I’m not going to waste your time with a long, boring introduction. Let’s get down to business…

1. Having a niche makes marketing more effective.

Almost any marketing campaign can be improved by making it specific to a group of people. This is one of the easiest wins I can give financial advisors and I’m amazed at how many people still refuse to niche down.

One specific example involves getting clients with LinkedIn. I posted this poll on LinkedIn:

I looked at the profiles of people who voted “0” and saw that almost none of them focused on a niche.

I also messaged several advisors who voted “more than ten” and asked them what they were doing.

The overwhelming response was that they were focused on a niche.

This makes sense. Because if you’re a financial advisor and your headline says something like, “Financial Advisor Helping Teachers Retire With Peace of Mind”, teachers are far more likely to send you an inbound message.

2. Videos don’t work as well on LinkedIn as they used to.

There was a period of time in 2019-2020 where videos performed exceptionally well on LinkedIn. Many people believe they got such high reach because they were favored by LinkedIn’s algorithm.

Today, videos don’t have nearly as much reach as they once did. However, they are still fantastic ways for your audience to see you in action. They also seem to make people more comfortable with messaging you.

Videos work well on websites. When I analyzed the websites of Barron’s Top 100 independent financial advisors, I was surprised to see how frequently they used videos. I anticipated seeing mostly photos, but many of these advisors had well-produced, informative videos showing prospective clients who they are and how they can help.

Yet, if you ARE going to upload videos to LinkedIn…

3. Make sure your videos have captions.

Depending on which study you read, anywhere from 65-95% of people watch videos on mobile with the sound off.

4. Email marketing is the best appointment-setting marketing strategy I’ve ever seen.

Notice how I said, “appointment setting”. You should still have other marketing strategies working to collect leads, build trust, get referrals, and so on.

However, when it comes to getting someone to finally set that appointment with you, nothing else comes close. Don’t believe me? That’s okay, here’s some proof:

- According to McKinsey & Co., email is 40X more effective than Facebook and Twitter combined.

- According to YCharts, clients prefer email over ALL other forms of communication (and it's not even close).

- According to CampaignMonitor, email averages a 4,400% return on investment.

- According to Forrester, people are twice as likely to sign up for your email list as they are to interact with you on Facebook. (This blows a lot of people's minds but it's true.)

- According to the AARP, 45% of middle-aged Americans would rather go to the dentist than meet with a financial advisor. Guess what overcomes that skepticism and gets them to meet with you? Email.

- According to Optinmonster, 58% of people check email first thing in the morning before anything else. Guess which message is going to get consumed? Email.

- According to research by Litmus, 28% of people check email on an iPhone. Guess what allows you to track links and call people once you KNOW they've consumed your message? Email.

5. The key to making email marketing work is to use an autoresponder.

I don’t have time to explain all the nuts and bolts in this article. Essentially, you want a series of emails that go out in a predetermined order at predetermined times.

This is an asset you own that will continue to work for you (by following up with email subscribers) as long as you let it.

6. The best emails don’t talk about money.

Lots of financial advisors worry about compliance harassing them for trying to create email marketing campaigns. Most of compliance’s fears come from the advisors talking about money or investments in their emails.

Well, I’ve got news for you: if you’re talking about money or investments in your emails, you’re doing it wrong. Stick to stories mixed with information. I’ve sent and tested more than 3 million emails, and I guarantee you this is true.

7. Referral marketing is dying.

Research from Spectrem found only 4% of millennials said a recommendation from a trusted associate was their most important factor when choosing a financial advisor.

(Compared to 19% of Gen X and 20% of Baby Boomer respondents.)

8. Websites are becoming more important than ever.

That same research also found that 11% of Millennials ranked websites as THE most important factor when choosing a financial advisor.

9. Clients are won on LinkedIn through messages.

According to Putnam’s 2020 Social Advisor Survey, 94% of advisors seeing success on social media (getting new clients) are using direct messaging capabilities.

You read that right. Nearly one hundred percent of financial advisors getting new clients are doing direct outreach on places like LinkedIn.

This means if you’ve been sold this idea that all you need to do is constantly post content, you’ve been sold a lie.

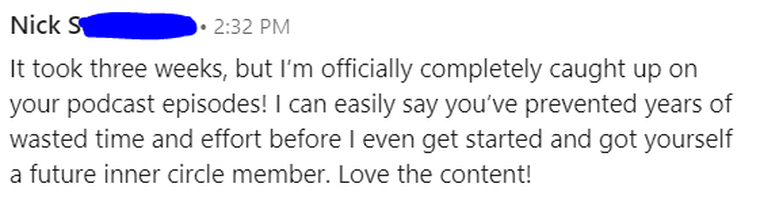

10. Podcasting can work well if you’re willing to invest time and effort.

Several of my Inner Circle members are crushing it with podcasts right now.

