongruous that markets should be rising, when consumer confidence and spending are plummeting, the ranks of the unemployed rising and professional economists are painting a picture of impending doom.

There are some market gurus who are pointing to this disconnect as evidence that markets are just wrong and that a major correction is around the corner, but their credibility is undercut by the fact that many in this group have been forecasting this correction for the last decade, and with metrics (PE, CAPE, Shiller PE) that have lost their potency. I have absolutely no shame in admitting that I am not a market timer, but I do believe that embedded in market action is always a link, though sometimes tenuous, to fundamentals. In this post, I will start with my usual updates of what has transpired in the last few weeks across markets, in general, and equities, in particular. I will then revisit my framework for valuing the S&P index, which I first presented in my first viral market post on February 27 and then expanded on in subsequent posts on March 9 and March 16. While I will update my valuation of the index, given what we have learned since, I will also follow a template that I developed when I valued Tesla earlier this year, and offer a Do-it-yourself (DIY) valuation of the index.

Market Update

My crisis clock started on February 14, 2020, shortly after US equities hit all time highs, and in the weeks since, I have tracked the ups and downs of equity indices.

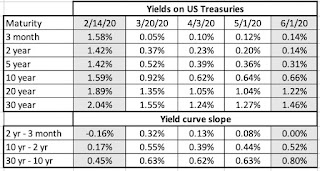

Between February 14 and March 20, it was a precipitous drop with almost equity index in the world down between 30-40%, with the Chinese markets being the exceptions, a bear market compressed into five weeks. Since March 20, though, it has been not just an up market, but one that has climbed steeply. For instance, the S&P 500 which dropped a little over 28% between February 14 and March 20, had recouped most of those losses by June 1, and is now down only 5.29% since February 14. Two emerging market indices, the Bovespa (Brazil) and the Sensex (India), and one developed market index, the CAC (France), have still lost more than 20% of their value over the period. Moving on to treasuries, the immediate effect of the crisis was a flight to US treasuries, where yields dropped across the board:

Note that almost all of the yield drop occurred before March 15, when the Fed announced its quantitative easing actions. The fear factor in the first few weeks that caused the flight to treasuries also pushed up default spreads on corporate bonds:

Note the dramatic surge in spreads between February 14 an April 3, with a tripling in the spread on BBB rated bonds. Like equities, corporate bonds seem to have entered a more sanguine period, with spreads on June 1, 2020, down significantly from their highs in early April. I have also been tracking two commodities, oil and copper, to measure how a global economic showdown is affecting prices:

Copper prices are down about 7% on June 1, from February 14 levels, but that is as improvement from the almost 14% drop in mid-March. The oil market has had volatility that cannot just be explained by the COVID crisis, as oil prices plunged in late April, with West Texas crude dropping below zero on April 19, but even oil prices have seen recovery in the last few weeks. Finally, I look at gold and bitcoin, the former a crisis asset of long standing and the latter a new entrant.

Gold has held up, and is up just over 9% in the weeks since February 14, but bitcoin has behaved more like a risky speculative investment than a crisis asset, dropping more than 50% by mid March before recouping most of its losses, as equities came back April and May.

Equity Breakdown

I have been downloading company-level data on publicly traded companies, at the end of each week for the last 15 weeks, and looking at changes in market capitalization across different classes of stocks. That allows me to see to not only get a more complete measure of market damage than just looking at indices, but to also use the data to double check assertions about causality.

Region

The problem with indices, especially those that contain only handfuls of stock, is that it is easy to miss changes that are occurring at smaller and lower profile companies. I used the company-level data to break down the market changes since February 14 by region:

As with the equity indices, the divide is clear, both in terms of time, with the drop occurring between February 14 and March 20 and the rise from March 20 to June 1, but also in terms of geography, with emerging markets showing bigger declines in percentage terms over the entire period. If you prefer your data on a country level, you may find this picture more revealing:

The full list of countries is available at this link. Note that all of the values in the data are in US dollar terms to allow for comparability, but that does mean that exchange rate effects will add to local stock market effects.

