Everyone is after the good advice clients it seems…or are they?

Robo-advisers, direct marketing, 24/7 online transaction facilities, product kiosks and over the counter solutions to shoppers at supermarkets…these are all “financial advice” choices for consumers today. (for “Financial Advice” read “anything associated with a financial services product or service which may or may not involve any actual advice). Real financial advice is usualy considered non-essential by most consumers…until they are presented with decisions or circumstances which demand it. Then it suddenly becomes absolutely essential.Naturally these new methods of

providing financial solutionschallenge traditional incumbent business models, and many advisers hold the view that professional financial advice, as opposed to just delivering financial products, is essential for all consumers.Is that true though?For example: The 23 year old just entering

the workforcewho is bright and disciplined, carefully saving a percentage of each pay, and with no dependents or liabilities to speak of…..they have fairly simple financial needs, right? I know we can make a good argument that getting a comprehensive financial plan at that stage can potentially help set them up for life and probably early retirement, but do they need it? Surely that is a “want” rather than a “need”?The point is that when consumer needs are relatively simple then the advice component may in fact be discretionary. A product solution to a simple need becomes the mandatory need. Equally, when there are a multitude of competing demands and needs for the use of the same budget then things have become complex for the consumer and good professional guidance is usually a godsend.It becomes clear to identify the opportunity zone for professional advice, and just as clear to identify those areas where advisers will struggle to differentiate, let alone compete.

