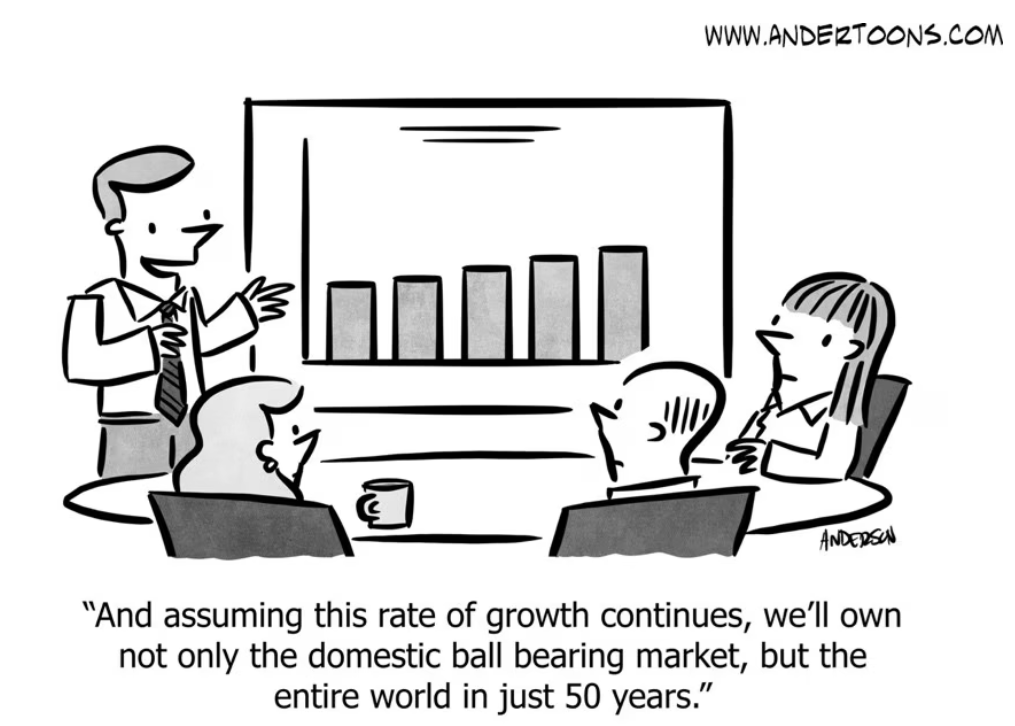

Let’s get real about something that’s been buzzing around lately. People are going bananas over how Nvidia’s sales shot up from $27 billion in 2022 to a jaw-dropping $60 billion in 2023, with profits skyrocketing from $4 billion to $30 billion. That’s over a 500% increase. Naturally, everyone’s on the hunt for the next Nvidia.

But here’s the kicker: research by Anthony Pisano and others tells us that only about 25% of public companies actually see significant growth. Hitting a 10% growth rate is considered top-notch, and even that doesn’t last forever. As it turns out, about 75% of companies barely budge in terms of yearly growth.

Realistic Expectations and Strategy

The above results suggest several strategies that should be considered:

Consider that real potential for growth frequently gets overestimated.

Companies tend to forget that products have life cycles—sales can start strong, take a dip, and then drop after a peak (Peloton is a great example). Plus, we tend to miscalculate the math. Growing 20% yearly for five years sounds great until you realize maintaining that momentum is a Herculean task.

Companies can also overestimate growth potential of diversifying or adding products.

When it comes to diversifying or adding new products, more isn’t always better. Just throwing in more colors, models, or features often doesn’t do much. Diversification needs the same magic touch as your core offerings and can also see diminishing returns. Remember the 80/20 rule? It’s real—80% of your sales come from 20% of what you offer. And “stick to your knitting” isn’t just a quaint saying; it’s solid advice that often holds true.

Companies need to consider other growth alternatives to increase effectiveness.

Should companies pay more dividends and do buybacks rather than invest in growth strategies? Should efficiency and effectiveness be considered more than growth in strategic planning?

Pricing Strategies in the Mix

Pricing Opportunities Continue to Grow.

Increased tipping pressures are starting to reach backlash. Many grocery chains are adding prepared foods to capture some of the eat-in market and to offer an alternative to the high prices of dining out.

Amazon continues to loom large, not just with prices but with selection, service, and speedy delivery. For example, one day shipping can be a game changer compared to visiting a store with low inventory, poor service, and inadequate staff. This puts traditional retailers in a tough spot, especially when they’re cutting back on offerings and service to boost margins, making Amazon even more appealing.

“Free” is not a dirty word. The concept of “Freemium” is more than a business model. It’s also a pricing strategy. Offering something for free and then charging for upgrades is a proven model (think Google and Facebook). Ancillary aspects of the Freemium strategy include samples, blogs, demonstrations, contributions to charities, etc. — these can all create new opportunities.

The Power of Logistics and the Internet

Logistics, sourcing and distribution efficiencies can drastically increase sales and profitability.

Efficient logistics, sourcing, and distribution can significantly cut costs and boost sales. Fast shipping and direct delivery methods can also make a big difference in pricing and profit.

Embrace the Internet.

The internet is a game-changer. Google, Facebook, and Amazon are essential players, whether as suppliers, customers, or information sources. Using the cloud, analytics, email marketing, and online ads can significantly enhance sales and leads.

Culture and Intangibles

In observing organizations, I consistently find culture, expectations and excellence greatly affect success more than we acknowledge.

While skills, finances, competition, and operations are all crucial, it’s often the intangibles that set you apart. For example, embracing risk, fostering passion, and cultivating a collaborative environment can greatly enhance effectiveness.

In summary, chasing growth for growth’s sake can be a wild goose chase. Instead, focusing on sharp execution, exploring alternatives, and prioritizing efficiency and profits might just be the smarter move.

Related: Fostering Collaboration: Essential Considerations for Success