“Time is free, but it’s priceless. You can’t own it, but you can use it. You can’t keep it, but you can spend it. Once you’ve lost it you can never get it back.” -- Harvey Mackay

Client loyalty, retention and growth are critical to practice success. Each client loyalty component can bring value to the client and value to the practice in terms of retention and growth. It also costs you (and your team) time. You need to be in balance for an efficient and effective financial advisory practice.

How do you balance costs and benefits?

Most financial advisors determine general client profitability by client based on their revenue.

Fewer financial advisors have measured their time and costs for servicing their clients by tier. Practice profitability can of course be measured in aggregate. Few FAs “know” where they are spending their time and costs and whether the time and costs are being appropriately invested in the “right” clients based on their profitability.

Consider your time, value, and knowledge.

- Time is your most precious raw material because it’s one thing that we can never get more of. This asset is specifically limited.

- Value is determined by the client; cost is determined by you. Don’t deliver items to the client that they don’t value because they always have a cost. If your service model calls for a certain deliverable (e.g., a financial plan) that the client doesn’t value, then you either need to convince them of their need for that plan or it may not be of value to deliver it. Find that out in conversation by asking.

- Knowledge is an important asset, and it should always grow over time.

Estimate the cost of delivering services to clients by tier.

Improve your client servicing costs by determining what may be restricting time for business growth and calculating advisor contact workload.

-

Decide how much time you specifically spend with each client, by tier, and how much you can afford to spend with each client. You are running a business, and there are practical aspects of that responsibility to your clients, your family, yourself, and your firm.

-

Costs are more effectively and efficiently managed in an environment that is process- based, establishes clear expectations for the client and team, has defined team member roles, and works with a definitive set of targeted clients.

Part of the costing process is determining how much time you can and want to devote to each major task.

Here’s how to do it in 6 steps:

1. Define practice tasks at a high level.

a. Business planning—annual and quarterly (~1% of your time) – Costs reflected in your hourly rate.

b. Relationship management including meetings, other contacts, life and financial planning and the other elements important to relationships that are in your service model. (~50% of your time) – Detail the elements of your client deliverables by tier.

c. Business development including introductions from clients, introductions from COIs, educational sessions, other. (~20%–25% of your time) – These costs should not be attributed to clients but will be reflected in your hourly rate.

d. Practice management including oversight of your teams work and communications with external personnel, e.g., management, wholesalers, other. (~10% of your time) – These costs will be evenly divided by the number of clients, e.g., Total practice costs of $1MM. 10% = $100k, 100 clients = Each client assigned cost of $1,000 since these areas benefit all clients.

e. Asset/investment management (~15% of your time) – These costs are apportioned by tier as higher tiers have more complex investment needs, e.g., Total costs = $100K, 70% of assets from Tier 1 or A, cost for investment management of Tier 1 = $70,000 / number of tier 1 clients, e.g., 35, each Tier 1 client assigned cost of $2,000. 15% of assets from Tier 2 or B, cost for investment management of Tier 2 = $15,000 / number of tier 2 clients, e.g., 70, each Tier 2 client assigned cost of $214.

f. Cleaning up messes (overtime) – Costs reflected in your hourly rate.

