The only time the bears appeared during yesterday's trading, was at the very U.S. open. A steady move higher followed, with the final hourly upswing erased 15 minutes before the closing bell. How concerning is this?

I don't think it's a setback worth much mentioning. Yesterday's ADP non-farm employment change hints at solid non-farm payrolls today. Credit markets are on the upturn, and stocks are undaunted by the rising U.S. Covid-19 cases. S&P 500 market breath is improving – but the Russell 2000 declined yesterday.

Still, I think that's no reason to be worried – and not only because of the low volume decline in smallcaps. The mid-May parallel of what happened after a period of credit markets' underperformance, is hiding in plain sight…

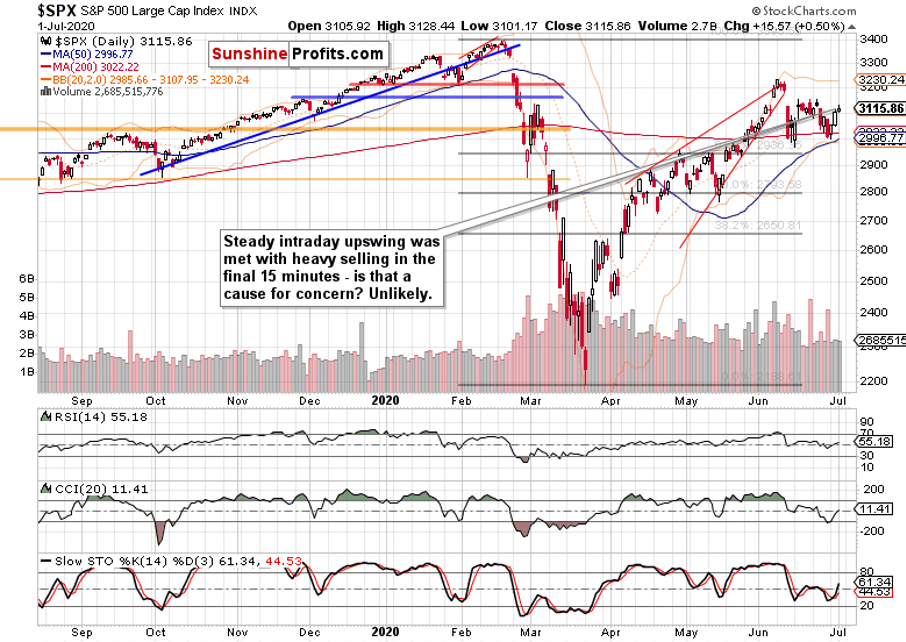

S&P 500 in the Short-Run

I’ll start with the daily chart perspective (charts courtesy of http://stockcharts.com):

Wednesday again brought us follow-through buying, this time with an upper knot. Is that a warning sign of an impending reversal? I would rather chalk it down to squaring the risk towards the end of the session. The joint examination of daily momentum and volume hints at a short-term pause merely – a daily affair.

The way I look at things, is that the upswing today's trading would likely bring, stands a good chance of overcoming yesterday's intraday highs on a closing basis.

That's because yesterday's non-farm employment change came in below expectations, yet stocks easily took off to new daily highs. And I expect the same dynamics to play out later today as well. There is not much new waiting in the wings to spoil today's picture.

Let's check the credit markets next.

