When it comes to valuing your advice to clients what is a “fair” rate or price? $100 per hour seems pretty cheap for any professional – plumbers cost more than that, right? But what about $1,000 per hour? That’s not actually a bad rate if someone can create $5,000 of value for a customer…expecially if they can do it with only 15 minutes of advice, right?

Valuing financial advice is definitely problematic, and the new trend of lobbyists and theorists trying to find a “fair” value is nothing more than a futile academic exercise at best..or social engineering at worst.

The value created from great advice is unique to the individual consumer who obtained it and used it. What value that should be placed upon that unique experience is between that consumer and the adviser who helped create the tangible difference. Frankly it is no business of the lobbyists to determine what is “fair”. It has nothing to do with them. Attempting to mandate “fair” in this area is nothing more than an attempt at price controls….it is pretty Stalinist really.

What is fair is what the consumer decided was fair. Value is received by, and ultimately decided by, the consumer, surely? And let’s face it: financial advisers generally are pretty awful at pricing value correctly in advance anyway. They overwhelmingly tend to undervalue what they do when it comes to charging consumers, and the majority still shy away entirely from charging consumers directly on an hourly rate or project/success fee basis.

In my experience most financial advisers are poor at valuing the advice they give. This is despite a number of excellent studies in recent years highlighting the difference a good financial adviser can make to a consumers wellbeing and net worth, as well as the experience of the advisers themselves over the course of their careers. It is worth noting that I am not referring to being poor at expressing the value – which we usually are – but we are poor at actually putting the proper value on the advice itself.

And there is clearly value for consumers in being advised.

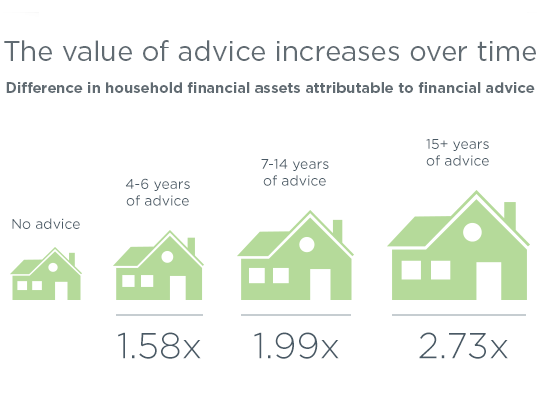

It has been shown that the longer that consumers are advice clients then the greater the impact on their net worth in comparison to the non-advised. The point has been well made that much of the difference in net worth can be attributable to the creation of a plan, bringing in good disciplines and habits, providing accountability, and reviewing and amending plans.

If the impact of advice on a typical consumer is that their net worth grows at 2.7 x that of the non-advised over a 15 year plus period as shown in one study, then what value should we place on the advice?

Let’s say a typical planning client first takes advice from us when their net worth is perhaps only $250,000 (and we ignore inflation, etc, etc) then the research suggests that there is a very real possibility of the client’s net worth being over $400,000 higher than it otherwise would have been in 15 years time.

So what value should we place upon the advice we provide? Would 5% of the increase in wealth be unreasonable?

Some will undoubtedly say that fees of $20,000 over that 15 year period are not reasonable…but then plenty would say otherwise. It is only $1,333 p.a. after all…

My feeling is that perhaps it is not a bad thing for an adviser today to use such research in their marketing and initial client meetings to highlight the value of preparing a plan and working with an adviser to follow it.

At the very least it should put any initial planning fees into their proper perspective. If it costs $5,000 to create an extra $400,000 or more in value that will be worth it to many consumers.

At the end of the day what is a “fair fee” will be determined by the consumer paying it. Linking the fee to the value created by sound advice to a client will at the very least put initial and ongoing fees into a fair perspective.