An ongoing challenge for any service business is to create “Mass Personalisation”, or something akin to a factory production line that delivers constant quality efficiently, but which still feels personal to the end user.

In professional services it is creating and efficient and affordable business system that allow mass actions to still feel like personalised service to customers. “Service” might simply mean “communication” too…and we’ve seen countless examples in recent times of professional service firms trying to communicate rapidly with clientele where it has been done either very very poorly, or very well indeed. The difference between the two extremes is whether they have built a great service & communications system, or just a mailing list.

It makes commercial sense to build the system. Being able to correspond or provide a service to 100 clients simultaneously yet making it fee personal to each of them is efficient, and far more profitable than trying to provide individual service to 100 clients singly obviously. The efficiency gains are tremendous over time (provided you do actually use the system you build), but the ROI from additional business or better retention is where the medium term gain is.

There are a lot of elements that go into developing the communications and servicing systems, but the essential element sitting at the centre of every efficient client service system is the often under-rated and poorly utilised client database, or CRM.

Pretty much everyone has the essential tool inside their business that can drive the results already…they have a CRM of some sort. Yet many don’t achieve the efficiency and personal service objectives because they haven’t gone through the full process of setting the system up. They’ve usually only gone part way.

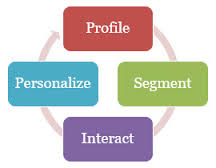

These are the 4 sequential steps that are needed to create an efficient and personalised service off an excellent database:

1. Build as strong a Profile of each client as you can. This needs to be a lot more than the factual policy or portfolio data and key contact information. Know their preferences, relationships, interests and aspirations – and be able to store and then search (or mine) that data.

2. A segmentation strategy is essential to creating efficient service systems. The labelling of those service standards matters from a marketing perspective in terms of how they are perceived by clients or the target market. It is far more important though to be able to group similar clients in terms of their value, interests, communication preferences, investing style, type of relationship with your firm, and so on. In today’s CRM systems segmentation and differentiation can be done in multiple layers and ways IF the data (the client profile) is built to begin with.

3. There has to be a communication strategy and a service delivery system working off the CRM system that creates interaction or engagement with the clients.

4. Using the data from client profiles, and aggregating clients from the segmentation strategy, enables the communication (or interaction) to be personalised.

Good data points in the CRM can be extracted and merged with a good communications system to create what feels like incredibly personalised interaction for the client. But it all begins with getting that data into the CRM system…you can only deliver mass personalisation in service if you have data captured electronically.

Even if you never quite evolve the system to deliver exceptional personalised service or rapid personalised communication, the capture of the data is in itself highly valuable and will add capital value to your practice as it presents an unrealised opportunity for any other adviser who might want to buy your business one day. That is the long term gain, so don’t underestimate the value of capturing how well you know your clients.

Either way – short term or long term – building a highly personalised service system which can be be operated like a production line will pay off for your practice.

Related: That Tech Competitor Threat Is Really an Opportunity for Entrepreneurial Advisors