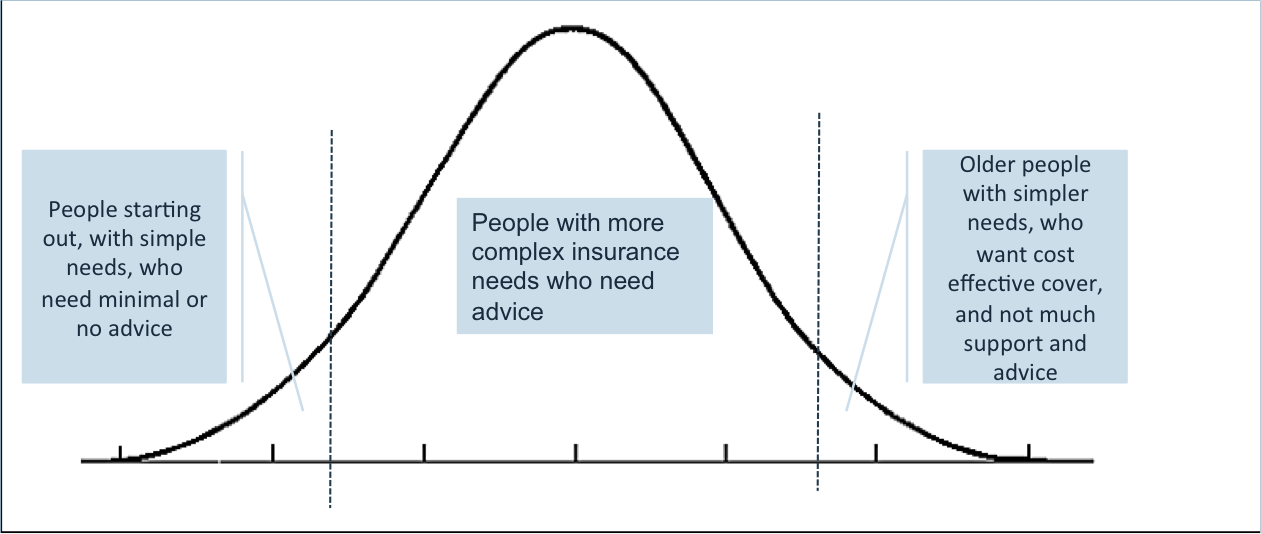

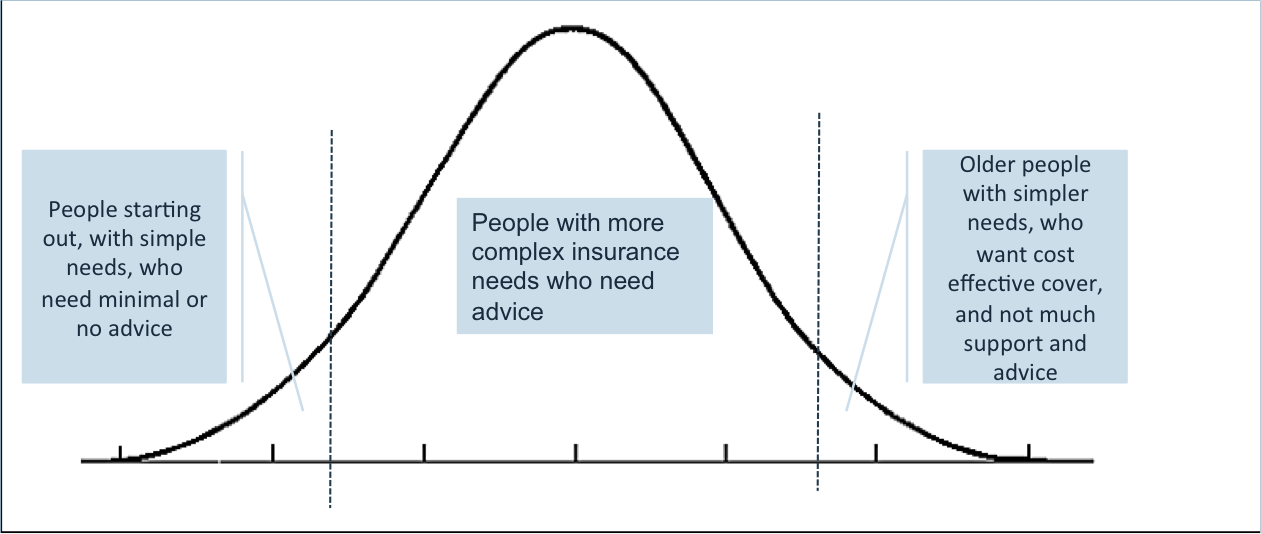

We could simplistically describe the typical consumers financial advice or products needs over time like this:

While it is not absolute correct for all consumers all the time I do believe that this is generally correct for the majority of consumers. That is, early in life their needs are few and relatively simple. Later in life their needs are relatively few (compared to prior working years), and more often than not the ongoing advice is extremely limited in scope or fairly simple.The mainstream advice area is naturally where life gets more complex for consumers, as it is where research, process, knowledge, information, strategy and choice come together to create value in customers lives. Of course this is where most advisers find themselves operating with most of their existing clients today – those who are still in the complex years and who are also (usually) time poor. The adviser is valued by those clients generally.At the extremes it really is becoming the domain of the direct transactors or commoditised product providers. Lowest possible costs together with highest possible convenience factors together with simple product structure equals an easy and instant “just add boiling water” solution. Advisers would generally be foolish to try and compete in that space.Most advice businesses will come to recognise this (if they haven’t already) and will direct their marketing efforts at gathering more of the consumers who are currently living lives of complexity. Those same consumers are being bombarded with over 3,000 advertising messages per day, are already time poor, and have rapidly improving privacy screens and filters. They are busy and stressed. They are going to be tough to get through to aren’t they?Related:

Being Clear About What Matters Most Actually Matters MostThe greatest opportunity to get their attention and engage them is before the period of stress and busy-ness dominates their life. The opportunity to acquire new clients who will increasingly value what an adviser does for them lies in the times of disruption and transition in consumers lives. The transition from simplicity to complexity, or vice versa. At the front end where simple needs are becoming more complex there is the

opportunity to gain clients who will grow. At the other end of the scale there is the opportunity to provide more transactional services perhaps, but still high value. Both types of business can grow a firm rapidly, and quite probably more easily than competing in the crowded middle market.The consumers in transition are the ones who want advice most. They are the ones who will place a higher value on the professionals who can simplify the complexity. Getting to them at the time when they are beginning to realise the unfolding complexity is the key….so instead of targeting consumers who are already running businesses or juggling their professional lives with family commitments, perhaps you need to be aiming your initial marketing and content at those who are most likely to be entering that “zone” in the next year or two…Aim to create content that engages people who are heading for complexity, rather than trying to get through to the currently busy and stressed with mass marketing. For those consumer who are currently dealing with complexity, then word of mouth/referral marketing is absolutely the best way to get to them rather than mass

marketing methods.I mean…think about YOUR world. Undoubtedly complex and too many choices and too many demands for the money you have, and not enough time to process all the information to your own satisfaction.What would work to get YOU as a client?

