This should be a self-evident truth that requires no explanation, but apparently it isn’t:

Your clients will stay with you longer and be more valuable to you if you cross-sell multiple products and services to them.Yes, yes…I know…there is that word “sell” and it doesn’t always sit well with professional services providers. But we are in

the business of providing professional services, so there is a fundamental

need to actually make some money in order for us to continue providing valuable advice and service to clients. So we as well take a leaf out of the playbook from the best in the business at doing this: the banks.The big institutions have done this incredibly successfully: they continue

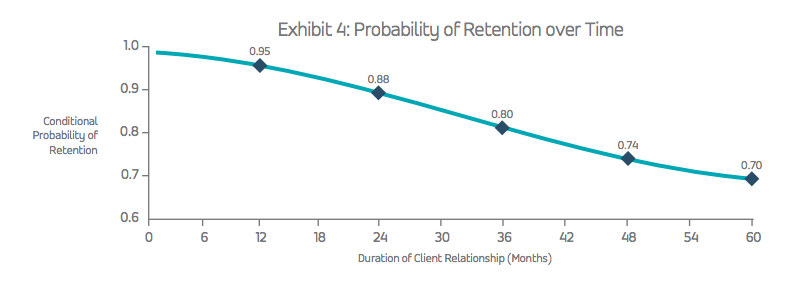

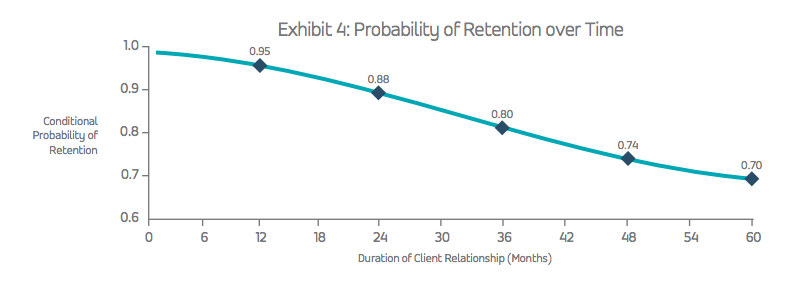

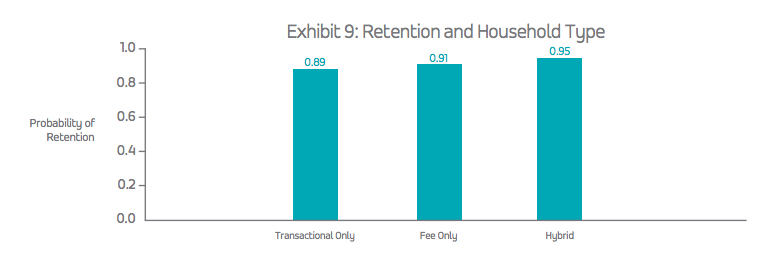

selling products and services to customersuntil they have as much of their business as possible, and either the customer doesn’t want to go anywhere else or it is just too inconvenient to do so.So one might conclude that a key difference between the boutique firm and the institutional one is simply that the latter is better at selling more stuff.One of the problems for many professionals today in pursuing this strategy is that they have become extremely proficient in a relatively narrow area of expertise, and that presents a cross-selling problem for them personally in that there is often not a wide range of products or services that the individual professional actually provides. The risk for the individual professional with a deep but narrow offering is that they effectively develop the very model they don’t want: a pure sales model.By that I mean the professional is continually selling the same solution repeatedly to an ever increasing volume of clients. It becomes a transactional business model in reality with the consequent risk of relatively short client retention. When relatively few services or products are provided to clients and the business relationship is largely transactional the probability of retaining them for “life” is remote. When their need for that particular solution which you provided has expired, or ceased to be a matter of urgency, then there is an increased risk that your services are redundant:

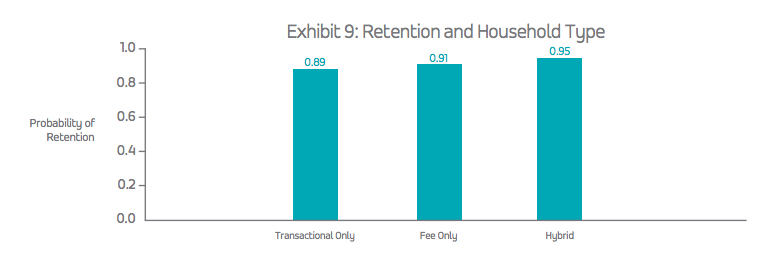

That changes (for the better) when the service is “advice” rather than a product solution, and that advice is paid for by the client. When advice is coupled with product or solutions then the chances of retention improve further:

