This article is being published a bit early, I realize that. When you go to the doctor with clogged sinuses, a splitting headache, and body aches like you’ve never had, you just want some antibiotics that will get you back on your feet as quickly as possible – you aren’t in the mood to hear a lengthy admonishment over your lack of exercise and eating habits. “Doc – if I survive this thing, I promise I’ll go on a diet and exercise in order to prevent this from happening again, but you’ve just got to help me get out of bed tomorrow, first!” we all say.

The recent pullback in the market is putting stress on Financial Advisors from coast to coast. Revenues are estimated to be down 10 – 15% for the year, putting pressure on profit margins and causing some RIA owners to fret about the viability of their businesses and what cuts they’ll need to endure in the coming months. We’ve written about the need to focus on profits before (What RIAs Should Learn From Uber and Lyft and The Age-Old Debate: Profit vs. Growth – What’s More Valuable?), and much has been published in the past few weeks about the need to focus on profitability in order to survive this downturn. Lecturing Financial Advisors about their profit margins right now is a bit like the doctor lecturing you about your eating habits when you are just trying not to pass out from exhaustion, as your body furiously fights off a bacterial infection. But at some point, it is prudent for you to look at preventative measures that can help you avoid that pain in the future. For now, advisors are focusing on exactly what they should be doing – guiding their clients through this turmoil and keeping them calm and focused on their long-term financial goals. When the time is right, however, I’ll forward this article to our clients so they can begin the work of focusing on the bottom line…

Why are profits so vitally critical now, you ask? A recent Financial Advisor IQ article quoted the Boston Consulting Group’s finding that “profits in absolute terms at wealth management companies have yet to reach pre-2008 crisis levels.” BCG says, “Even when allowing for some profit growth during 2019, the average firm thus has a much lower buffer to absorb shocks.”

Philip Palaveev recently stated in a Financial Advisor Magazine article, “Much like the [corona]virus, if someone has health issues, they are very vulnerable and perhaps they need to be looking ahead and taking even more precautions.” He continued, “Those firms with less than 25% profit margins have less room to wiggle without going to compensation reduction and layoffs.”

Brandon Kawal of Advisor Growth Strategies agrees with Palaveev’s 25% profitability hurdle, stating in a recent RIAIntel article, “A healthy operating margin – net of owner and employee compensation costs – is generally between 25% and 30%. Less profitable firms could potentially face drastic declines in compensation and even resort to cost cutting.” Kawal continued, “I imagine a lot of owners are sort of stuck in the here and now [tending to clients]. As we go through the coming weeks, it’s going to be time to take a step back and really take a look at the business holistically.”

In his recent article, Don’t Waste This Crisis, Matt Crow of Mercer Capital points out, “The value of RIAs and the future of transactions in the industry ultimately comes down to the health of the individual firms. Fortunately, there is a relatively straightforward way to assess the financial well-being of your firm, and ways of taking corrective action if your firm’s future is threatened.”

Crow recommends Financial Advisors take a look at their ongoing revenue and expenses. Starting with expenses, he advises, “Take your last month’s P&L. Your biggest expense is labor and benefits; it’s not unusual to see labor costs comprising two-thirds or more of an RIA’s total operating costs.” For a simpler calculation, he says to leave out discretionary bonuses and just focus on salaries and benefits. “Once you’ve quantified total personnel costs, look at other fixed costs like rent, research, compliance, technology, systems, etc. Adding all that together will derive your annualized expense base.”

Now it’s time to calculate your adjusted revenue, given the pullback in the markets. Crow points out, “The beauty of the Financial Advisor model is that you can know, on any given day, what annualized revenue is. Take your closing AUM as of the most recent trading day, filter it through your fee schedule, and you can tell, based on that day’s market pricing of your client assets under management, what annualized revenue is.”

He concludes, “With annualized revenue and expenses calculated, you know whether or not you’re profitable, and by how much.”

As every episode of G.I. Joe concluded in the 1980’s, “Knowing is Half the Battle.”

The next big question is, “What the heck are we going to do about it?”

There are only two sides to the profitability equation that you can manipulate in order to boost profitability: you can increase revenue, or you can decrease expenses. Given the fact that no one knows how the current economic uncertainty is going to play out and the effect it will have on RIA revenue, it is most logical to focus on expenses. There are hard costs to examine – “Where can we spend less money?” and there are productivity costs to review – “Where are we under allocating resources that we could be more productive and service our clients more efficiently?”

In our opinion, the best way to perform this analysis is through an Operational Diagnostic, where you review each of your core back office systems and workflows and ask yourself a few key questions, detailed below. Maybe you are spending money on systems that your firm is not fully utilizing, and there is a less expensive system that could be implemented without causing any decrease in client service. Maybe you have underspent in certain areas, which is causing too many man hours to be spent on basic tasks. The Operational Diagnostic process should reveal these areas and allow you to more efficiently provide high-touch service to your clients.