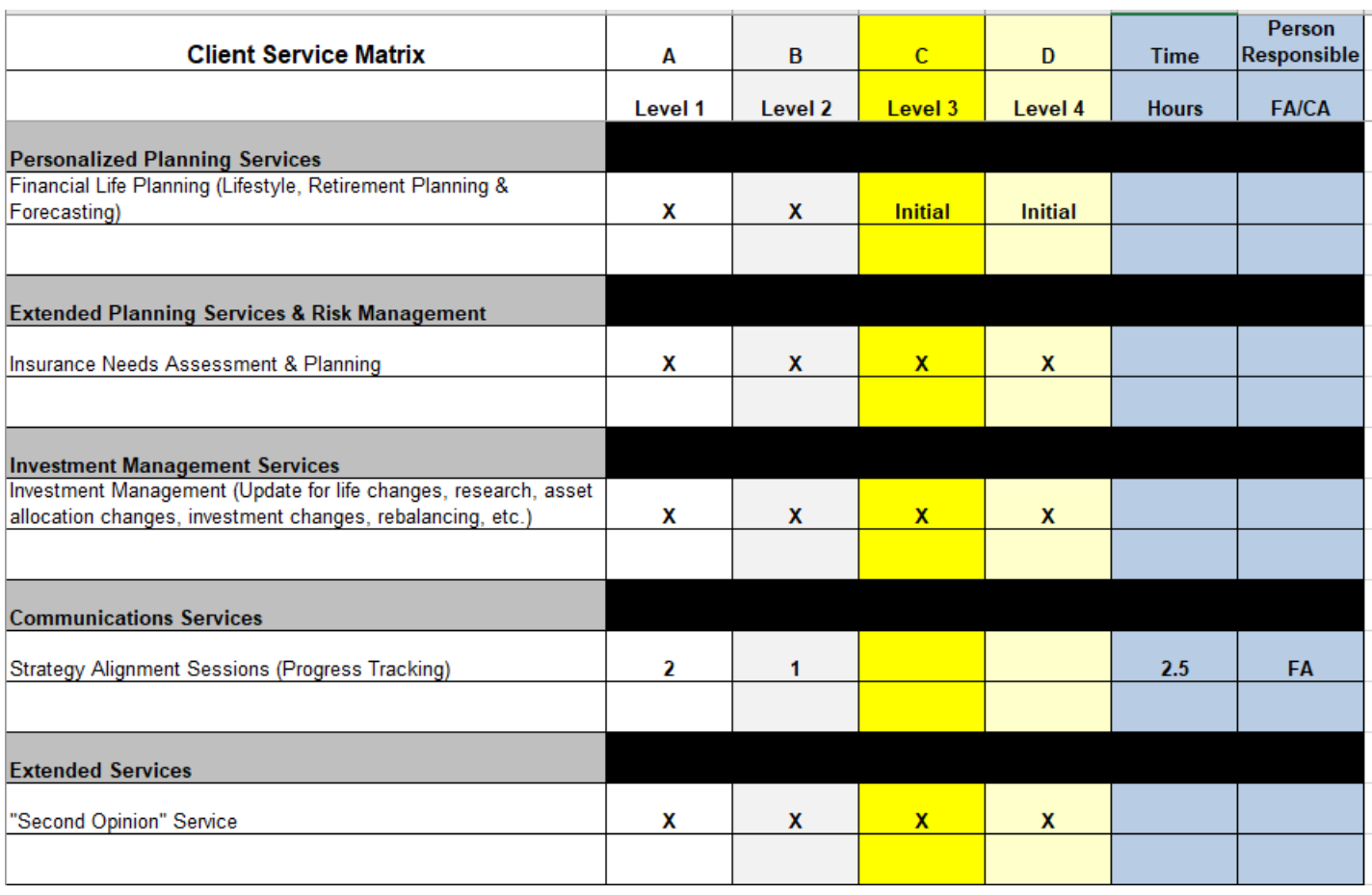

2. Determine the deliverables in your Client Service Model/Promises.

3. Determine the time to develop each deliverable.

4. Calculate an hourly rate, e.g., a million-dollar producer has a $500/hour rate ($1,000,000 / (40 X 50).

5. Using your list of deliverables and your “Client Service Promise”, estimate time and therefore cost for each deliverable for each tier.

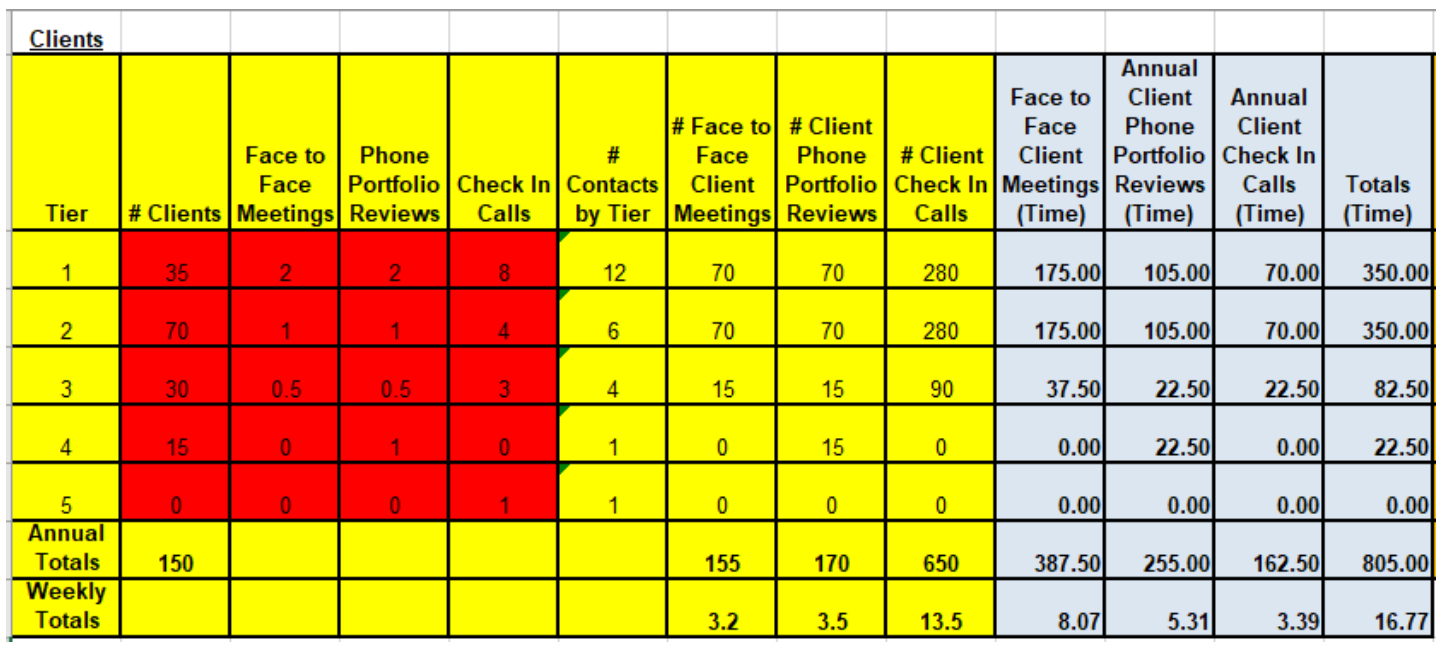

6. For example:

This spreadsheet takes explanation but in summary, using a set of assumptions on numbers of contacts by tier, type of contact and time per contact type, you can see 35 Tier 1 clients will require 350 hours of advisor contact time per year or 10 hours per client per year at $500 per hour or $5,000 per year of advisor cost. These data are exemplary, does not consider CA offload at lower hourly costs or variations in individual client requirements.

What are the next steps?

Determine how much time you spend on other services for clients by tier and the other tasks in your business: asset/investment management (estimated at $2,000 / Tier 1 client), any other client service/relationship management services, team management (estimated at $1,000 / client), and assumedly other activities. In addition, there are emails and inbound phone calls. Similar techniques can be applied to each of these other FA business activities.

The point here is to organize and structure your business as best you can based on the realities of your current book of business, your team, an effective and efficient set of roles and responsibilities, your business plan, and the goals your plan includes.