If you’re interested in starting your own podcast, let me know and I will introduce you to The Podcast Factory family. Also, read this: 3 Reasons Financial Advisors Should (And Shouldn’t) Start A Podcast

11. Words matter.

A study called “Advisor Value Propositions” found that those younger than 40 prefer the word “advocate” to “fiduciary”.

They also found that 91% of people aged 65 and older prefer the word “dedicated” to “passionate”. And that while those under 40 prefer “live the life you want” over “achieve objectives”, people older than 40 prefer the opposite.

Every niche has quirks like this. It’s up to you to find what your market prefers.

12. Emotion must be present in your marketing.

Neuroscience proves that people make the bulk of their decisions (including hiring a financial advisor) unconsciously. Their subconscious processes an enormous amount of data and leads them to an intuitive feeling about whether they should say “yes” to a decision.

Harvard Business School professor Gerald Zaltman goes as far as to say 95% of our purchase decisions take place unconsciously.

13. Prospecting should be about filtering.

Most people believe prospecting is about gathering the biggest list of people you can possibly gather.

Not so.

Prospecting is about ruthlessly qualifying everyone in your list until you’re left with only the people who want to work with you. One of the best ways to do this is with email marketing. Think about it…

If someone reads an email from you and you have your calendar link at the bottom, do you think an uninterested prospect will schedule an appointment?

Of course not!

Which means that - by definition - the only people who set appointments with you are the ones interested in some way.

14. Marketing companies tend to overcomplicate things.

Here’s a dirty little secret: there are entire segments of the marketing “expert!” population that makes its money on making marketing as complicated as possible.

After all, if you can’t understand it, you’re more likely to fork over wheelbarrows of cash to have them do it for you.

In my experience, the best marketing is drop-dead simple. So simple, in fact, that many “experts!” have told me it shouldn’t work.

Lol. The joke’s on them. It works better than anything they can dream up.

15. Longer lead magnets work better than short ones.

Some of my lead magnets include an 80+ page PDF and a 90-minute webinar.

Most people recommend little checklists or short, 45-minute webinars.

Hmmm.

Do I know something they don’t know?

16. You’re likely being influenced by the anchoring bias.

Let’s play a guessing game…

Do you think the tallest tree in the world is taller or shorter than 1,000 feet?

Go ahead, answer the question in your head.

The tallest tree in the world is…

Drumroll, please…

379 feet!

Your answer was probably influenced by the “1,000” anchor I put in your head.

This is known as the anchoring bias, and it costs people money when they anchor their goals based on their previous achievements. This is common with income goals. For example, if you made $100,000 last year, you might convince yourself that a goal of $120,000 is good for next year.

It doesn’t have to be this way. You don’t have to think linearly.

Marketing is beautiful because - if done correctly - it allows for exponential growth. Especially if you master something like online advertising. Fortunately, I’ve put together a free 42-minute video about how financial advisors can run better ads, which you can find here: How Financial Advisors Can Run Profitable Online Ads

17. Marketing is psychology mixed with math.

I talk a lot about the psychology behind marketing (I even have a degree in psychology), but I’d be remiss if I didn’t acknowledge math’s critical role.

Most marketing comes down to knowing how much it costs you to acquire a client and how much you make from said client.

If you make $5,000 per client, you shouldn’t fret about spending the equivalent of $500 per client. It makes no sense.

Yet, I’ve seen some advisors moan and complain about how marketing is “too expensive!” when they easily make their money back and then some.

18. 58% of Barron’s Top 100 independent financial advisors use email marketing.

This statistic is mind-blowing because, in my experience, fewer than 20% of independent financial advisors are leveraging the incredible power of email.

The fact that advisors on Barron’s Top 100 list are 3X as likely to use email should tell you something.

19. Most financial advisors screw up their “contact” pages.

From 2017 to 2020, I offered a website review service for $497.

I would record a ten-minute video critiquing a financial advisor’s website and I would give specific, actionable advice on how to make the website better.

However, I kept seeing the same things over and over.

ESPECIALLY on the “contact” page.

If you think your contact page is merely a place for people to reach out to you or request more information, I guarantee you’re leaving money on the table.

20. These three pages matter more than everywhere else on your website.

Your homepage, your “about us” page, and your “contact” page.

If you don’t believe me, check your analytics. Look at your most-visited pages.

I’ll wait.

You’ll almost certainly see those three pages in your top five.

Now, the biggest mistake financial advisors make with these pages is not having them work together.

Remember how I told you I did those website reviews? Well, 99% of the time I saw advisors treat these pages as if they were isolated from each other.

This is the wrong move.

Because when someone visits your website, that visitor is likely to go to all three of those pages… in order…

This means you can immediately make your website more effective by having these three pages work together.

It’s something almost NOBODY is doing. And it’s a way for smart financial advisors to gain a serious edge over their competitors.

Related: 5 Daily Marketing Habits That Can Get Financial Advisors More Clients