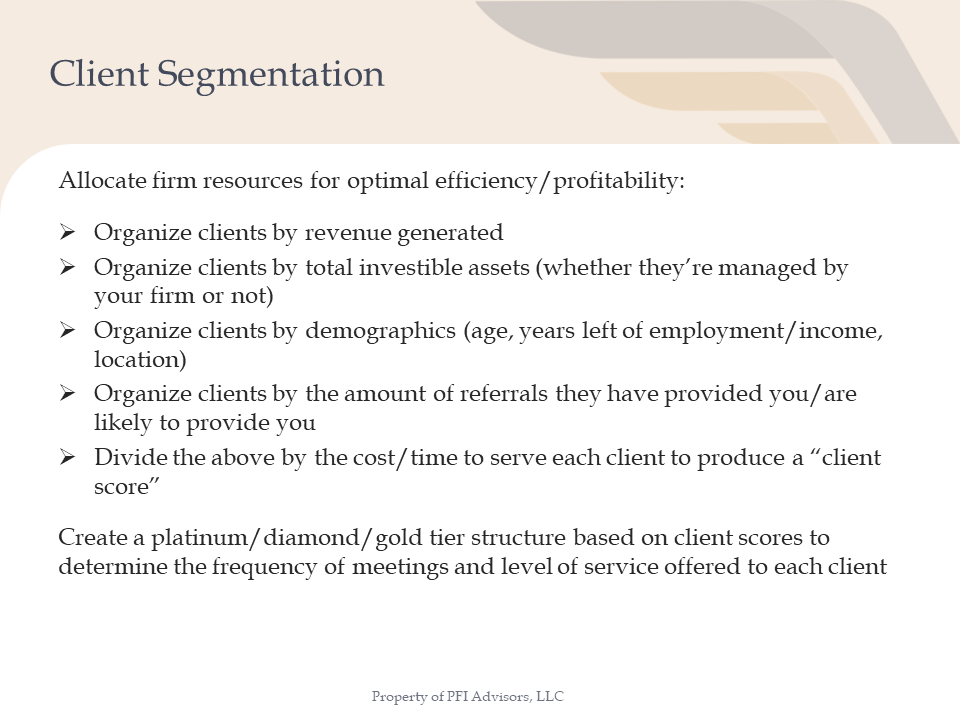

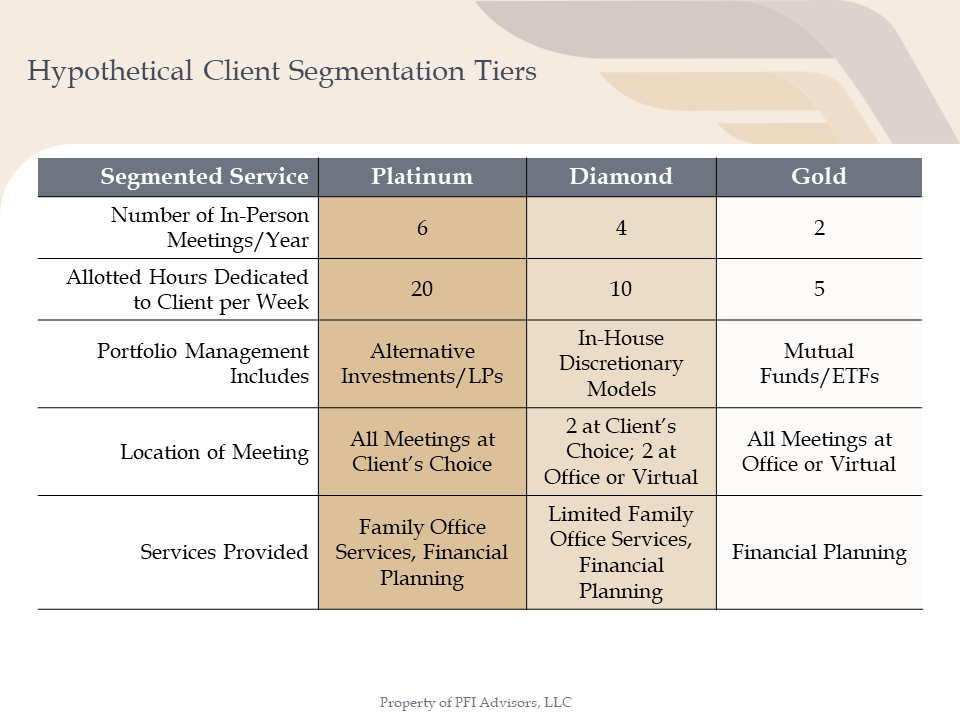

Another area to focus on would be Client Segmentation. The goal of any client segmentation exercise is to determine the proper resources to allocate across your client base. Are you profitably servicing every client, based on the complexity of the relationship and the fees they are paying you? Here are some ideas around a Client Segmentation exercise:

One last area worth evaluating is what services are you outsourcing vs. conducting in-house? We recently wrote an article expressing our thoughts around building vs. buying your RIA’s client portal. Other areas you may want to consider outsourcing are:

PFI Advisors has helped many Financial Advisors think through profitability since our launch in 2015 – whether we are asked, “How do I run my firm more profitably?” or “How do I launch an RIA that will be designed to maximize profitability?” or “How do I successful execute a merger in the most profitable fashion?” We are always here to help RIAs think through these issues, but this analysis can be done in-house as well, following the guides included above.

We’ll make it through this, just like we’ve made it through other economic downturns in the past. Matt Crow points out, “The current [environment] threatens our physical health as well as our financial health, so it wears on our psychology much more than most economic downturns.” This one is tough, on many levels. But when the dust settles, and our physical health is assured, use this wake-up call to focus on the health of your business. As management guru and former CEO of Intel, Andy Grove, stated, “Bad companies are destroyed by crisis. Good companies survive them. Great companies are improved by them.”

Related: How the RIA COO Is Pivotal to Transitions: Both Work From Home and M&A