Sector/ Industry

While market behavior was characterized as chaotic in the first few weeks, this is clearly a market that has been orderly in how it doles out rewards and metes out punishment, as you can see in the breakdown of market cap changes by sector in the table below:

As you browse the table, note that health care, as a sector, is now in the plus column and that technology and consumer goods (both staple and discretionary) show much less damage than the rest of the market. In effect, the overall market may have recovered much of its losses, but along the way, value has been reallocated from financials, real estate and energy into health care and technology. Breaking down sectors into industries provides for more detail, and the ten best performing and ten worst performing industries between February 14 and June 1, 2020 are listed below:

The list of best and worst performing industries has stayed stable for most of the last seven to eight weeks, but the rise in the market in the last few weeks has led to some of the best performing industries now delivering positive returns, with software, precious metal, biotech and healthcare info/tech now posting returns exceeding 10%, since February 14, 2020.

The Mystery of Markets

As markets have recovered from their mid-March lows, there are many who are puzzled by the rise. For some, the skepticism comes from the disconnect with macroeconomic numbers that are abysmal, as unemployment claims climb into the tens of millions and consumer confidence hovers around historic lows. I will spend the first part of this section arguing that this reflects a fundamental misunderstanding of what markets try to do, and a misreading of history. For others, the question is whether markets are adequately reflecting the potential for long term damage to earnings and cash flows, as well as the cost of defaults, from this crisis. Since that answer to that question lies in the eyes of the beholder, I will provide a framework for converting your fears and hopes into numbers and a value for the market.

Markets and the Economy

The notion that stock markets and economies are closely tied together is deeply held, simply because it appeals to intuition. After all, how can stocks keep going up if the economy is doing badly? While I concede that the right answer is they cannot, there are three factors that may delink the two.

- The first is that stocks are driven by earnings, not real growth in the economy or employment, and to the extent that companies can continue to generate income, even in stagnant or declining economies, you may see stock prices rise.

- The second is that the “economy” that stocks are tied to does not always have to be the domestic one, since globalization has made it possible for companies to continue to prosper in slow-growing economies.

- The third is time, since stock markets are prediction machines, albeit with a lot of noise and error, the link between markets and the economy, even if it exists, will be with a lag of months or longer.

To those who prefer a data-based argument, the graph below plots US stock market returns against real GDP growth in the United States, using quarterly data.

|

| Download data |

Note that there is almost no correlation between stock returns and real GDP growth contemporaneously, and while the correlation grows as you look at GDP is subsequent quarters, it is still modest even four quarters ahead. If the relationship between stock returns and measures of economic activity is weak, as both logic and the data suggest, it should be even weaker right now, where every measure of economic activity is ravaged by the crisis-driven shutdown. To those in the media and the investment community who profess to be shocked by the latest economic numbers, my question is whether you are just as shocked to see your speedometer at zero, when your car is parked in the driveway, or when your pie does not bake in an oven that is not turned on? In short, there is almost nothing of use to investors from poring over current macroeconomic data, which is one reason why markets have started ignoring them. That will change, as the economy opens up again, and markets start looking at the data for cues on how quickly it is coming back to life.

Valuing the Market

In my first viral market update, I sketched a picture of the drivers of value for the market, drawing on fundamentals. I revisited that picture and tweaked it to reflect the uncertainties that investors face about the future, broke down into near term (2020 & 2021) and the long term (in the years through 2024):

While the picture looks daunting and your estimates are fraught with uncertainty, we are now in a better position to estimate the effects than even a few weeks ago:

Earnings and Growth: In 2019, the companies in the S&P 500 reported 163 in earnings, and analysts were forecasting modest growth of about 4% over the next five years, prior to the crisis. It is beyond debate that the economic shut down will be devastating for earnings in 2020, with the damage spilling over in 2021. In my valuation in March 2020, there was almost no information on the extent of this damage, but as companies have reported first quarter earnings, we are getting preliminary estimates of future earnings. In the picture below, I look at three sets of predictions from analysts who trace the index:

|

| Sources: Yardeni, Thomson Reuters, Factset |

I follow up by also reporting on what market strategists at major banks are forecasting:

As of right now, there seems to be only nascent attempts to forecast long term damage to earnings, but a consensus is forming that there will be some.