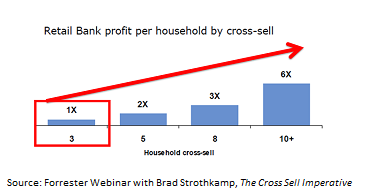

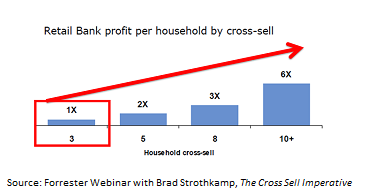

When one is able to do that repeatedly with the same clients then there is an exponential impact upon business profitability:

Related:

Not All Consumers Make Good Advice ClientsThe more products and services that clients have bought from you the more profitable your firm becomes. This is not a linear logic where each time they buy something it adds the same value (roughly) to your bottom line. It is exponential as each additional transaction (usually) costs less in acquisition or marketing, tends to be quicker to implement, and with less immediate post-sale support required by the client. This diminishing cost per additional sale results in vastly improved profitability per additional transaction.It also vastly improves the probable duration of the client relationship and therefore the Lifetime Value of each client for the firm.The bottom line is that

to build the most valuable practice you canwhereby you have the greatest opportunity to provide valuable ongoing professional advice and service to your clients, you actually have to find ways to introduce more services and products (that they need and will value!) via your firm. That does not necessarily mean each individual professional must personally manage all the transactions that a client will engage in with the firm either, but the practice must find a way to continually manage an ever increasing proportion of the clients affairs if it is to become exceptionally successful and valuable.

That changes (for the better) when the service is “advice” rather than a product solution, and that advice is paid for by the client. When advice is coupled with product or solutions then the chances of retention improve further:

That changes (for the better) when the service is “advice” rather than a product solution, and that advice is paid for by the client. When advice is coupled with product or solutions then the chances of retention improve further: When one is able to do that repeatedly with the same clients then there is an exponential impact upon business profitability:

When one is able to do that repeatedly with the same clients then there is an exponential impact upon business profitability: Related: Not All Consumers Make Good Advice ClientsThe more products and services that clients have bought from you the more profitable your firm becomes. This is not a linear logic where each time they buy something it adds the same value (roughly) to your bottom line. It is exponential as each additional transaction (usually) costs less in acquisition or marketing, tends to be quicker to implement, and with less immediate post-sale support required by the client. This diminishing cost per additional sale results in vastly improved profitability per additional transaction.It also vastly improves the probable duration of the client relationship and therefore the Lifetime Value of each client for the firm.The bottom line is that to build the most valuable practice you canwhereby you have the greatest opportunity to provide valuable ongoing professional advice and service to your clients, you actually have to find ways to introduce more services and products (that they need and will value!) via your firm. That does not necessarily mean each individual professional must personally manage all the transactions that a client will engage in with the firm either, but the practice must find a way to continually manage an ever increasing proportion of the clients affairs if it is to become exceptionally successful and valuable.

Related: Not All Consumers Make Good Advice ClientsThe more products and services that clients have bought from you the more profitable your firm becomes. This is not a linear logic where each time they buy something it adds the same value (roughly) to your bottom line. It is exponential as each additional transaction (usually) costs less in acquisition or marketing, tends to be quicker to implement, and with less immediate post-sale support required by the client. This diminishing cost per additional sale results in vastly improved profitability per additional transaction.It also vastly improves the probable duration of the client relationship and therefore the Lifetime Value of each client for the firm.The bottom line is that to build the most valuable practice you canwhereby you have the greatest opportunity to provide valuable ongoing professional advice and service to your clients, you actually have to find ways to introduce more services and products (that they need and will value!) via your firm. That does not necessarily mean each individual professional must personally manage all the transactions that a client will engage in with the firm either, but the practice must find a way to continually manage an ever increasing proportion of the clients affairs if it is to become exceptionally successful and valuable.