[The traditional, decades-old, advisor business model and value proposition - providing exclusive access to financial products and services, professional investment portfolio management, and purchase guidance to new financial product opportunities - has become increasingly untenable going forward. FinTech companies are continuing to provide a “democratization” of access into all areas of the financial markets, robo-advisors now offer relatively inexpensive money management options, and the oncoming onslaught of AI-driven chatbots and virtual financial guides, like Fidelity’s Cora, will be helping investors walk through a simple financial decision-making process. This has led to much soul-searching by many advisors and, more importantly, has led some advisors to develop very innovative approaches to redefining and redrawing the parameters of what a financial advisor can do and be for their clients - well beyond the traditional expectations and capabilities that clients have attached to them. These advisors are attempting to create substantially deeper relationships through a more profound value proposition.

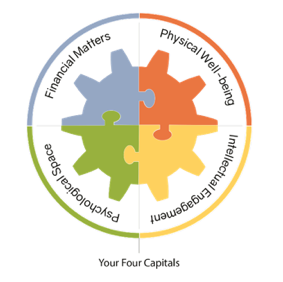

In order to further explore how some advisors are building better value propositions for clients, The Institute for Innovation Development reached out to Schultz Financial Group (SFG) of Reno, Nevada – an independent RIA firm with a decades-long commitment to deepening client relationships and offering a unique integrated package of services to create a working partnership with their clients. With a firm motto of A Legacy of Trust and Innovation, they started their firm back in 1982 with a belief that their firm’s purpose should realize that true wealth is measured by more than money, and that it’s as much about aspirations as assets. This belief has shaped their conscious decisions, activities, and firm goals to provide their clients with a more holistic and carefully integrated family and business wealth planning approach that covers, what they term as, the Four Capitals of Wealth – Financial Matters, Physical Well-being, Intellectual Engagement, and Psychological Space.]

Hortz: Can you explain what you mean about the Four Capitals of true wealth?

Russ: True wealth is so much more than just financial wealth. What good is having financial wealth if you don’t have the health or peace of mind to enjoy it? When founding SFG in 1982, we did not have a concrete idea for the Four Capital Approach, rather it developed naturally over time as we continued to help clients with any issues they had. The Four Capitals approach is designed to serve clients in ways that go beyond their Financial Matters. We also focus on our clients’ Physical Well-being, Intellectual Engagement, and Psychological Space. Through this approach, we provide insights and solutions to support and inspire our clients to take action so that they can lead fulfilled lives and increase their longevity. We provide them with an individualized platform and tools to define their path and achieve their personal goals.

Hortz: Why are these four distinctions so important?

Russ: These four distinctions are important because they help our clients to fully enjoy each stage of their lives and the financial successes achieved by their hard work. Though their Financial Matters are of the utmost importance, we also place an emphasis on their Physical Well-being, as health often influences decision-making. We want them to be healthy enough to travel, spend time with loved ones, and learn new skills, all while having the peace of mind that our team of advisors is there to support them along the way. We believe the Four Capitals are interconnected, as illustrated below, and that, when optimized, they can collectively increase longevity and create true wealth.

Hortz: What do you see as your firm’s role in those Four Capitals?

Russ: The key is “Your Four Capitals,” not SFG’s Four Capitals applied across all clients. While we define the overarching framework, our clients define what each capital means to them and what they want to achieve within each one. Our role is to guide each client in their individual pursuit and practice of their Four Capitals goals. These goals will evolve through different stages of life and life events, so we incorporate updated goal setting as part of our ongoing client engagement. We are committed to being good listeners and providing solutions through our support, network and resources. We serve as our clients’ “orchestra leader,” connecting resources and other advisors together so we all work in harmony to help clients achieve their goals. We believe in managing our clients’ balance sheets – across all Four Capitals.

Hortz: Can you give us some examples of how you are engaging with clients in these expanded ways?

Russ: The engagement begins with client onboarding, where we work with new clients through a collaborative process to create their Four Capitals Plan. In addition to collecting the standard information needed for financial planning, we help clients define their goals and aspirations for each capital. The resulting Four Capitals Plan serves as the foundation for an ongoing, interactive, and personal relationship. It helps us understand our clients holistically and serve them in a meaningful way.

For Financial Matters, we gather and analyze information from the client, as well as their other advisors (such as their CPA, estate planning attorney, etc.), to strategize for tax planning, estate planning, investments, and more. For investments, we build customized portfolios (which may include private investments) for each of our clients because no two clients have the same Four Capital goals. We provide Family Office services and consult with those clients regarding their family’s values, vision, and mission statement. Furthermore, we strategize how to share those with the next generation so that their children and grandchildren may be good stewards of the family’s wealth.

For Physical Well-being, we provide clients with a subscription to the Tufts Health & Nutrition Letter, which has prompted clients to engage deeper in health-related discussions with our Physical Capital Resource Manager. We also provide access to articles and resources on Diet & Nutrition, Health & Fitness, and healthy recipes, and guide clients to the information that relates specifically to their Physical Well-being goals.

Like physical health, one’s Intellectual Capital is an invaluable asset, and we recognize that it evolves throughout life. As such, we help clients identify opportunities and resources to harness their natural desires and maximize their intellectual capital during their high-earning years. Then, we help them transform it to their next career, avocation or hobby using their personal skills and experience to positively impact their future.

Last but not least, we believe that keeping a clear mind and a healthy attitude are part of a wealthy, fulfilled life. For Psychological Space, we work with clients to identify what brings them joy and how they can share that with others, whether that be family, friends, or their community. We also help clients identify how they want to contribute to society, as giving back can enhance psychological well-being. Legacy planning is another important part of our Psychological Space services.

Hortz: What tangible resources have you built into your firm to support these services around the Four Capitals for your clients?

Russ: We have several internal resources as well as third-party resources to support our clients’ Four Capitals. We spend a lot of time vetting third-party resources before suggesting them to any of our clients.

To support all Four Capitals, we have also created the SFG Library so clients can peruse the ever-changing collection of resources we are compiling for our clients. As an example, if a client finds a book of interest from our library, then SFG provides the client with a complimentary copy of the book.

Hortz: Any other thoughts you would like to share on what you have learned about the advisor-client relationship from developing your Four Capitals approach?

Russ: We learned how we can truly engage with our clients at a deeper level than just their financial matters. To do that though, as an advisor you need to go way beyond the traditional industry standards. The Four Capitals approach was developed organically through our practical experience of listening intently and responding sincerely. We provide our clients with insights and solutions to support and inspire them to take action so that they can lead fulfilled lives. It is amazing how much you can innovate your approach and impact your clients’ lives just by listening.

Related: Redefining the Insurance Marketing Organization

The Institute for Innovation Development is an educational and business development catalyst for growth-oriented financial advisors and financial services firms determined to lead their businesses in an operating environment of accelerating business and cultural change. We position our members with the necessary ongoing innovation resources and best practices to drive and facilitate their next-generation growth, differentiation, and unique community engagement strategies. The institute was launched with the support and foresight of our founding sponsors - Pershing, NASDAQ, Ultimus Fund Solutions, Voya Financial, Fidelity, and Charter Financial Publishing (publisher of Financial Advisor and Private Wealth magazines).