- Cash Return: In 2019, companies in the index returned 146.30 in cash to stockholders, 57.5 in dividends and 87.8 in buybacks, amounting to 89.75% of earnings in that year. This represented a continuation of a trend through the decade of increasing buybacks and cash return:

As with earnings, this crisis will result in cash flow shocks, and dividends and buybacks will drop this year. Given that dividends tend to be stickier than buybacks, the drop will be lower fro the former than the latter. Analysts vary on how much, though, with a range of a drop of 30-70% in buybacks and 10-30% in dividends.

- Risk: Every crisis has consequences for risk premiums, as I noted in this post, and it is for that reason that I have been updating equity risk premiums, by day, since February 14.

In the early weeks of this crisis, equity risk premiums soared, peaking at more than 7% in mid-March, and have steadily dropping since, though at 5.3-5.5% on June 1, they remain above pre-crisis levels.

Add caption

Using this information, I made my best judgments, assuming that earnings for the S&P 500 will be 120 in 2020 and 150 in 2021, at the more conservative end of the analyst estimates, and that dividends and buybacks would drop in 2020, the former by 20% and the latter by 50%. I also assume that companies will return far less cash in future years, partly in response to the crisis:

With these assumptions, I can value the index and I capture the valuation in the picture below. My estimated value for the index is about 2926, which would lead to a judgment that the index was over valued by about 6% (based upon the level on June 1, 2020).

As with my March 2020 valuation, I am fully aware that my numbers are just a reflection of my story and that each of the inputs has a range around it, and I have brought in that uncertainty into a simulation below:

|

| Download simulation results (Oracle Crystal Ball used in simulation) |

Note that I have centered the simulations around the median estimates of earnings for 2020 and 2021 from analysts, while building in the range in the estimates into the distributions. The median value from the simulation is 2932. On June 1, the S&P 500 was trading at close to 3100, putting it near the 80th percentile of the distribution, bolstering the "market has gotten ahead of itself" camp, but there is something here for everyone. If you are more optimistic about earnings in 2020 and 2021 than the the median analyst, and about how quickly and completely the market will recover from the crisis shock, you will arrive at a higher value than mine. If you are more pessimistic about the future, perhaps because you think the market is under estimating the likelihood of a second wave of shutdowns or a surge in company defaults, your valuations will be much lower.

In all of this discussion, you will note that I have not mentioned the Fed, and to those who are Fed-focused, it may seem like I am ignoring the elephant in the room. I have argued, for much of the last decade, that analysts and investors over estimate the effect that the Fed has on markets. To the counter that it is low interest rates that are keeping the index level high, my response is that low interest rates cut both ways, first by lowering the discount rate (and thus increasing value) but also by signaling much lower growth in the long term (which I capture by lowering growth in perpetuity to the risk free rate). In fact, in my valuation spreadsheet, I offer the option of raising interest rates to what you may believe are more normal levels over time, and you can check out the effect on value, and don't be surprised if it is not as large as you expect it to be, since I also adjust growth rates and equity risk premiums to reflect changed rates. In fact, use the spreadsheet to and make your disagreements with me explicit, come up with your value for the index, and let's get a crowd valuation of the S&P 500 going. (It is a google shared spreadsheet, where you can enter your estimated value for the index).

Bottom Line

Every investor has a narrative, sometimes explicit and sometimes implicit, about how the economy and markets will evolve over time. Markets reflect a collective narrative across investors, and there are times when your narrative will be at odds with that of the market. It is during those times that you will feel the urge to label markets as crazy or irrational, and to view yourself as the last sane investor left on the planet. While I understand that urge, it is my experience that projecting your personal fears and hopes on to the market, and then getting angry when the market responds differently is a recipe for frustration and dysfunctional investing. That is not to say that markets cannot be wrong, but even if they are, a dose of humility is always in order, and there is always something that can be learned from market movements. Right now, it is true that markets are collectively more upbeat about the future than most economists/market experts, but given their relative track records over time, are you really more willing to trust the latter? I most certainly am not!

Related: A Crisis Test: Value vs Growth, Active vs Passive, Small Cap vs Large!