While it is not absolute correct for all consumers all the time I do believe that this is generally correct for the majority of consumers. That is, early in life their needs are few and relatively simple. Later in life their needs are relatively few (compared to prior working years), and more often than not the ongoing advice is extremely limited in scope or fairly simple.The mainstream advice area is naturally where life gets more complex for consumers, as it is where research, process, knowledge, information, strategy and choice come together to create value in customers lives. Of course this is where most advisers find themselves operating with most of their existing clients today – those who are still in the complex years and who are also (usually) time poor. The adviser is valued by those clients generally.At the extremes it really is becoming the domain of the direct transactors or commoditised product providers. Lowest possible costs together with highest possible convenience factors together with simple product structure equals an easy and instant “just add boiling water” solution. Advisers would generally be foolish to try and compete in that space.Most advice businesses will come to recognise this (if they haven’t already) and will direct their marketing efforts at gathering more of the consumers who are currently living lives of complexity. Those same consumers are being bombarded with over 3,000 advertising messages per day, are already time poor, and have rapidly improving privacy screens and filters. They are busy and stressed. They are going to be tough to get through to aren’t they?Related: Being Clear About What Matters Most Actually Matters MostThe greatest opportunity to get their attention and engage them is before the period of stress and busy-ness dominates their life. The opportunity to acquire new clients who will increasingly value what an adviser does for them lies in the times of disruption and transition in consumers lives. The transition from simplicity to complexity, or vice versa. At the front end where simple needs are becoming more complex there is the opportunity to gain clients who will grow. At the other end of the scale there is the opportunity to provide more transactional services perhaps, but still high value. Both types of business can grow a firm rapidly, and quite probably more easily than competing in the crowded middle market.The consumers in transition are the ones who want advice most. They are the ones who will place a higher value on the professionals who can simplify the complexity. Getting to them at the time when they are beginning to realise the unfolding complexity is the key….so instead of targeting consumers who are already running businesses or juggling their professional lives with family commitments, perhaps you need to be aiming your initial marketing and content at those who are most likely to be entering that “zone” in the next year or two…Aim to create content that engages people who are heading for complexity, rather than trying to get through to the currently busy and stressed with mass marketing. For those consumer who are currently dealing with complexity, then word of mouth/referral marketing is absolutely the best way to get to them rather than mass marketing methods.I mean…think about YOUR world. Undoubtedly complex and too many choices and too many demands for the money you have, and not enough time to process all the information to your own satisfaction.What would work to get YOU as a client?

While it is not absolute correct for all consumers all the time I do believe that this is generally correct for the majority of consumers. That is, early in life their needs are few and relatively simple. Later in life their needs are relatively few (compared to prior working years), and more often than not the ongoing advice is extremely limited in scope or fairly simple.The mainstream advice area is naturally where life gets more complex for consumers, as it is where research, process, knowledge, information, strategy and choice come together to create value in customers lives. Of course this is where most advisers find themselves operating with most of their existing clients today – those who are still in the complex years and who are also (usually) time poor. The adviser is valued by those clients generally.At the extremes it really is becoming the domain of the direct transactors or commoditised product providers. Lowest possible costs together with highest possible convenience factors together with simple product structure equals an easy and instant “just add boiling water” solution. Advisers would generally be foolish to try and compete in that space.Most advice businesses will come to recognise this (if they haven’t already) and will direct their marketing efforts at gathering more of the consumers who are currently living lives of complexity. Those same consumers are being bombarded with over 3,000 advertising messages per day, are already time poor, and have rapidly improving privacy screens and filters. They are busy and stressed. They are going to be tough to get through to aren’t they?Related: Being Clear About What Matters Most Actually Matters MostThe greatest opportunity to get their attention and engage them is before the period of stress and busy-ness dominates their life. The opportunity to acquire new clients who will increasingly value what an adviser does for them lies in the times of disruption and transition in consumers lives. The transition from simplicity to complexity, or vice versa. At the front end where simple needs are becoming more complex there is the opportunity to gain clients who will grow. At the other end of the scale there is the opportunity to provide more transactional services perhaps, but still high value. Both types of business can grow a firm rapidly, and quite probably more easily than competing in the crowded middle market.The consumers in transition are the ones who want advice most. They are the ones who will place a higher value on the professionals who can simplify the complexity. Getting to them at the time when they are beginning to realise the unfolding complexity is the key….so instead of targeting consumers who are already running businesses or juggling their professional lives with family commitments, perhaps you need to be aiming your initial marketing and content at those who are most likely to be entering that “zone” in the next year or two…Aim to create content that engages people who are heading for complexity, rather than trying to get through to the currently busy and stressed with mass marketing. For those consumer who are currently dealing with complexity, then word of mouth/referral marketing is absolutely the best way to get to them rather than mass marketing methods.I mean…think about YOUR world. Undoubtedly complex and too many choices and too many demands for the money you have, and not enough time to process all the information to your own satisfaction.What would work to get YOU as a client?