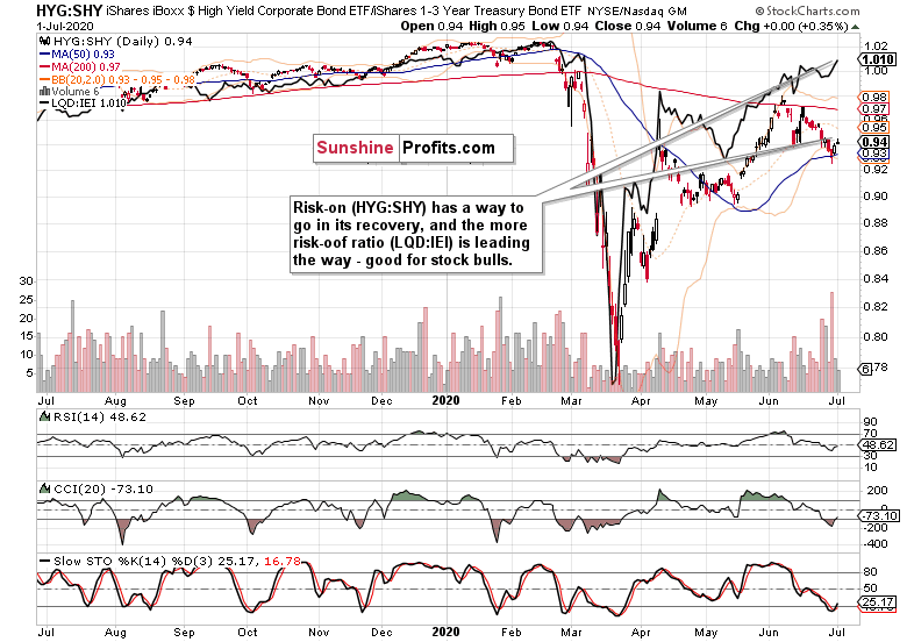

The Credit Markets’ Point of View

The daily candle in high yield corporate bonds (HYG ETF) mirrored the S&P 500 one, and the low volume here shows that the sellers are nowhere to be really seen. This low a volume is consistent with a daily consolidation, which means that more gains are around the corner. And these gains would work to power stocks higher.

Risk-on is back. Slowly at first, as the preference for investment grade corporate bonds to the longer-term Treasuries (LQD:IEI) shows, with more still to come thanks to the high yield corporate bonds to short-term Treasuries (HYG:SHY) ratio.

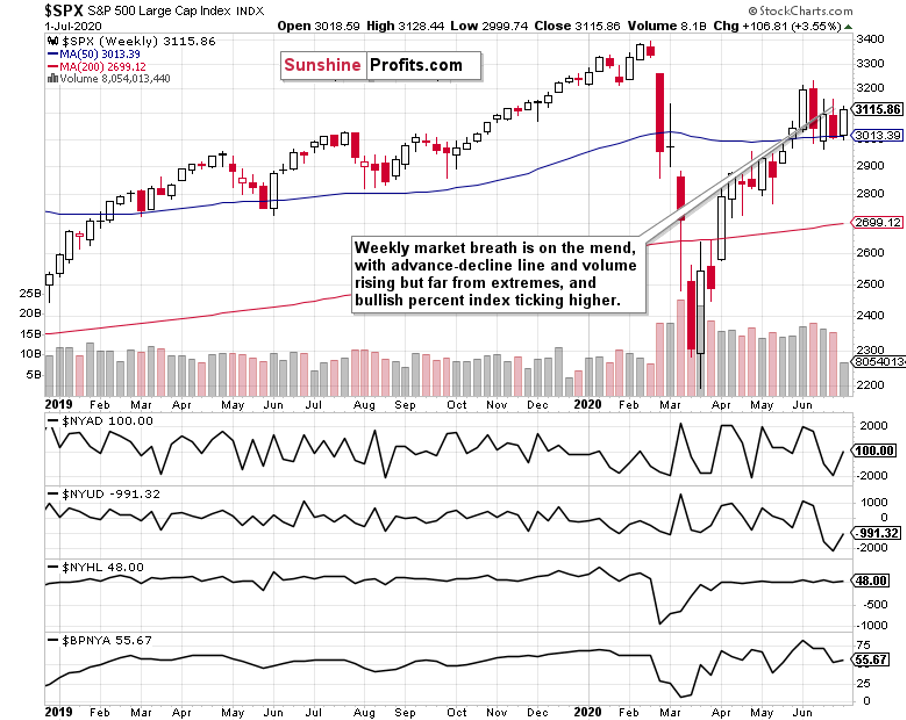

S&P 500 Market Breadth and USDX in Focus

The weekly chart shows the repair in both the advance-decline line and the advance-decline volume. After their recent plunge, they have ample scope for moving higher – they are just around their neutral readings when Thursday's closing prices are taken into account. Bullish percent index hasn't dipped as low as back in May, which illustrates that the bulls are stronger this time around.

And that paints a rather bullish picture for the coming week(s), just as the USD Index situation does.

The swing structure of this relief rally appears to have run its course for the most part. To me, the chart's message is that a more risk-on environment is on the way – not a deflationary crash. Wouldn't you expect a more veracious move on new U.S. daily corona cases highs? Yeah, cases… That's it.

Summary

Summing up, yesterday's gains extended Tuesday's upswing with full support from the credit markets. The way they're turning a page over the recent prolonged weakness, points to more appreciation potential as the HYG:SHY ratio has plenty of room left to catch up with momentum to the more bullish LQD:IEI performance. Stock market breadth is improving, with both advance-decline line and volume sending positive messages amid bottoming bullish percent index. Technology and healthcare are leading the charge.

The greenback isn't likely to get in the way of further stock gains, and I expect it to rather weaken as the recovery narrative gains more traction – and if you look at emerging market stocks, they've done better over the June consolidation than their U.S. counterparts. They could even start to outperform – and should they do so, that also means more gains for the U.S. stock indices as they explode higher again.